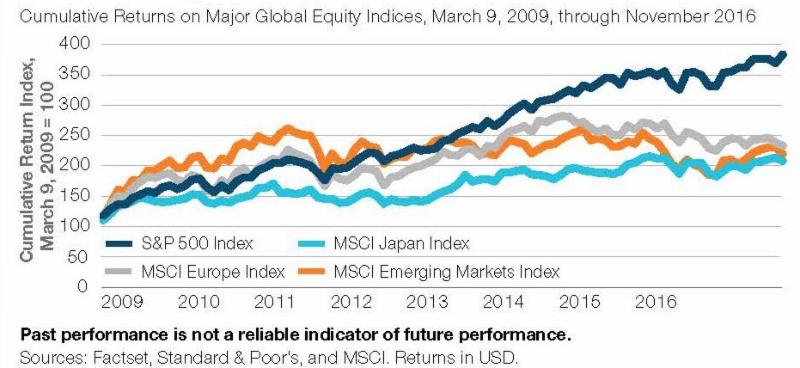

| Stocks across the globe climbed higher in the first quarter of 2017. U.S. Stocks as whole were up 5.8%, International Developed Stocks 6.8%, and Emerging Markets Stocks 11.4%. All Elevation Wealth Partners client accounts posted solid gains for the quarter (with returns in the range of low to mid-single digits – largely dependent upon the amount of stocks in the client’s account). Manager performance relative to their stated investment objectives, benchmark, and peers continued to be excellent. Among U.S. Stocks, growth stocks outperformed value stocks. This was largely driven by technology stocks and healthcare stocks (as the prospects for major changes to the healthcare system dimmed).On March 15, the Federal Reserve raised the federal-funds rate by 25 basis points to a range of 0.75% to 1.00%. This is the second time in three months the Fed increased its benchmark interest rate a quarter point amid rising confidence the economy continues to strengthen. Investment grade U.S. Bonds as a whole returned 0.82% for the quarter – contrary to the common misconception that rising interest rates spell doom for bond investors. As interest rates rise, bond prices are supposed to decline. Therefore, rising interest rates are a headwind for fixed income investors. While that is certainly true, it only explains one variable (out of dozens, if not hundreds) in the fixed income markets. In reality, it’s impossible to account for (much less know) how every variable will affect short-term market movements (and three months is a very short period of time). Elevation Wealth Partners takes a cautious approach to fixed income investing and we have little concern about how our carefully selected fixed income investments will perform if the Fed continues to raise rates at its current measured pace. Looking ForwardLong-term, we believe stocks will continue to be the dominant growth engine in investment portfolios. Eight years into the current bull market, there will eventually be a significant (greater than 20%) pullback. In the meantime, broadly speaking, global equity valuations appear fairly reasonable. Looking at the chart below, stocks in many regions of the world are trading slightly above their historical averages, but nowhere near their all-time highs.

Annual ADV Disclosure Brochure and Privacy PolicyAt the bottom of every page of our website https://elevationwp.com/ you will find links to our updated Form ADV and Privacy Policy. The Form ADV (also known as a “Disclosure Brochure”) is an important regulatory document we file with the United States Securities and Exchange Commission (SEC). As a Registered Investment Advisor, Elevation Wealth Partners is required to update this document whenever there are material changes at the firm (and at least annually). The only material change since the last filing is that Assets Under Management increased to $177,284,285. Sincerely, Sources: Morningstar, Inc., Dimensional Fund Advisors, FactSet, Inc. and T. Rowe Price Associates, Inc. |