Happy New Year to you and your loved ones! We are thrilled to welcome four new clients to the firm this quarter. It’s an honor to serve all of you and we are grateful for the trust you have placed in us to help guide you in your financial journey. Thank you to everyone who continues to share what we do to friends and family. In these often challenging times, we are never too busy to speak to you or those important to you.

4th Quarter Commentary & Market Summary

- Though we believe the economic outlook remains good, brace for more volatility in 2019.

- Don’t give up on international stocks.

- Don’t go chasing unicorns . . . and returns.

- Focus on what you can control.

The long bull market for U.S. stocks showed signs of ending in 2018, with some parts of the market falling into bear-market territory by late December. The U.S. economy remained healthy for the most part and for most of the year stocks marched upward amid healthy corporate profits. But in the fourth quarter, news reports of political turmoil, global economic growth, corporate earnings, record low unemployment in the U.S., the implementation of Brexit, U.S. trade wars with China and other countries, and a flattening U.S. Treasury yield curve spooked the markets and caused stock prices to tumble. After logging strong returns in 2017, global equity markets delivered negative returns in 2018.

For the quarter, the S&P 500 declined 13.5% and MSCI All Country World Index declined 12.8%. For the year, the S&P 500 declined 4.4% and MSCI All Country World Index lost 9.4%. Longer term, U.S. equity returns are decidedly positive across all time periods – up mid to high single digits over the last three and five years on average. Over the last ten years, U.S. equity returns are up double digits on average – several percentage points above their historic averages. On the other hand, foreign equity returns are up mid to high single digits over the last decade, suggesting they still have room to run.

While the S&P 500’s current streak of nine years in row with positive returns comes to end (tying the late 1990’s in length), its magnitude falls significantly short. On a cumulative basis, from 1991 – 1999 the S&P 500 gained 442%, while from 2009 – 2017 the S&P 500 gained 255%.

Though it is evident the rate at which the U.S. economy is growing is slowing, we do not believe a recession is imminent. What exactly constitutes a recession varies – we consider it to largely be two consecutive quarters of decline in GDP (gross domestic product). In other words, “falling output” and the economy retracting. However, as we have been warning for some time, there does not have to be a recession (or signs of looming recession) for equity markets to decline precipitously. Such as in 1962 (Cuban Missile Crisis) -28%, 1987 (program trading / “portfolio insurance”) -34%, or 1998 (Asian financial crisis) -17%.

Equity market declines of 10% have occurred numerous times in the past. After declines of 10% or more, equity returns over the subsequent 12 months have been positive 71% of the time in U.S. markets and 72% of the time in other developed markets.*

The exhibit below shows the performance of markets subsequent to declines of 10%, 20%, and 30%. For each decline threshold, returns are shown for U.S. large cap, non-U.S. developed markets large cap, and emerging markets large cap stocks in the following 12-month period. While declines in equity markets may cause concern, the data provides evidence that markets generally have positive returns after a decline. For more on the recent market volatility https://elevationwp.com/december-2018-recent-market-volatility/ .

Looking Forward

As we detailed last quarter, a handful of storied U.S. stocks accounted for much of the S&P 500’s gain. That held true through the end of the year with Amazon.com, Microsoft, & Netflix being the largest positive contributors to the S&P 500 in 2018. For the year, the S&P 500 lost -4.38%.

As a group, the ten largest contributors posted an average trailing Price / Earnings Ratio of 80.6. For perspective, the Price / Earnings Ratio for S&P 500 as a whole (all 500 constituents) is 17.2. As attractive of the returns of these stocks might be, as a group they stock prices are very high in relation to their company fundamentals. While buying high and hoping to sell higher is certainly one investment strategy … history has shown that the price you pay for a security matters a lot.

As a group, the ten largest contributors posted an average trailing Price / Earnings Ratio of 80.6. For perspective, the Price / Earnings Ratio for S&P 500 as a whole (all 500 constituents) is 17.2. As attractive of the returns of these stocks might be, as a group they stock prices are very high in relation to their company fundamentals. While buying high and hoping to sell higher is certainly one investment strategy … history has shown that the price you pay for a security matters a lot.

