We are happy to welcome new clients to the Elevation Wealth Partners family this quarter. It’s an honor to serve you and we look forward to many years of working together. Thank you to everyone who continues to recommend our services to friends and family.

Our take on the 2nd Quarter and the Markets So Far this Year

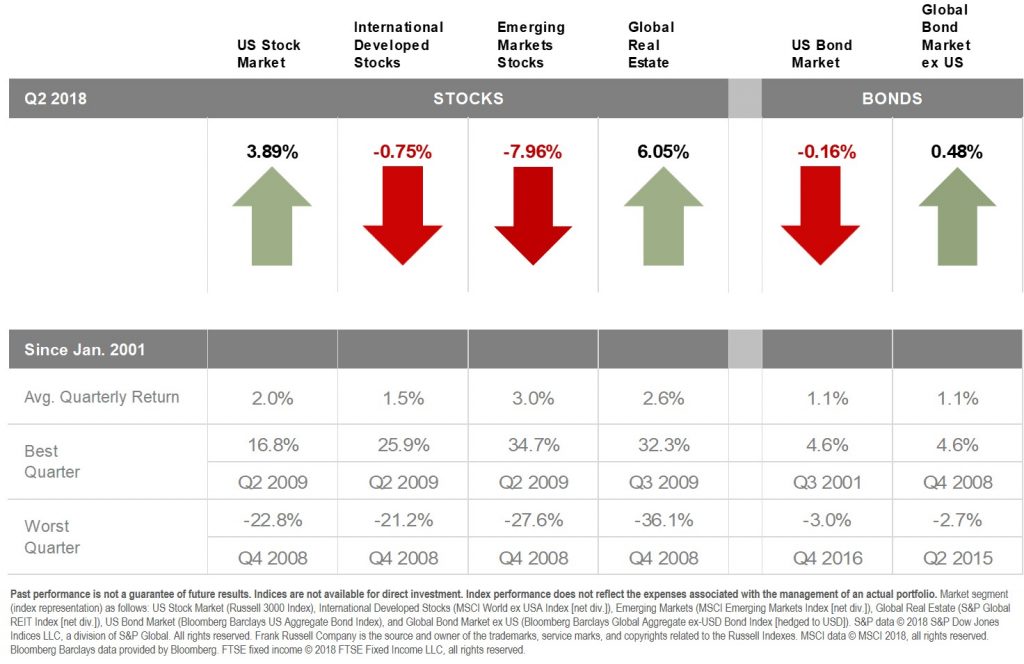

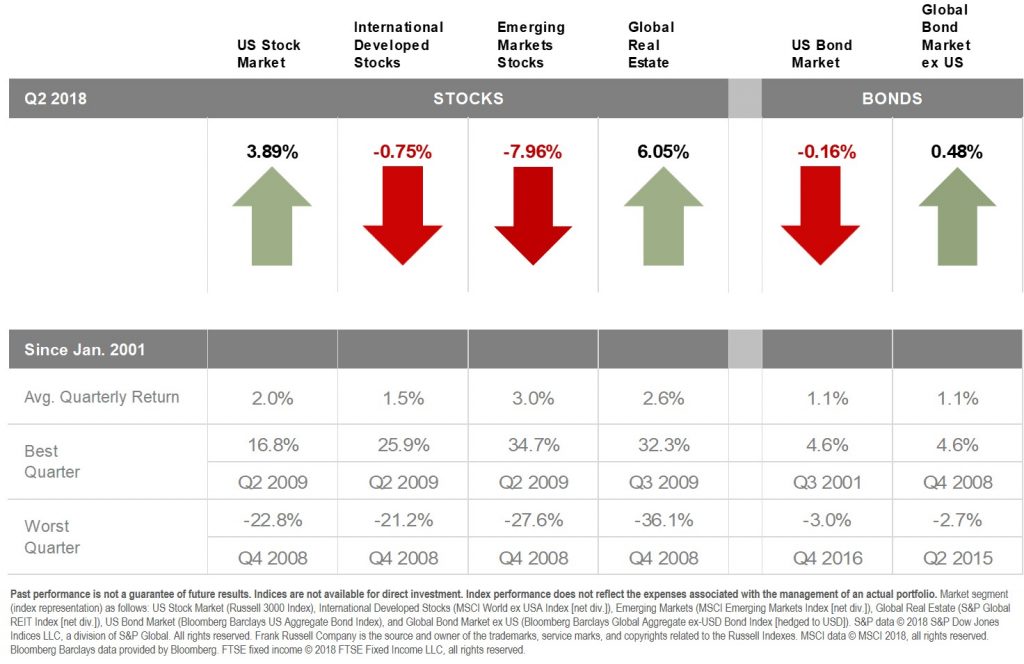

In a year where stocks should be basking in the light of corporate tax reform, healthy consumer spending, and an expanding global economy, investor returns are not what we would expect to see. For the quarter, U.S. stocks advanced, with the S&P 500 Index gaining 3.4%, while non-U.S. stocks declined.

