3rd Quarter 2020 reports and other portfolio information are now available to view on the new Elevation Wealth Partners platform. If you haven’t already done so, please bookmark this page for future use. Once you access the portal, please click on your DOCUMENTS tab or to find your 3rd Quarter 2020 Report. You can also find additional reports, updated as of the close of the market, under the tab titled REPORTS.

This video provides a demo of the new portal, highlighting key features.

The feedback we’ve received on the new portal and client dashboard has been positively overwhelming! Clients love seeing their financial data organized in one spot and are pleased with how easy it is to navigate, find, and upload information. Please continue to provide any comments as we welcome your feedback, good or not so good.

We are excited to announce that the new Elevation Wealth Partners app for Apple and Android mobile devices is now available! For your iPhone or iPad, download it from the iTunes store here and Google Play here.

The new app has many robust features that provide a clear, up-to-date picture of your financial position. One login provides a view of all your investment accounts and assets. This information is updated daily, providing real-time details on your holdings, asset allocation, and investment performance.

We are still moving many clients’ documents and reports from Citrix / ShareFile to the new portal. Thank you for your patience.

If you requested to receive your reports via mail, you will receive them shortly.

How will the upcoming Presidential election affect the markets?

This is the #1 question we’ve been asked the last few months. It’s natural for investors to look for a connection between who wins the White House and which way the markets will move. We want to believe that our President, the leader of the free world, can bring order to chaos. However, as nearly a century of stock returns show, stocks have trended upward across administrations from both parties.

Over the years, we’ve seen countless economic predictions based on political beliefs. And while it may seem the President can affect such policy as taxes, who chairs the Fed, and global relations, there are hundreds, if not thousands, of other factors at work. The actions of foreign leaders, a global pandemic, interest rate changes, rising and falling oil prices, and technological advances, are just a few. In reality, Presidential elections have little effect on the general economy and even then, the general economy isn’t necessarily reflected in current stock prices (now is a great example of that).

Shareholders are investing in companies, not a political party. Investors buy into the future prospects of companies by voting with their capital while companies focus on serving their customers and growing their businesses, regardless of who occupies the Oval Office. Most of the time it is a fairly efficient system where those who put up the capital are eventually rewarded. Successful investing is as simple as that.

For a fascinating interactive look on how the economy and markets shaped nearly 100 years of U.S. presidential terms click here.

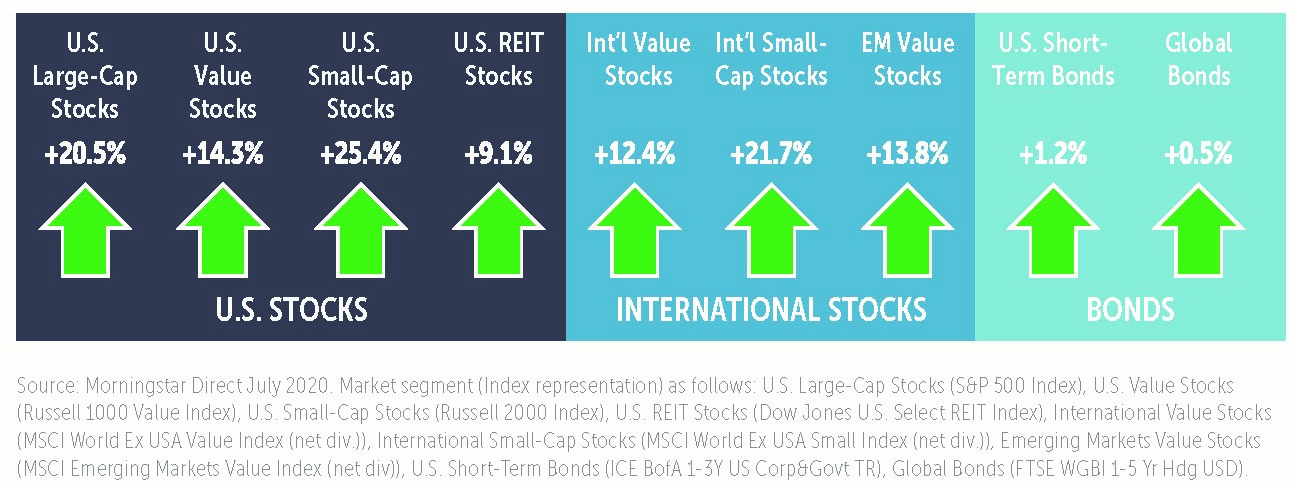

3rd Quarter Market Review and Index Returns

Global stock markets continued to rebound during the third quarter and are still recovering losses from the first quarter in most areas of foreign and domestic markets. This positive performance follows continued global efforts to reopen economies under social distancing guidelines during the quarter. While markets may experience volatility ahead with risks such as a resurgence of the virus or election uncertainty, ultra-low rates and support from the Federal Reserve provide meaningful support to equities.