Among client’s international investments, currency movements detracted from U.S. dollar returns in 2018 for non-U.S. dollar assets. The strengthening of the U.S. dollar and the weakening of non-U.S. currencies had a negative impact on returns for U.S. dollar investors with holdings in unhedged non-U.S. dollar assets, and detracted 3.5% from the returns as measured by the difference in returns between the MSCI All Country World ex USA IMI Index in local returns vs. USD. The U.S. dollar strengthened against most currencies, including the euro, the British pound, and the Canadian dollar, and weakened against the Japanese yen.

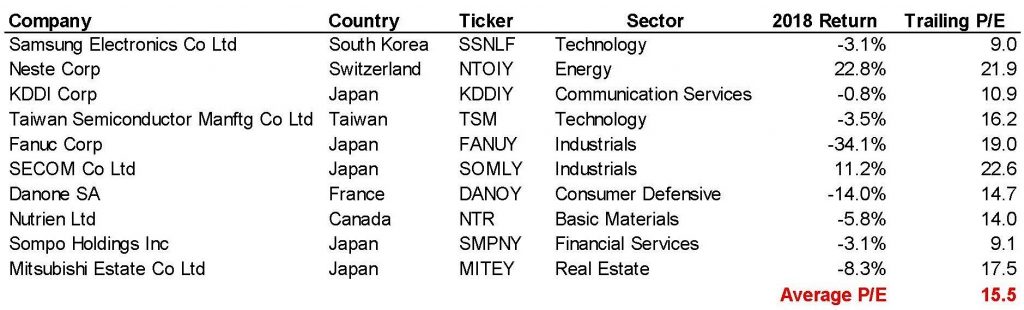

International equity investments continue to be a critical component in all client portfolios. While we believe the U.S. is in the late stages of its economic recovery, we believe many foreign markets are still in the early stages. Furthermore, many international stocks trade at valuations much lower than comparable U.S. companies. Almost universally, below are the ten largest foreign stock holdings owned by clients (via your foreign stock funds). In contrast to ten U.S. stocks above, their average trailing Price / Earnings Ratio is just 15.5! From a bottom-up perspective, foreign equities look more attractive.

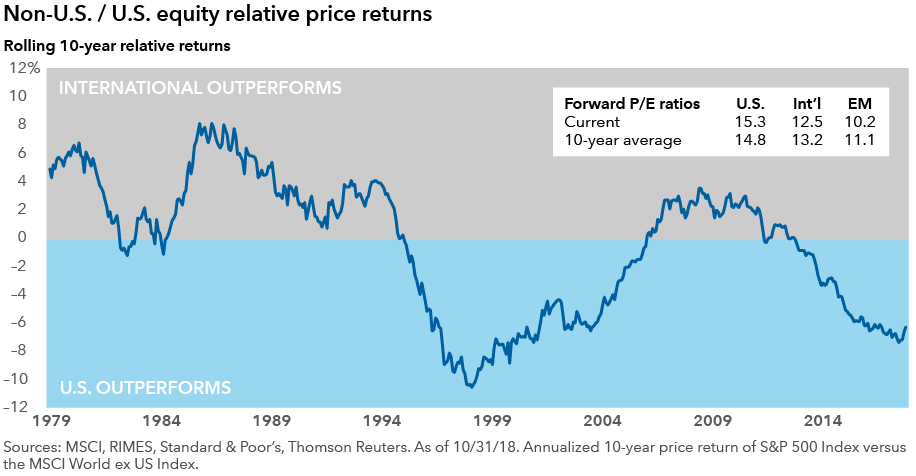

Furthermore, the relative outperformance of U.S. stocks compared with their non-U.S. brethren is at the highest level in history. Consider the graphic below charting the rolling 10-year relative returns of International stocks to U.S. stocks. When the blue line is above 0% and in the grey area, International stocks have outperformed U.S. stocks over the preceding ten years. When the line blue line is below 0% and in the aqua area, U.S. stocks have outperformed International stocks over the preceding ten years. Given where we are in the economic cycles of these broad markets and the significantly lower valuations of International stocks, we expect this trend to eventually reverse.

