We are happy to welcome four new clients this quarter. It’s an honor to serve you and we look forward to many years of working together. Thank you to everyone who continues to recommend our services to friends and family.

1st Quarter Commentary

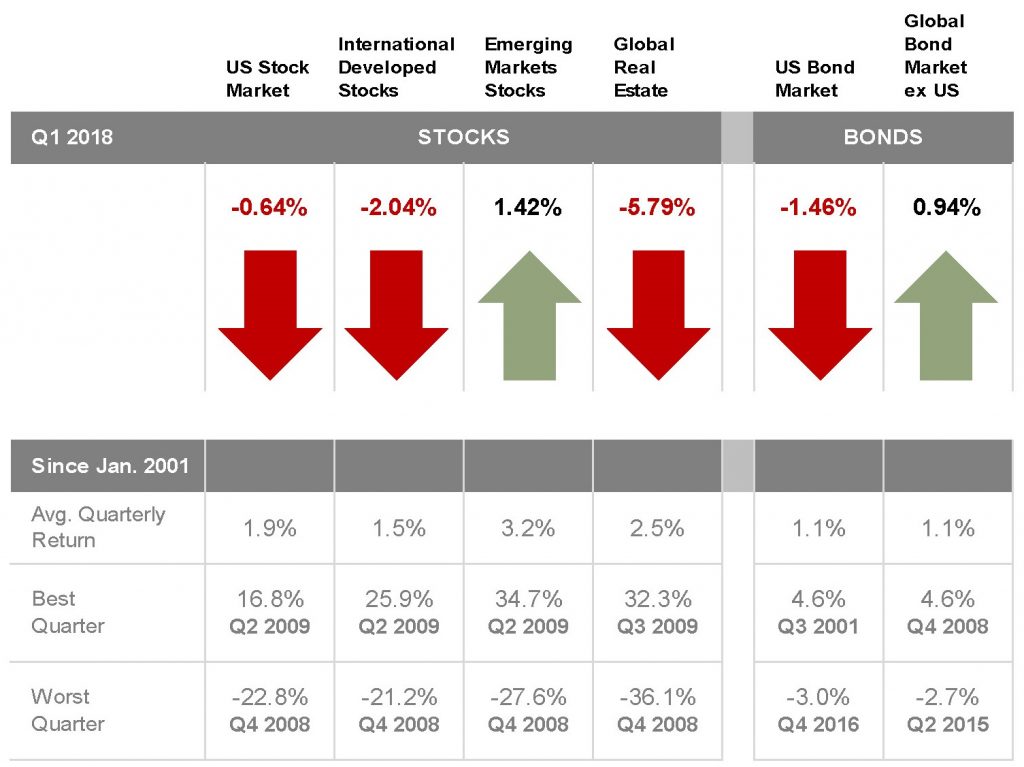

The first quarter was a wild ride for investors. January was fabulous with U.S. stocks up more than 5% for the month. Then worries about inflation, a trade war with China, and the prospect of new regulations on technology companies spooked the markets. The S&P 500 Index of mostly large company U.S. Stocks returned -0.76% for the quarter and is still up more than 13% over the last 12 months.

Abroad the results were mixed for the quarter with stocks of companies in developed markets (such as Japan, the U.K., and Germany) down 1.8% for the quarter, but still up more than 15% over the last 12 months. Through this volatility, the stocks of companies in emerging markets did quite well, returning 1.4% for the quarter and more than 24% over the last 12 months. Egypt, Brazil, Peru, and Russia were the best performing markets (in that order).

In fixed income (bonds), concerns about inflation, too much corporate bond issuance, and new Fed Chair Jerome Powell led to a decline of 1.5% for investment grade bonds in the first quarter (as represented by Barclays Capital U.S. Aggregate Bond Index), yet such bonds still returned 1.2% over the last 12 months. It is not uncommon for bond investments to experience years in which they decline in value. As the Federal Reserve and other major central banks push yields higher, that will certainly weigh on bond prices. However, we expect investors will end up earning a little more income, which over time should more than offset any price declines.

On March 21st, the Federal Reserve Board of Governors (led by newly appointed Chair Jerome “Jay” Powell) raised interest rates by 0.25% to a range of 1.50% – 1.75%. Though inflation is still very low and below 2% (compared to a 40-year average of more than 3%), the Fed left the door open for two to three more rate hikes this year. Higher interest rates help savers who earn more interest on their savings accounts – especially retirees whose income sources are often limited in retirement. However, higher interest rates hurt short-term borrowers (such as adjustable rate mortgage, credit cards, home equity lines of credit) and anyone with variable interest rate debt.

Looking forward

U.S. equity valuations are now at the high end of their historical range. In our quarterly newsletter a year ago, we talked about how foreign stocks were trading at much more reasonable valuations than U.S. stocks and have significantly trailed the performance of U.S. stocks for most of the period following the 2007 – 2009 financial crisis. The combination of these two factors are very desirable to us from an investment standpoint. Now a year later, stocks of companies in developed markets have outperformed U.S. stocks by more than 2% while the stocks in emerging markets have outperformed the U.S. market by more than 9%. This trend could certainly well continue.