For the quarter, U.S. stocks (as measured by the S&P 500 Index) gained 8.9%, non-U.S. developed market stocks (as measured by the MSCI World Ex U.S.) gained 4.9% and emerging market stocks (as measured by the MSCI Emerging Markets Index) gained 9.6%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, decreased in the third quarter by 3.6% compared to foreign currencies. Over the past 12 months, the U.S. dollar has depreciated by 5.5%. The decrease in the dollar is a tailwind to non-U.S. investments held by U.S. investors in the third quarter.

U.S. interest rates remained unchanged during the quarter as the Federal Reserve continues to maintain a target range of 0.0% to 0.25% for the Fed Funds rate.

Both U.S. and international stocks sold off at the height of the COVID crisis, but the valuation gap between U.S. and international stocks that persisted throughout the recent expansion still persist today. However, this dynamic could shift in the next expansion.

Despite a rebound in the stock markets, the economy, labor market, and earnings recoveries will likely improve at a much slower rate. The long-term growth prospects of emerging market economies still look better than the U.S., as valuations remain cheaper overseas, and the dollar has been retreating, which amplifies the return on international equities. Europe, which has been long unloved, may have a catalyst for a turnaround with more promising efforts toward fiscal integration. With additional risks ahead such as a resurgence of the virus and the election in November, investors may benefit from diversification to confront a range of outcomes. Click here from more on our take on the 3rd Quarter.

Medicare Open Enrollment is October 15 – December 7

For those newly eligible for Medicare or already enrolled in Medicare, you can make changes to your Medicare Advantage Plan (Part C) or Medicare prescription drug coverage (Part D) for the following year from October 15 – December 7.

What can you do?

- Change from Original Medicare to a Medicare Advantage Plan.

- Change from a Medicare Advantage Plan back to Original Medicare.

- Switch from one Medicare Advantage Plan to another Medicare Advantage Plan.

- Switch from a Medicare Advantage Plan that doesn’t offer drug coverage to a Medicare Advantage Plan that offers drug coverage.

- Switch from a Medicare Advantage Plan that offers drug coverage to a Medicare Advantage Plan that doesn’t offer drug coverage.

- Join a Medicare drug plan.

- Switch from one Medicare drug plan to another Medicare drug plan.

- Drop your Medicare prescription drug coverage completely.

Visit the official U.S. Government website to learn more. If you are preparing to enroll in Medicare, California Health Advocates, through their Health Insurance Counseling & Advocacy Program (HICAP), is the leading Medicare education non-profit in California. We recommend all clients consult with HICAP before enrolling in Medicare. Learn more.

Kelly Gillette promoted to the role of Client Service Manager

Kelly joined Elevation Wealth Partners in January 2018, returning to her passion of helping individual investors with their investments and finances. Kelly came to ZRC with more than eight years of financial services experience (including seven years with Charles Schwab & Co.). Her impact at ZRC was felt immediately, as she expertly and efficiently helped clients with important financial matters. However, it is the great care she shows for clients that people remember the most. If you have a moment, please congratulate Kelly on this wonderful achievement and recognition.

Welcome Andrew Kirchner as a Client Service & Trading Associate

Andrew joins Elevation Wealth Partners with more than six years of investment and financial services experience. After serving in the Marine Corps for eight years, he began his career as an analyst for a boutique investment advisor in Maryland. He later moved to California where he worked for a regional broker dealer serving financial advisors. Andrew then became an overlay manager at Envestnet – a leading fintech company that has more than $3.5 trillion on its investment platforms. At Envestnet, Andrew was responsible for trading and rebalancing investment accounts totaling more than $2.5 billion. He will eventually be based in the Walnut Creek office.

As always, we are grateful for the opportunity to serve you and to now provide a new, engaging online experience. If the “Current Probability of Success” of your financial plan happens to read “N/A,” then it has been too long since we have reviewed it together. Please let us know a convenient time for us to meet.

Sincerely,

Sources: Dr. David Kelly – J.P. Morgan Asset Management, Dimensional Fund Advisors, Morningstar Inc., and Buckingham Strategic Wealth.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.