Furthermore, the relative outperformance of U.S. stocks compared with their non-U.S. brethren is at the highest level in history. Consider the graphic below charting the rolling 10-year relative returns of International stocks to U.S. stocks. When the blue line is above 0% and in the grey area, International stocks have outperformed U.S. stocks over the preceding ten years. When the line blue line is below 0% and in the aqua area, U.S. stocks have outperformed International stocks over the preceding ten years. Given where we are in the economic cycles of these broad markets and the significantly lower valuations of International stocks, we expect this trend to eventually reverse.

While some may question the point of international diversification, we remind clients that they buoyed returns in 2017. Your best performing investment were international equities. Diversification, by definition, means that some areas of your portfolio may be down while others are doing well. Rebalancing works the same way, selling a portion of what has done well and investing the proceeds in what we believe will do well in the future – while maintaining the risk profile you are comfortable with.

It is worth noting that if we look at the past 20 years going back to 1999, U.S. equity markets have only outperformed in 10 of those years – the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000 – 2009, commonly known as the “lost decade” among U.S. investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of -9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio. We are certain that everything you are invested in will perform well . . . if just given enough time. For more on how international stocks can benefit investors see https://elevationwp.com/why-should-you-diversify/ .

Don’t chase unicorns . . . or returns. In investment parlance, a unicorn is a privately held startup company with a value over $1 billion. It’s that mythical investment that you heard someone made a fortune investing in. It is human nature to talk about our accomplishments. That is no truer than in investing. Invariably, at some point during a holiday party last month, your cousin / co-worker / neighbor told you how they made a fortune last year investing in Canadian cannabis stocks. While that may true, what they won’t tell you is how much money they lost investing in crypto-currencies. We call this “cocktail” or “barbeque” talk – friends or acquaintances fondly regaling you with stories of their investment conquests. Take them with a grain of salt and don’t be lured into chasing the latest investment fashion. In 2018 we talked several clients out of buying cryptocurrencies. Good thing because the market for them cratered (Bitcoin returned -71.1% and Ethereum returned -81.1%).

Focus on what you can control. As a client of Elevation Wealth Partners, you’ve probably done pretty well in life. You’ve made smart decisions, worked hard, and saved. Continue to focus on what you can control – how you spend your time, taking good care of yourself, and pursuing your dreams. We’ll help you take care of the rest.

In Santa Rosa and St. Helena, we share our office space with Zainer Rinehart Clark CPA’s … an accounting firm Rick Clarke co-founded in 1979. Though Elevation Wealth Partners and Elevation Wealth Partners CPAs are unaffiliated entities, we share the same client-focused mentality and have many clients in common. In December, a merger was finalized, bringing Zainer Rinehart Clarke CPA’s and Pisenti & Brinker together into one firm.

The newly combined firm, under the name Pisenti & Brinker LLP, provides businesses and individuals with even more capabilities in the areas of tax planning, management advice, audit and assurance services, valuation and litigation support and, estate and succession planning. As the largest accounting firm in the North Bay with nearly 80 employees, P&B works across various industries, including construction, real estate, wineries, vineyards and other agriculture, manufacturing, nonprofits, retail, food and beverage, hospitality, and governmental and municipal agencies. When you phone our Santa Rosa office, you will hear that you have reached Pisenti & Brinker. Rest assured, Kelly and Barry are still at this number. To learn more about the newly combined Pisenti & Brinker LLP visit https://pbllp.com/ .

* Declines are defined as points in time, measured monthly, when the market’s return since the prior market maximum has declined by at least 10%. Declines after December 2017 are not included, but subsequent 12-month returns can include 2018 returns. Compound returns are computed for the 12 months after each decline observed and averaged across all declines for the cutoff. U.S. markets (1926–2018) are represented by the S&P 500 and Developed ex U.S. markets (1970–2018) are represented by the MSCI World ex USA Index.