It is impossible to know for sure how long the stock market will continue its unprecedented rise. History tells us these things don’t last forever. 10% corrections should be fairly routine events, but in the current bull market have rarely occurred. Many investors wonder if we can expect such volatility to continue. The answer is “Yes” and to a much greater degree (a 20% decline or more). For clients concerned about such volatility, fixed income investments (bonds) act as a buffer against declines in the equity markets. Furthermore, each investment has a specific role in your portfolio and many complement each other. Put together, your “globally diversified portfolio” is designed to help weather financial storms. We are happy to discuss with you why we own each investment (even if it hasn’t performed well relative to other investments in the last year, month, or week).

While we have a tempered return outlook for the U.S. market as a whole, we are still quite optimistic about the prospects of our investment strategy and the expected performance of the funds and managers we invest with.

What is a Trusted Contact and should you name one?

With the aging of the U.S. population, financial exploitation of seniors is a serious and growing concern. To help combat this, on February 5th the Financial Industry Regulatory Authority (FINRA) adopted new rules that requires member firms (such as Charles Schwab & Co.) to make reasonable effort to obtain the name of and contact information for a trusted contact person for a client’s account. The Trusted Contact person is intended to be a resource for Schwab AND Elevation Wealth Partners in administering your account, protecting assets and responding to possible financial exploitation.

The Trusted Contact you elect can be a close family member, child, sibling, friend or neighbor, someone who knows you well and has your best interest at heart. Examples of when we would reach out to a Trusted Contact could be:

- If we are unable to reach you after multiple attempts and methods, we might call the named Trusted Contact to inquire about your current contact information.

- If we notice unusual or out-of-character behavior with regard to spending/budget habits – say you start buying lavish “gifts” for a new “friend” – we might reach out to the Trusted Contact to analyze the circumstances of this new-found generous gift giving.

- If we suspect the onset of dementia, Alzheimer’s, or another form of diminished capacity.

- Only you as the account holder have the ability to add, update, or remove a Trusted Contact Person(s) for your account(s).

- Providing Schwab with Trusted Contact Person information is voluntary.

What you will be authorizing.

If you provide a Trusted Contact Person(s) to Schwab, you understand that you have authorized Schwab and Elevation Wealth Partners to contact the Trusted Contact Person(s) at their discretion and to disclose information about your account to address possible activities that might indicate financial exploitation of you; to confirm the specifics of your current contact information, health status (including physical or mental capacity), or the identity of any legal guardian, executor, trustee, or holder of a power of attorney on your account(s); or as otherwise permitted by FINRA rules or state law.

We encourage all of our clients to name a Trusted Contact. To do this, please visit our website at https://zrcwm.com/what-is-a-trusted-contact-and-should-you-name-one, call Schwab at 800-515-2157, or contact Kelly Gillette – Client Advisor. For additional information, please do not hesitate to contact us.

Annual ADV Disclosure Brochure and Privacy Policy

At the bottom of every page of our website www.zrcwm.com you will find links to our updated Form ADV and Privacy Policy. The Form ADV (also known as a “Disclosure Brochure”) is an important regulatory document we file with the United States Securities and Exchange Commission (SEC). As a Registered Investment Advisor, Elevation Wealth Partners is required to update this document whenever there are material changes at the firm (and at least annually). The only material change since the last filing is that Assets Under Management increased to $190,338,807.

Elevation Wealth Partners distinguishes itself as a “fee-only” wealth manager registered with SEC. As a wealth manager, the quarterly fee our clients pay us covers both the management of assets as well as comprehensive financial planning. Unlike many firms, Elevation Wealth Partners does not charge a separate financial planning fee. Additionally, as an investment advisor registered with the SEC, we are a trusted partner to our clients – placing their interests above all us. The brochure also provides important information about Elevation Wealth Partners, its business practices, and the qualifications of those associated with the firm. We recommend you read it and the Privacy Policy – and contact us if you have any questions. If you would like to receive a copy of our brochure, privacy policy, or code of ethics – please contact us.

If you or someone you know is interested in a different type of advisor relationship. One where the cornerstones are Trust, Expertise, Transparency, and Results, contact any one of us to schedule a Discovery Meeting. We are here to be a resource to you and those important to you.

Elevation Wealth Partners Fan Fest – Take me out to the ballgame!

We are delighted to announce our third annual Elevation Wealth Partners Fan Fest events. We are excited to offer this exclusive opportunity to our valued clients. This year’s events will be hosted in the first-class Audi Legends Suite at AT&T Park while we take in America’s favorite pastime. With catered food & beverages, giveaways, and a top-notch view of the action, this occasion is sure to be a home-run.

Sincerely,

Barry Mendelson, CFP John Davis, CFP Richard Clarke, CPA, PFS

Ryan Kosakura, CFA Kelly Gillette

Sources: Morningstar, Inc., Dimensional Fund Advisors, Dodge & Cox, The Vanguard Group, Inc., and Capital Group.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.