We are pleased to welcome four new clients to the firm this quarter. It’s an honor to serve you and we look forward to many years of working together. Elevation Wealth Partners now serves more than 130 investors (families, individuals, and company retirement plans) and manages more than $160 million. Though we are selective about who we work with, we believe that anyone genuinely committed to improving their financial well-being deserves honest, expert advice. For this reason, we did away with our investment minimum last year. By leveraging the latest financial and video-conferencing tools, we effectively serve clients around the globe.

3rd Quarter Commentary

U.S. stocks continued their march higher in the third quarter. The broad-based Dow Jones U.S. Total Stock Market Index was up 4.4% during the period. That index is now up 8.1% so far this year and the S&P 500 Index is up 7.5%. Two U.S. stock funds that are in almost every Elevation Wealth Partners client account (the DFA U.S Core Equity 1 Fund and DFA U.S. Core Equity 2 Fund), returned 8.6% and 8.9%, respectively.

As the quarter began, investors were still trying to make sense of the Brexit vote, but that quickly fell into the background as the market was generally docile for most of the summer. The quiet was driven by a few factors. First, U.S. economic data that was strong enough to calm worries of a recession, but not so strong enough to force the Fed to raise interest rates. Secondly, fears around China and other emerging-markets that had been center stage earlier in the year eased. And finally, even though oil prices did bounce around they remained much higher than the levels seen at the start of the year. Volatility picked up again toward the end of the quarter as the market reassessed the prospect of a rate increase and the U.S. elections.

Abroad, foreign stocks posted solid gains for the quarter. Though the pound fell to an almost three-decade low against the dollar (and almost 15% below where it traded on June 23, the day of the Brexit vote), investors believe a weaker currency will benefit the UK’s largest companies (which make over 70% of their profits abroad). The UK’s leading share index, the FTSE 100, is up 12% since the June 23 referendum. Though the MSCI EAFE Index is up just 1.8% for the year, two funds in most Elevation Wealth Partners client accounts (the First Eagle Overseas Fund and DFA International Core Equity Fund) are up 9.55% and 5.74%, respectively, so far this year.

The rebound in Brazil’s market and currency is one of the main reasons emerging market stocks are performing so well this year. That and the global rally in energy stocks has also buoyed Russia’s stock market and pushed the MSCI Emerging Markets Index up 17.1%. The three emerging market stock funds that are in almost every Elevation Wealth Partners client account (the DFA Emerging Markets Value Fund, DFA Emerging Markets Core Fund, and Schwab Fundamental Emerging Markets Index Fund), are up 21.96%, 19.29%, and 27.49%, respectively.*

The Upcoming Presidential Elections

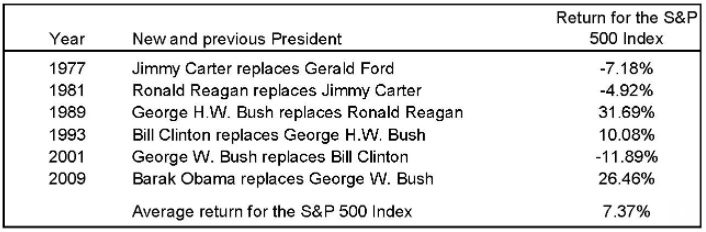

Next month, Americans will head to the polls to elect the next president of the United States. While the outcome is unknown, one thing is for certain: There will be a steady stream of opinions from pundits and prognosticators about how the election will impact the stock market. One common notion suggests a sell-off is imminent the year a new President takes office. In going back to 1970 (the earliest we can go back using the S&P 500 Index), there are six instances of a new President taking office (excluding Gerald Ford taking-over for Richard Nixon who resigned in August 1974). Though half the calendar year returns are negative, there is no obvious trend and the average return during a new administration was a positive 7.37%.

Investors would be well-served to avoid the temptation to make significant changes to a long-term investment plan based upon these sorts of predictions. Predictions about presidential elections and the stock market often focus on which party or candidate will be “better for the market” over the long run.