Despite robust earnings for U.S. companies during the first-quarter earnings season — the S&P 500 Index generated a massive 24.8% increase in earnings on a year-over-year basis — the escalating trade posturing between the U.S. and its major trading partners made investors nervous. The Trump administration continues to push its trading partners for more reciprocal trade relationships and is threatening tariffs on specific industries. These changes potentially impact the way some companies and countries do business, and therefore investors are concerned about what that means for stocks.

The strengthening U.S. dollar posed the greatest headwind for international stocks. Emerging markets, as measured by MSCI Emerging Markets, declined 8.0%, and non-U.S. developed markets, as measured by MSCI World Ex US, declined 0.8%. International stocks have trailed U.S. stocks 6 out of the last 8 calendar years, and 4 of the last 5. However, international stocks tend to outperform U.S stocks when U.S. returns have been low. When then 10-year return for U.S. stocks has averaged less than 6% a year, international has outperformed 94% of the time and by a margin of 2.05% a year. And when the 10-year returns for U.S. stocks has been less than 4% a year, international has outperformed 100% of the time and by a margin of 2.36% a year. Given today’s high valuations for US stocks (potentially foreshadowing lower future long-term returns), we maintain a healthy international equity allocation in all client accounts.

Interest rates were also a concern for investors in the second quarter. As anticipated, the Federal Reserve increased their key policy rate by 0.25% in June, the seventh rate-hike since December 2015. The new benchmark target rate is 1.75% – 2.00%. The Fed also indicated they are targeting two additional interest rate increases this year (for a total of four). Then back to three rate increases next year as fiscal stimulus from the tax cuts begins to fall off. Expect 3% GDP growth in 2018 and possibly into 2019 as well. The unemployment rate actually rose in June by 0.2% to 4.0%. However, wages continue to tick up and the economy could peak in 2019. Long-term, The Fed does not believe GDP growth at or above 3.0% is sustainable.

For the quarter, the 2-Year Treasury rose 0.25% to 2.52%, while the 10-Year Treasury advanced 0.11% to end at 2.85% – indicating a nearly flat yield curve. Bonds continued to struggle this quarter, declining 0.16% (on top of 1st Quarter’s 1.46% decline). The sell-off in bonds is largely the result of overblown inflation fears about the current administration getting the U.S. into a trade war. Year-over-year, inflation and the Personal Consumption Expenditures Index rose 2.2% – 2.4%.

Among the bond managers we invest with (PIMCO, DFA, Vanguard, Fidelity, and others) performance thus far this year relative to comparable benchmarks and indexes has been good – with most funds outperforming. Additionally, despite the broader bond market, several funds are in positive territory this year.

We put great thought and care into the managers we invest with – meeting and speaking with them throughout the year. There will be times when your fixed income investments decline in value . . . as we experienced in 2008 during the “financial crisis” and in 2013 during the “taper tantrum.” In both cases, these fixed income investments were back in positive territory in a matter of months.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, advanced in the second quarter — with the U.S. dollar appreciating by 4.3% compared to foreign currencies. Despite the second quarter gain, the U.S. dollar is weaker by -0.6% over the last 12 months.

Looking forward

The positives in the economy and available investment opportunities continue to outweigh the negatives. We continue to manage risk through diversification and by seeking to understand every client’s unique financial circumstances. Financial planning is not easy and requires a lot of work by us, your Financial Planners and Wealth Advisors, and by you the client. However, clients tell us the financial security, confidence, and stress relief they gain through the process is worth it many times over. One of the most frequent requests we receive is helping clients understand what to do with investment properties they own – whether they be single family homes, commercial buildings, or partnership interests. Given all the possible outcomes and unique circumstances, this is rarely an easy or straightforward decision. However, to us, helping clients make sense of difficult and complex financial decisions is some of the most rewarding work we do.

Question of the Quarter

Almost every day we receive a question from one of you about something you read, something you heard, or a personal financial matter. We love receiving such inquiries! It may cause us to do a little research and hone our communication skills, but it tells us you are engaged and interested in your financial well-being.

We’ve begun to keep track of such questions and every quarter we’ll attempt to answer, address, and demystify one or more of them here in our quarterly newsletter. A few weeks ago, we received this one . . .

On June 19th, S&P Dow Jones Indices announced that on June 26th General Electric (ticker GE) would be booted from the Dow Jones Industrial Average (aka Dow, aka DJIA) and replaced with drug retailer Walgreens Boot Alliance (ticker WBA).

“Is the Dow Jones Industrial Average important and something we should keep track of?”

