Our hearts go out to those affected by the devastating 2017 North Bay fires. Our Santa Rosa and St. Helena offices have thus far survived. Elevation Wealth Partners has served Sonoma and Napa counties since the 1990’s. We have already begun to help those in need and will continue to do so in a significant way for years to come.

3rd Quarter Commentary

Stocks continued to climb during the third quarter as rising tensions with North Korea, a series of devastating storms, and the Fed’s announcement that it would begin to normalize its balance sheet didn’t slow the market. The S&P 500 Index rose 4.5% in the quarter and has risen over 14% year-to-date. After a volatile first half in which growth stocks posted double-digit gains while energy stocks suffered big losses, U.S. stocks settled down in 2017’s third quarter. With the U.S. economy slowly chugging along, corporate earnings producing few major surprises, and oil prices on the rise after falling in the year’s first half, the major stock indexes all produced modest single-digit gains for the quarter, with the S&P 500 hitting new all-time highs. Although there was plenty of news, including devastation from hurricanes and continued political turmoil in Washington, D.C., the markets mostly shrugged it off.

The biggest winners during the quarter were developed and emerging market stocks funds (such as the DFA International Core Equity Fund and DFA Emerging Markets Core and Emerging Markets Value Funds), posting gains from 5.5% – 8.0%. After a lackluster first half of the year, U.S. Small Company Value stocks (as represented in client accounts by the DFA U.S. Small Cap Value Fund and Vericimetry U.S. Small Cap Value Fund) gained about 6.0% on the quarter. All Elevation Wealth Partners managed accounts posted solid gains for the quarter (with returns in the range of low to mid-single digits).

Looking Forward & The Inevitable Bear Market

Ten years ago, the U.S. stock market peaked on October 12, 2007. Over the next 15 months, stocks would fall by more than 50% and the country would experience one of the worst financial crises in its history. Storied financial institutions and companies would have to be bailed out by the government or acquired such as; Bank of America, Merrill Lynch, Citigroup, Bear Stearns, AIG, and General Motors. Lehman Brothers would fail. Unemployment would hit 10%. Not only was it scary time to be an investor, it was a scary time period!

The stock market bottomed on March 9, 2009. Despite all the negativity (the home foreclosures, rising unemployment, and bankruptcies), stocks began to climb their way back. The recovery was fragile for sure as any down day in the markets felt like an aftershock you experience after a major earthquake. If you had just held on, 2009 turned out to be a great year for stock investors with the S&P 500 Index gaining nearly 26%!

Bear markets and stock market corrections are an investible part of investing. Consider the following statistics;

- In the 91 one-year periods since 1926, stocks have posted losses 24 times (about one out of every four years).

- The average Bear Market has lasted 24 months with a total return of -45%.

- The average Bull Market has lasted 54 months with a total return of +158%.

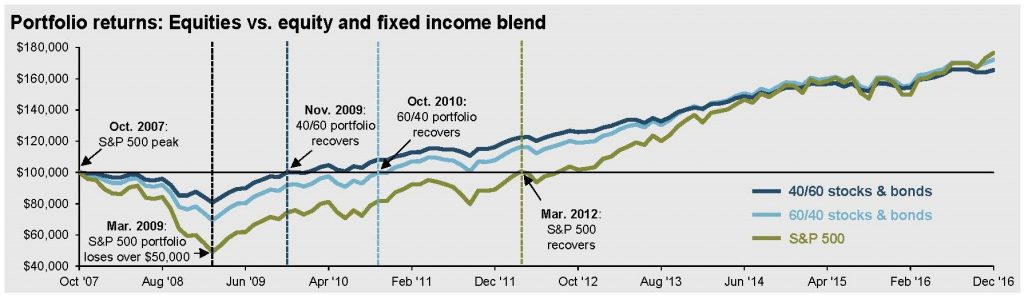

We love these odds! That is why is we are always bullish when we look into our crystal ball. Even during the last bear market from late 2007 to early 2009, when stocks lost 50% of their value, a 60% stock / 40% bond portfolio recovered just 19 months after hitting bottom in March 2009.

60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high quality U.S. fixed income, represented by the Barclays U.S. Aggregate Index. The portfolio is rebalanced annually.

Even though we don’t see the “irrational exuberance of the late 1990’s that culminated in a bubble in the technology sector and subsequent collapse in the stock market, nor signs of financial shenanigans that led to the collapse in mortgage back securities (and practically the entire financial system), the next bear market could be right around the corner.

Here are three things you can do to not only survive, but to thrive during the next bear market.