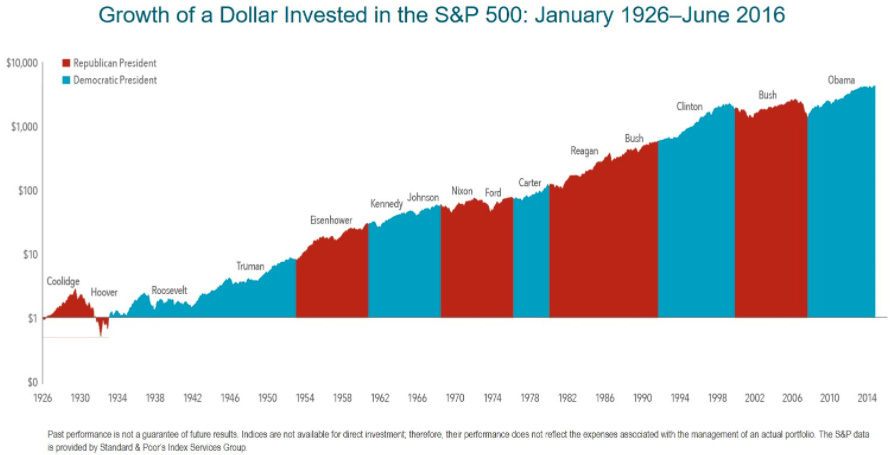

The exhibit below shows the growth of one dollar invested in the S&P 500 Index over nine decades and 15 presidencies (from Coolidge to Obama). This data does not suggest an obvious pattern of long-term stock market performance based upon which party holds the Oval Office. The key takeaway here is that over the long run, the market has provided substantial returns regardless of who controlled the executive branch.**

A Word About Wells Fargo

In September, Wells Fargo & Co. (the bank and financial services holding company) agreed to pay $185 million to resolve claims that “Wells Fargo employees secretly opened unauthorized accounts to hit sales targets and receive bonuses,” Consumer Financial Protection Bureau Director Richard Cordray said in his agency’s statement. Of this amount, $100 million goes to paying the largest fine the CFPB has ever issued. This is after the CFPB last year ordered Citibank to pay $700 million to customers it had overcharged plus $35 million in civil penalties for similar “deceptive marketing and unfair billing practices.”

These types of sales practices are deplorable. And it says a lot about the leaders of these companies and their culture. Sadly, to those of us in the financial services industry, we are not surprised… these types of practices happen all the time! American financial history is littered with hundreds of examples of companies viewing investors, not as valued clients, but as “profit centers.” A recent example detailed in Michael Lewis’ book Flash Boys (about high frequency trading), is brokerage firms such as Morgan Stanley and UBS created “dark pools” or opaque internal trading platforms by which they could trade ahead (or front-run) trades placed by their own clients with the goal of earning an extra profit.

In financial transactions, broker and investor are assumed to have all the necessary information to make an informed decision. The problem is, even in this day and age, the investor is not aware of all the hidden costs; distribution fees, 12b-1 marketing fees, referral fees, finders’ fees, placement fees, and other frictional costs. Much that is supposed to be disclosed simply is not.

This is why Elevation Wealth Partners does business the way we do. We are compensated one way; by the quarterly fee our clients pay us. That’s it. Period. Therefore, it is crystal clear who we work for – You, the client. And what we endeavor to deliver is expertise, service, and results. Though not easy, this business model greatly reduces the penchant for conflicts of interest.

Is it a scary time to be an investor? Yes, but it is also an exciting time. There has never been better access to quality investments and sound advice. If it has been some time since we reviewed your financial goals or something has changed in your financial life; you sold a business (or are considering selling your business), you are nearing retirement, recently changed jobs (or want to change jobs!), or lost a loved one – please call the office to schedule a meeting. As always, we are here to be a resource to you and those important to you.

Sincerely,

Barry N. Mendelson, CFP | Richard P, Clarke, CPA, PFS | Ryan K. Kosakura, CFA | John L. Davis, CFP

*Source: Morningstar, Inc.

**Source: Dimensional Fund