Please welcome our Summer Intern – Zachary Byrd. Zac just completed his sophomore year at Washington State University in Pullman. He is majoring in Business Marketing and is excited to start taking higher level business courses. In addition to learning about our business, Zac was tasked with developing several new marketing pieces that we are excited to share with clients. One of the documents expands on our expertise in managing portfolios emphasizing investments in companies with leading environmental, social, and governance (ESG) practices. For clients that wish to align their values with their investments, we can help you do just that.

2nd Quarter Economic Review or: How We Learned to Stop Worrying and Love the Current Bull Market. As of the first day of the 3rd quarter, the current economic expansion is now the longest in United States history dating back to 1900; ten years and a day. Just because our current U.S. expansion is the longest doesn’t mean it is the greatest. The expansions of the 1960s, 1980s and the 1990s all had higher rates of growth as well as total growth. Expansions don’t die of old age and we don’t see any reason why this one can’t continue for another year . . . if not longer. Tax rates have been cut, consumption is up, and monetary policy isn’t too tight with more accommodation on the way, possibly as soon as this month. The June jobs report showed a nice rebound with a better than expected 224,000 jobs with an unemployment rate of 3.7%, near a 50-year low and the highest wage growth (3.4%) since the recovery began.

The Fed, having been spooked by the global manufacturing slowdown at the end of 2018 has moved from being on the sidelines to being open to cutting rates later this year. The Fed changed its language in its latest statement that it has abandoned “patience” and “will act as appropriate to sustain the expansion.” With low inflation and a slowing global economy, the Fed has the wiggle room to take a much more dovish stance towards interest rates. This should help support emerging market (EM) equities as the dollar tends to weaken with an accommodating Federal Reserve. We still favor international and emerging markets as they are cheaper than U.S. stocks and are good diversifiers. According to International Monetary Fund (IMF) forecasts, EM and developing economies will grow at more than double the pace of advanced economies in 2019 (4.3% versus 1.8%) and 2020 (4.8% versus 1.7%). Source: IMF World Economic Outlook, April 2019.

Looking back just a little over six months ago, it’s amazing to think about how the markets have reacted in the first half of 2019. We were coming off the worst December for the S&P 500 since the Great Depression back in the 1930’s and anxiety was high rolling into the New Year. Markets rallied across the board to start off the year and that momentum kept going into the 2nd quarter of 2019 posting a 7.05% return for the S&P 500 in June and 4.30% for the second quarter. Escalating trade tensions and heightened political risk remain the biggest threats for the global markets.

The S&P 500 is now up 18.54% year to date, its best first half of the year since 1999. With still strong economic and corporate growth, stock valuations – though a little high – are still reasonable. Fixed income rallied in the 2nd quarter as central banks around the globe have become more accommodative over the past several months. We expect to see heightened volatility for the foreseeable future. That is why the best asset allocation for you is the one that you can stomach when things get choppy. As a client, you understand how your stock investments are for the long-term. This is why we received very few calls in December when the markets declined by almost 10%. Thanks to your discipline, vacation plans, or just ignoring the news – you kept with you custom-tailored investment plan and have ridden the markets back up this year to all-time highs. If it has been some time since we reviewed your financial goals or something has changed in your financial life (you have been granted stock in your company, changed jobs, lost a loved one, or are nearing retirement) – please contact us to schedule a meeting.

2nd Quarter Market Review and Index Returns. Equity markets around the globe posted positive returns for the quarter. Looking at broad market indices, U.S. equities outperformed non-U.S. developed and emerging markets during the quarter. Value stocks outperformed growth stocks in emerging markets but underperformed in developed markets. Small caps underperformed large caps in all regions. REIT indices underperformed equity market indices in both the U.S. and non-U.S. developed markets.