No. The Dow is comprised of just 30 stocks and GE was the sole remainder from a time when the index consisted mostly of “smokestack” companies. The inclusion of a particular stock in the Dow is very murky. There is no set formula or any rules that are made public. Exclusion and inclusion is simply made by committee.

What is also perplexing about the Dow is that it is a “price-weighted index.” Meaning that at $14/share GE would have a weight in the index ¼ of that of WBA at $63/share. Even though GE’s publicly traded shares are worth almost twice that of WBA’s ($121 billion vs. $63 billion). Any lay investor knows that weighting an index by stock prices makes no sense! Share price without knowing the number of shares outstanding (which multiplied together gives you the company’s “market cap” or total value of their outstanding shares) tells you nothing. Despite this, expect the Dow Jones Industrial Average to continue to be reported on by the media and discussed at backyard barbeques. If you want a sense of how the U.S. stock market is performing, following the S&P 500 Index – which represents 90% of market – is a much better way to go. See this Wall Street Journal article that provides a brief look at the index’s components during historical periods (subscription required).

Elevation Wealth Partners Summer Intern: Dalia Anwar

Please welcome Elevation Wealth Partners Summer Intern, Dalia Anwar. Dalia just completed her freshman year at the University of California at Santa Cruz. She hasn’t declared a major yet and is considering Politics. Dalia will be working in our Walnut Creek office. If you know of a college student that might be interested in an internship at Elevation Wealth Partners next Summer, please have them email Kelly at kelly@elevationwp.com.

Elevation Wealth Partners Fan Fest – Take me out to the ballgame!

Offered exclusively to our valued clients, we are delighted to be hosting our third annual Elevation Wealth Partners Fan Fest events. The first of two games was well attended on June 23rd as we enjoyed a picture perfect day in the first-class Audi Legends Suite at AT&T Park. The catered food & beverages, giveaways, and top-notch view of the action made it a memorable day. We look forward to hosting the second event as the Giants take on the Milwaukee Brewers on July 28th.

Sincerely,

Sources: LWI Financial, Inc. Morningstar, Inc., Dimensional Fund Advisors, J.P. Morgan, Inc., Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg Economic Calendar, U.S. Department of the Treasury, Morningstar Direct 2018, and Blackrock, Inc.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

2nd Quarter 2018 Market & Investment Commentary

We are happy to welcome new clients to the Elevation Wealth Partners family this quarter. It’s an honor to serve you and we look forward to many years of working together. Thank you to everyone who continues to recommend our services to friends and family.

Our take on the 2nd Quarter and the Markets So Far this Year

In a year where stocks should be basking in the light of corporate tax reform, healthy consumer spending, and an expanding global economy, investor returns are not what we would expect to see. For the quarter, U.S. stocks advanced, with the S&P 500 Index gaining 3.4%, while non-U.S. stocks declined.

Despite robust earnings for U.S. companies during the first-quarter earnings season — the S&P 500 Index generated a massive 24.8% increase in earnings on a year-over-year basis — the escalating trade posturing between the U.S. and its major trading partners made investors nervous. The Trump administration continues to push its trading partners for more reciprocal trade relationships and is threatening tariffs on specific industries. These changes potentially impact the way some companies and countries do business, and therefore investors are concerned about what that means for stocks.

The strengthening U.S. dollar posed the greatest headwind for international stocks. Emerging markets, as measured by MSCI Emerging Markets, declined 8.0%, and non-U.S. developed markets, as measured by MSCI World Ex US, declined 0.8%. International stocks have trailed U.S. stocks 6 out of the last 8 calendar years, and 4 of the last 5. However, international stocks tend to outperform U.S stocks when U.S. returns have been low. When then 10-year return for U.S. stocks has averaged less than 6% a year, international has outperformed 94% of the time and by a margin of 2.05% a year. And when the 10-year returns for U.S. stocks has been less than 4% a year, international has outperformed 100% of the time and by a margin of 2.36% a year. Given today’s high valuations for US stocks (potentially foreshadowing lower future long-term returns), we maintain a healthy international equity allocation in all client accounts.

Interest rates were also a concern for investors in the second quarter. As anticipated, the Federal Reserve increased their key policy rate by 0.25% in June, the seventh rate-hike since December 2015. The new benchmark target rate is 1.75% – 2.00%. The Fed also indicated they are targeting two additional interest rate increases this year (for a total of four). Then back to three rate increases next year as fiscal stimulus from the tax cuts begins to fall off. Expect 3% GDP growth in 2018 and possibly into 2019 as well. The unemployment rate actually rose in June by 0.2% to 4.0%. However, wages continue to tick up and the economy could peak in 2019. Long-term, The Fed does not believe GDP growth at or above 3.0% is sustainable.