Sources: Dimensional Fund Advisors, David Kathman, CFA, Ph.D at Morningstar, Inc., Capital Group

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

4th Quarter 2018 Market & Investment Commentary

Happy New Year to you and your loved ones! We are thrilled to welcome four new clients to the firm this quarter. It’s an honor to serve all of you and we are grateful for the trust you have placed in us to help guide you in your financial journey. Thank you to everyone who continues to share what we do to friends and family. In these often challenging times, we are never too busy to speak to you or those important to you.

4th Quarter Commentary & Market Summary

The long bull market for U.S. stocks showed signs of ending in 2018, with some parts of the market falling into bear-market territory by late December. The U.S. economy remained healthy for the most part and for most of the year stocks marched upward amid healthy corporate profits. But in the fourth quarter, news reports of political turmoil, global economic growth, corporate earnings, record low unemployment in the U.S., the implementation of Brexit, U.S. trade wars with China and other countries, and a flattening U.S. Treasury yield curve spooked the markets and caused stock prices to tumble. After logging strong returns in 2017, global equity markets delivered negative returns in 2018.

For the quarter, the S&P 500 declined 13.5% and MSCI All Country World Index declined 12.8%. For the year, the S&P 500 declined 4.4% and MSCI All Country World Index lost 9.4%. Longer term, U.S. equity returns are decidedly positive across all time periods – up mid to high single digits over the last three and five years on average. Over the last ten years, U.S. equity returns are up double digits on average – several percentage points above their historic averages. On the other hand, foreign equity returns are up mid to high single digits over the last decade, suggesting they still have room to run.

While the S&P 500’s current streak of nine years in row with positive returns comes to end (tying the late 1990’s in length), its magnitude falls significantly short. On a cumulative basis, from 1991 – 1999 the S&P 500 gained 442%, while from 2009 – 2017 the S&P 500 gained 255%.

Though it is evident the rate at which the U.S. economy is growing is slowing, we do not believe a recession is imminent. What exactly constitutes a recession varies – we consider it to largely be two consecutive quarters of decline in GDP (gross domestic product). In other words, “falling output” and the economy retracting. However, as we have been warning for some time, there does not have to be a recession (or signs of looming recession) for equity markets to decline precipitously. Such as in 1962 (Cuban Missile Crisis) -28%, 1987 (program trading / “portfolio insurance”) -34%, or 1998 (Asian financial crisis) -17%.

Equity market declines of 10% have occurred numerous times in the past. After declines of 10% or more, equity returns over the subsequent 12 months have been positive 71% of the time in U.S. markets and 72% of the time in other developed markets.*

The exhibit below shows the performance of markets subsequent to declines of 10%, 20%, and 30%. For each decline threshold, returns are shown for U.S. large cap, non-U.S. developed markets large cap, and emerging markets large cap stocks in the following 12-month period. While declines in equity markets may cause concern, the data provides evidence that markets generally have positive returns after a decline. For more on the recent market volatility https://elevationwp.com/december-2018-recent-market-volatility/ .

Looking Forward

As we detailed last quarter, a handful of storied U.S. stocks accounted for much of the S&P 500’s gain. That held true through the end of the year with Amazon.com, Microsoft, & Netflix being the largest positive contributors to the S&P 500 in 2018. For the year, the S&P 500 lost -4.38%.

Among client’s international investments, currency movements detracted from U.S. dollar returns in 2018 for non-U.S. dollar assets. The strengthening of the U.S. dollar and the weakening of non-U.S. currencies had a negative impact on returns for U.S. dollar investors with holdings in unhedged non-U.S. dollar assets, and detracted 3.5% from the returns as measured by the difference in returns between the MSCI All Country World ex USA IMI Index in local returns vs. USD. The U.S. dollar strengthened against most currencies, including the euro, the British pound, and the Canadian dollar, and weakened against the Japanese yen.

International equity investments continue to be a critical component in all client portfolios. While we believe the U.S. is in the late stages of its economic recovery, we believe many foreign markets are still in the early stages. Furthermore, many international stocks trade at valuations much lower than comparable U.S. companies. Almost universally, below are the ten largest foreign stock holdings owned by clients (via your foreign stock funds). In contrast to ten U.S. stocks above, their average trailing Price / Earnings Ratio is just 15.5! From a bottom-up perspective, foreign equities look more attractive.