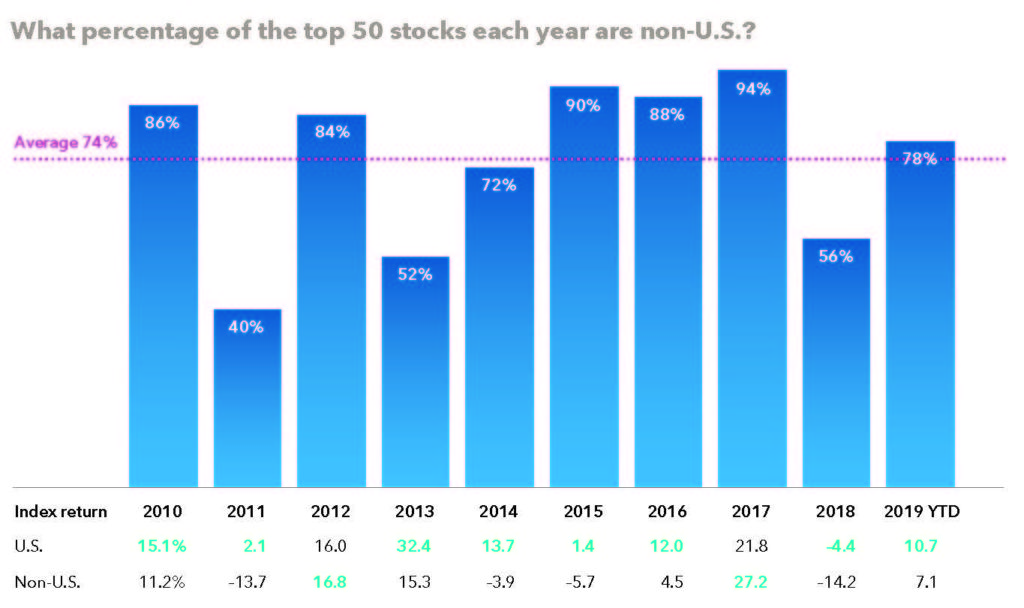

While it’s true that international equities have lagged U.S. markets over the past decade, the index-based returns that most investors follow don’t tell the whole story. On a company-by-company basis, the picture is significantly different than you may think.

Sources: RIMES, MSCI. 2019 as of 5/31/19. Returns in U.S. dollars. S&P 500 Index and MSCI ACWI ex USA used for U.S. and non-U.S. returns.

Since 2009, the top 50 companies with the best annual returns were overwhelmingly based outside the United States. In many of those years, 80% to 90% carried a non-U.S. address. That means if you had decided to ignore international equities, you would have missed a shot at many of the best opportunities.

In certain sectors, the U.S. is not the most dominant player. Many premiere luxury goods companies, such as LVMH and Kering, are found in Europe (think Louis Vuitton, Fendi and Gucci). Japan is home to a number of cutting-edge robotics firms, including Murata and Fanuc. Big pharma has no shortage of innovative drug companies in Europe: AstraZeneca, Novartis, Novo Nordisk.

In addition, dividend-paying companies outside the U.S. tend to offer higher yields. All reasons to consider maintaining a healthy allocation to international stocks, even if you think U.S. markets will continue to lead the way. For more on our take on markets and our Quarterly Market Review visit https://elevationwp.com/insights/

Important To-Do’s Before Sending Your Child Off to College. For those of you that will be sending a kid off to college this year, we offer these six items you hopefully haven’t overlooked. Visit https://elevationwp.com/insights/ to read the full article.

- Make an appointment with your attorney to create a durable power of attorney document for financial matters and a health-care proxy.

- Establish a monthly budget for your child.

- Determine whether your child will receive a credit or debit card and set rules around when to use each.

- Once on campus, make sure you and your child know where the closest hospital, urgent care and 24-hour pharmacy are located.

- Have your child write down all passwords to any digital profiles, including financial and social media accounts.

- Talk to your insurance agent and ask about covering your child’s belongings while they are living on or off campus.

In a future newsletter, we will discuss one of the most important financial decisions a family makes (and often the third largest after saving for retirement and purchasing a home), deciding on a college. In our experience, too few parameters are set and too little thought is given to the return on investment the parent and child should expect from any possible institution of higher education. As much as we hope to address this in a future article, with an expense of this magnitude (for an in-state student at Barry and Ryan’s alma mater, UCSB is expected to cost at least $130,000 over the next four years), the best advice for you and your student is one that is highly personalized. We are happy to begin that conversation anytime.

Cancer Support Community’s Hope Walk. On May 18th, Ryan Kosakura and more than 20 people on Team Kosakura participated in the 5th Annual Hope Walk. The 5k journey in and around Heather Farm Park in Walnut Creek benefited the Cancer Support Community of the San Francisco Bay Area. Thank you to all friends, family, clients, and business partners who generously supported this amazing cause. Elevation Wealth Partners contributed $2,500 in matching donations and Team Kosakura was the top fundraising team, raising more than $8,000. In total, the event raised more than $180,000 – with much of it earmarked toward a new center under development in Lafayette. CSC is a fantastic organization that every year serves more than 2,000 cancer patients and their loved ones in our local community, providing counseling, support groups, nutrition, exercise and patient education programs free of charge (see www.cancersupport.net ).

As always, we are here to be a resource to you and those important to you.

Sincerely,

Sources: Morningstar, Inc., Dimensional Fund Advisors, J.P. Morgan, Inc., Capital Group, Blackrock, Inc., Ken Rosenbaum, CPA & Loring Ward.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

S&P data is provided by Standard & Poor’s Index Services Group. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data © MSCI 2019, all rights reserved. Dow Jones data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. S&P data © 2019 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Bloomberg Barclays data provided by Bloomberg. Treasury bills © Stocks, Bonds, Bills, and Inflation Yearbook™, Ibbotson Associates, Chicago (annually updated work by Roger G. Ibbotson and Rex A. Sinquefield).