1. Know what you need to live on. We are not talking about budgeting. We are talking about knowing what you need each year and where that money is going to come from. This is what we call financial planning. In knowing that you have, say, five years of living expenses in bonds in your Elevation Wealth Partners managed accounts should give you great confidence you can withstand the next downturn.

Want to take that a step further? Then actually track your money, so you know what you spend each month and what is discretionary and can be temporarily cut if need be. Trade that trip to Europe for a trip to Canada. Dine out less. Cut gifts to adult children. In a two driver family, get rid of that third car (unless it’s your prized ’67 Corvette). You can find dozens of such worksheets in Microsoft Excel or Google Sheets. Click here for one.

2. Know your threshold for investment loss. For most people, money elicits strong emotions. This is why we often think of ourselves as behavior coaches at Elevation Wealth Partners – helping to keep clients focused on their financial goals. The graphic below illustrates the Best, Average, and Worst one year returns for various mixes of stocks and bonds over the last 20 years (1997 – 2016).

If you have $2 million with 75% in stocks and 25% in bonds, it could decline by 32% (or more) during the next bear market. $2 million could fall to $1.3 million. Though a temporary loss, unnerving for sure. But would you lose sight of long-term goals?

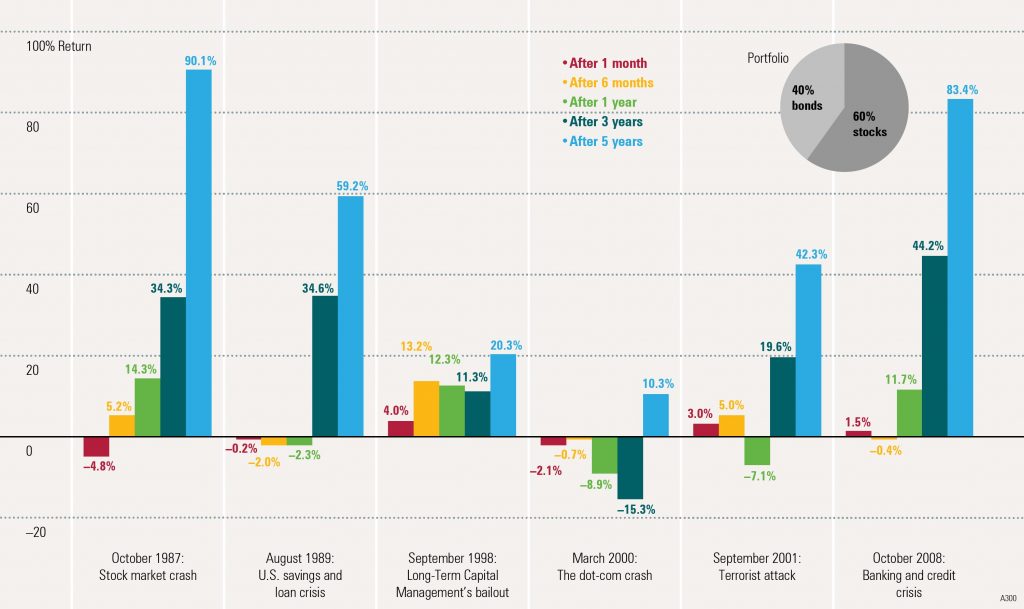

3. Turn off the TV or close the iPad and take a long walk, go see your grandchildren, or call your wealth manager. We have worked together to create an investment strategy for you that will carry you through thick and thin. Consider the chart below and how markets have eventually recovered from every major financial crisis of the last 30 years.

What is Elevation Wealth Partners doing in anticipation of the next major downturn?

As we shared at our client luncheons in May, we continue to make sure clients have ample foreign stock investments in their portfolios. In general, foreign stocks are trading at valuations significantly less than U.S. stocks. For this reason, we expect them to potentially hold-up better in the next downturn and very possibly outperform U.S. stocks over the next decade.

Likewise, as we’ve shared in recent client meetings, among U.S. stocks we are emphasizing investment in value stocks (stocks that currently trade at a low price relative to their fundamentals; such as dividends, earnings, sales, and book value). Historically, these types of stocks have outperformed the market as a whole. While they didn’t do any better than the market during the last financial crisis, such stocks lost much less during the dot-com fueled collapse.

If it has been some time since we reviewed your financial goals or something has changed in your financial life (you have been granted stock in your company, changed jobs, lost a loved one, or are nearing retirement) – please contact us to schedule a meeting. As always, we are here to be a resource to you and those important to you.

Sincerely,

Sources: Jeremy Glaser & David Kathman, CFA, PhD. – Morningstar, Inc., Dimensional Fund Advisors, J.P. Morgan Asset Management, Loring Ward Financial.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.