For the quarter, the 2-Year Treasury rose 0.25% to 2.52%, while the 10-Year Treasury advanced 0.11% to end at 2.85% – indicating a nearly flat yield curve. Bonds continued to struggle this quarter, declining 0.16% (on top of 1st Quarter’s 1.46% decline). The sell-off in bonds is largely the result of overblown inflation fears about the current administration getting the U.S. into a trade war. Year-over-year, inflation and the Personal Consumption Expenditures Index rose 2.2% – 2.4%.

Among the bond managers we invest with (PIMCO, DFA, Vanguard, Fidelity, and others) performance thus far this year relative to comparable benchmarks and indexes has been good – with most funds outperforming. Additionally, despite the broader bond market, several funds are in positive territory this year.

We put great thought and care into the managers we invest with – meeting and speaking with them throughout the year. There will be times when your fixed income investments decline in value . . . as we experienced in 2008 during the “financial crisis” and in 2013 during the “taper tantrum.” In both cases, these fixed income investments were back in positive territory in a matter of months.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, advanced in the second quarter — with the U.S. dollar appreciating by 4.3% compared to foreign currencies. Despite the second quarter gain, the U.S. dollar is weaker by -0.6% over the last 12 months.

Looking forward

The positives in the economy and available investment opportunities continue to outweigh the negatives. We continue to manage risk through diversification and by seeking to understand every client’s unique financial circumstances. Financial planning is not easy and requires a lot of work by us, your Financial Planners and Wealth Advisors, and by you the client. However, clients tell us the financial security, confidence, and stress relief they gain through the process is worth it many times over. One of the most frequent requests we receive is helping clients understand what to do with investment properties they own – whether they be single family homes, commercial buildings, or partnership interests. Given all the possible outcomes and unique circumstances, this is rarely an easy or straightforward decision. However, to us, helping clients make sense of difficult and complex financial decisions is some of the most rewarding work we do.

Question of the Quarter

Almost every day we receive a question from one of you about something you read, something you heard, or a personal financial matter. We love receiving such inquiries! It may cause us to do a little research and hone our communication skills, but it tells us you are engaged and interested in your financial well-being.

We’ve begun to keep track of such questions and every quarter we’ll attempt to answer, address, and demystify one or more of them here in our quarterly newsletter. A few weeks ago, we received this one . . .

On June 19th, S&P Dow Jones Indices announced that on June 26th General Electric (ticker GE) would be booted from the Dow Jones Industrial Average (aka Dow, aka DJIA) and replaced with drug retailer Walgreens Boot Alliance (ticker WBA).

“Is the Dow Jones Industrial Average important and something we should keep track of?”

No. The Dow is comprised of just 30 stocks and GE was the sole remainder from a time when the index consisted mostly of “smokestack” companies. The inclusion of a particular stock in the Dow is very murky. There is no set formula or any rules that are made public. Exclusion and inclusion is simply made by committee.

What is also perplexing about the Dow is that it is a “price-weighted index.” Meaning that at $14/share GE would have a weight in the index ¼ of that of WBA at $63/share. Even though GE’s publicly traded shares are worth almost twice that of WBA’s ($121 billion vs. $63 billion). Any lay investor knows that weighting an index by stock prices makes no sense! Share price without knowing the number of shares outstanding (which multiplied together gives you the company’s “market cap” or total value of their outstanding shares) tells you nothing. Despite this, expect the Dow Jones Industrial Average to continue to be reported on by the media and discussed at backyard barbeques. If you want a sense of how the U.S. stock market is performing, following the S&P 500 Index – which represents 90% of market – is a much better way to go. See this Wall Street Journal article that provides a brief look at the index’s components during historical periods (subscription required).

Elevation Wealth Partners Summer Intern: Dalia Anwar

Please welcome Elevation Wealth Partners Summer Intern, Dalia Anwar. Dalia just completed her freshman year at the University of California at Santa Cruz. She hasn’t declared a major yet and is considering Politics. Dalia will be working in our Walnut Creek office. If you know of a college student that might be interested in an internship at Elevation Wealth Partners next Summer, please have them email Kelly at kelly@elevationwp.com.

Elevation Wealth Partners Fan Fest – Take me out to the ballgame!

Offered exclusively to our valued clients, we are delighted to be hosting our third annual Elevation Wealth Partners Fan Fest events. The first of two games was well attended on June 23rd as we enjoyed a picture perfect day in the first-class Audi Legends Suite at AT&T Park. The catered food & beverages, giveaways, and top-notch view of the action made it a memorable day. We look forward to hosting the second event as the Giants take on the Milwaukee Brewers on July 28th.

Sincerely,

Sources: LWI Financial, Inc. Morningstar, Inc., Dimensional Fund Advisors, J.P. Morgan, Inc., Bureau of Economic Analysis, Bureau of Labor Statistics, Bloomberg Economic Calendar, U.S. Department of the Treasury, Morningstar Direct 2018, and Blackrock, Inc.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.