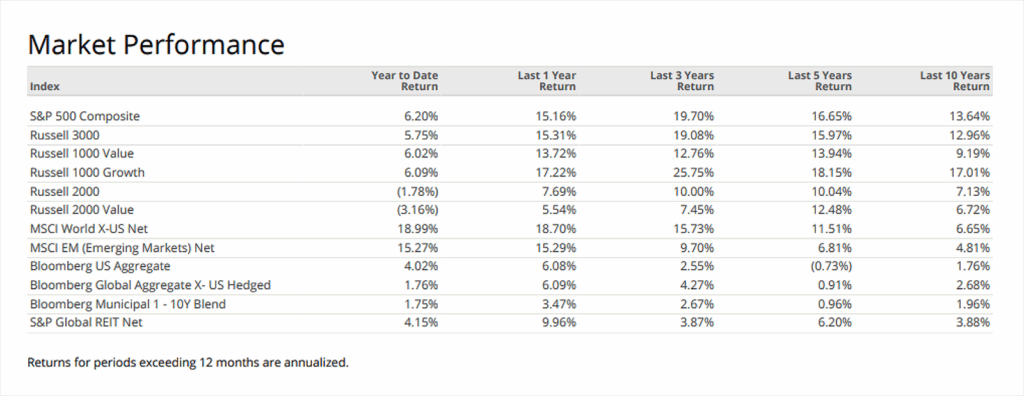

Global markets had a strong second quarter, bouncing back from early losses to finish in solidly positive territory. U.S. bonds also rallied in June, helping deliver a gain for the quarter. Looking forward, we see both risk and opportunity in the investment markets. Long-term, we are bullish on stocks across the globe. Our enthusiasm for them must be tempered with a client’s risk tolerance and near-term financial goals.

- U.S. stocks took a hit in early April amid a flurry of new tariff announcements but quickly recovered. Markets rallied in May and June, helped by a cooling in trade tensions and strong Q1 earnings. The S&P 500® hit another record high by quarter-end, finishing up nearly 11% for the

quarter. - Most sectors had a solid June—consumer staples was the only one to decline. Over the full quarter, four sectors posted double-digit gains, with tech leading the way, up nearly 24%. Energy, on the other hand, lagged, dropping close to 9%.

- International stocks outperformed U.S. equities over the quarter. Emerging markets stood out in June, gaining 6% and outperforming their U.S. counterparts for the quarter overall.

- U.S. inflation eased in April, then moved back to 2.4% in May. Core inflation stayed flat at 2.8%. In Europe, inflation cooled, but it ticked up in the U.K.

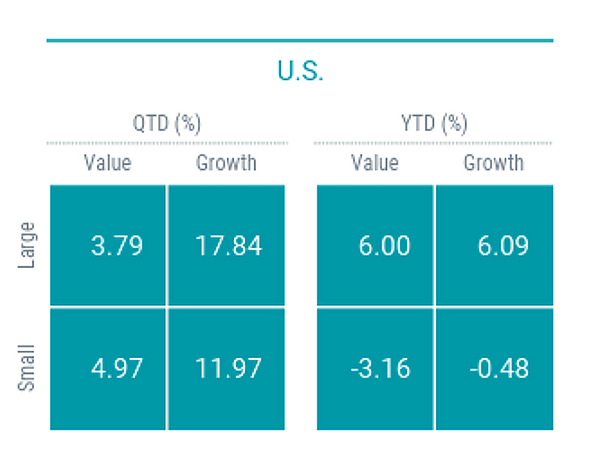

- Across the board, U.S. stocks posted gains for June and the quarter. Small caps led in June, while large caps were the winners over the three-month stretch. Global markets followed a similar pattern, with gains across major size and style categories.

- Treasury yields fell in June and were mixed across the quarter. U.S. bonds gained ground both for the month and the quarter.

Recent Economic Trends

- Inflation remained subdued, with core inflation currently at 2.4%.