While some may question the point of international diversification, we remind clients that they buoyed returns in 2017. Your best performing investment were international equities. Diversification, by definition, means that some areas of your portfolio may be down while others are doing well. Rebalancing works the same way, selling a portion of what has done well and investing the proceeds in what we believe will do well in the future – while maintaining the risk profile you are comfortable with.

It is worth noting that if we look at the past 20 years going back to 1999, U.S. equity markets have only outperformed in 10 of those years – the same expected by chance. We can examine the potential opportunity cost associated with failing to diversify globally by reflecting on the period in global markets from 2000 – 2009, commonly known as the “lost decade” among U.S. investors. While the S&P 500 recorded its worst ever 10-year cumulative total return of -9.1%, the MSCI World ex USA Index returned 17.5%, and the MSCI Emerging Markets Index returned 154.3%. In periods such as this, investors were rewarded for holding a globally diversified portfolio. We are certain that everything you are invested in will perform well . . . if just given enough time. For more on how international stocks can benefit investors see https://elevationwp.com/why-should-you-diversify/ .

Don’t chase unicorns . . . or returns. In investment parlance, a unicorn is a privately held startup company with a value over $1 billion. It’s that mythical investment that you heard someone made a fortune investing in. It is human nature to talk about our accomplishments. That is no truer than in investing. Invariably, at some point during a holiday party last month, your cousin / co-worker / neighbor told you how they made a fortune last year investing in Canadian cannabis stocks. While that may true, what they won’t tell you is how much money they lost investing in crypto-currencies. We call this “cocktail” or “barbeque” talk – friends or acquaintances fondly regaling you with stories of their investment conquests. Take them with a grain of salt and don’t be lured into chasing the latest investment fashion. In 2018 we talked several clients out of buying cryptocurrencies. Good thing because the market for them cratered (Bitcoin returned -71.1% and Ethereum returned -81.1%).

Focus on what you can control. As a client of Elevation Wealth Partners, you’ve probably done pretty well in life. You’ve made smart decisions, worked hard, and saved. Continue to focus on what you can control – how you spend your time, taking good care of yourself, and pursuing your dreams. We’ll help you take care of the rest.

In Santa Rosa and St. Helena, we share our office space with Zainer Rinehart Clark CPA’s … an accounting firm Rick Clarke co-founded in 1979. Though Elevation Wealth Partners and Elevation Wealth Partners CPAs are unaffiliated entities, we share the same client-focused mentality and have many clients in common. In December, a merger was finalized, bringing Zainer Rinehart Clarke CPA’s and Pisenti & Brinker together into one firm.

The newly combined firm, under the name Pisenti & Brinker LLP, provides businesses and individuals with even more capabilities in the areas of tax planning, management advice, audit and assurance services, valuation and litigation support and, estate and succession planning. As the largest accounting firm in the North Bay with nearly 80 employees, P&B works across various industries, including construction, real estate, wineries, vineyards and other agriculture, manufacturing, nonprofits, retail, food and beverage, hospitality, and governmental and municipal agencies. When you phone our Santa Rosa office, you will hear that you have reached Pisenti & Brinker. Rest assured, Kelly and Barry are still at this number. To learn more about the newly combined Pisenti & Brinker LLP visit https://pbllp.com/ .

* Declines are defined as points in time, measured monthly, when the market’s return since the prior market maximum has declined by at least 10%. Declines after December 2017 are not included, but subsequent 12-month returns can include 2018 returns. Compound returns are computed for the 12 months after each decline observed and averaged across all declines for the cutoff. U.S. markets (1926–2018) are represented by the S&P 500 and Developed ex U.S. markets (1970–2018) are represented by the MSCI World ex USA Index.

Sources: Dimensional Fund Advisors, David Kathman, CFA, Ph.D at Morningstar, Inc., Capital Group

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.