- The US dollar weakened significantly, boosting international asset returns for US investors.

- Oil prices fell nearly 9% despite geopolitical risks; gold rose 4%.

- Business investment, especially in AI and tech, remained strong. The labor market softened slightly, but no recession signs are clear.

- Key risks include the longer-term impact of tariffs and US fiscal sustainability.

Stocks across markets, styles, and market capitalizations

The broad U.S. stock market index rallies in the quarter, lifting its year-to-date return into positive territory. Size and style indices advanced for the quarter but were mixed year to date.

Large-cap stocks gained more than 11% for the quarter, outpacing small-caps, which returned 8.5%. Year to date, large-caps advanced and significantly outperformed small-caps.

- Across the board, growth stocks outperformed their value peers in the quarter and year to date. Large-cap growth stocks gained nearly 18% for the quarter, while large-cap value stocks were up almost 4%.

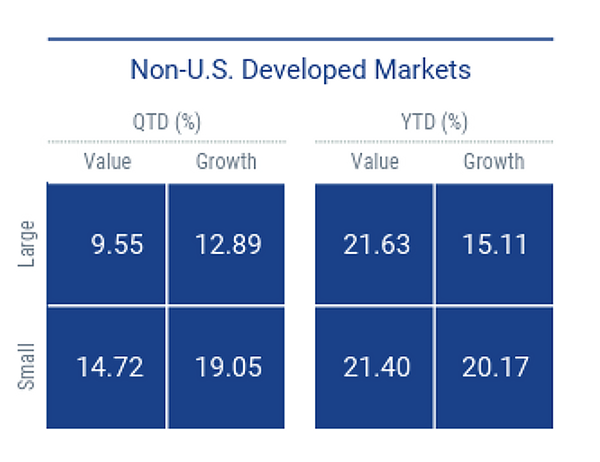

- Non-U.S. developed markets stocks outperformed U.S. stocks for the quarter and year-to-date period. All major size and style indices advanced for both periods.

- Small-cap stocks outperformed large-caps for the second quarter and year to date. For the quarter, small-caps gained nearly 17%, while the large-cap index rose more than 11%.

- Growth outperformed value in the quarter but lagged year to date. Small-cap growth stocks advanced 19% for the quarter. With a gain of almost 22%, large-cap value stocks were top year-to-date performers.

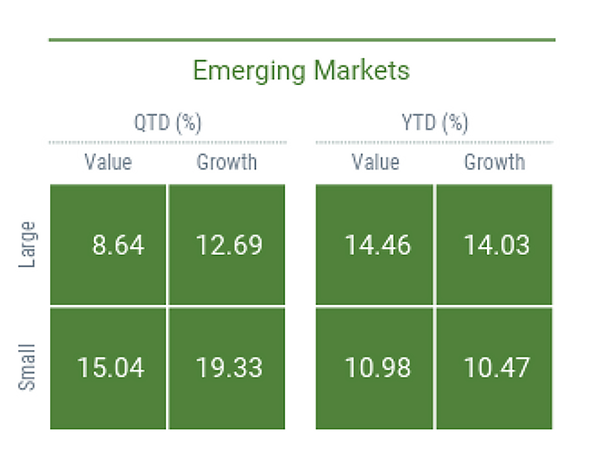

- The broad emerging markets stock index outperformed U.S. stocks for the quarter and year-to-date period. They lagged non-U.S. developed markets stocks for both periods.

- Small-cap stocks rose more than 17% in the quarter, outpacing large-caps, which rose nearly 11%. Year to date, large-caps outperformed small-caps.

- In the second quarter, growth stocks outperformed value stocks across capitalizations. Small-cap growth stocks were top performers, up more than 19%. Year to date, value stocks modestly outperformed their growth-style peers.

Sources: Avantis Investors, by American Century Investments – Monthly ETF Field Guide, Morningstar, Inc.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.