We are happy to welcome two new clients into the Elevation Wealth Partners family this quarter. Thank you to everyone who continues to share with friends and family, their experiences about how we’ve added clarity to your financial lives and increased your net worth over the years. It’s an honor to serve you and we look forward to many years of working together.

2020 Market Review and Index Returns

2020 proved to be one of the most tumultuous years in modern history, marked by a number of developments that were historically unprecedented. But the year also demonstrated the resilience of people, institutions, and financial markets.

The year started with the novel coronavirus in the news and concerns grew rapidly as more countries began reporting their first cases of COVID-19. Infections multiplied around the world through February and by early March, when the outbreak was labeled a pandemic, it was clear that the crisis would affect nearly every area of our lives. The Spring would see a spike in cases and a global economic contraction as people stayed closer to home followed by another surge of infections during the summer months. Governments and central banks worked to cushion the blow, providing financial support for individuals and businesses and adjusting lending rates.

On top of the health crisis, there was widespread civil unrest in the U.S. tied to policing and racial justice. In August, Americans increasingly focused on the U.S. presidential race in this unusual year. Politicians, supporters, and voting officials wrestled with the challenges of a campaign that at times was conducted virtually and with an election in the Fall that would include a heightened level of mail-in and early voting. In the end, the results of the election would be disputed well into December. As Autumn turned to Winter, 2020 would end with both troubling and hopeful news: yet another spike in COVID-19 cases, along with the first deliveries of vaccines in the U.S. and elsewhere. Through it all, businesses and companies do what they do . . . adapt. Likewise, the markets processed information and rose with the hope and expectations of investors.

MSCI All Country World Index with selected headlines from 2020

In U.S. dollars, net dividends. MSCI data © MSCI 2021, all rights reserved. Indices are not available for direct investment. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

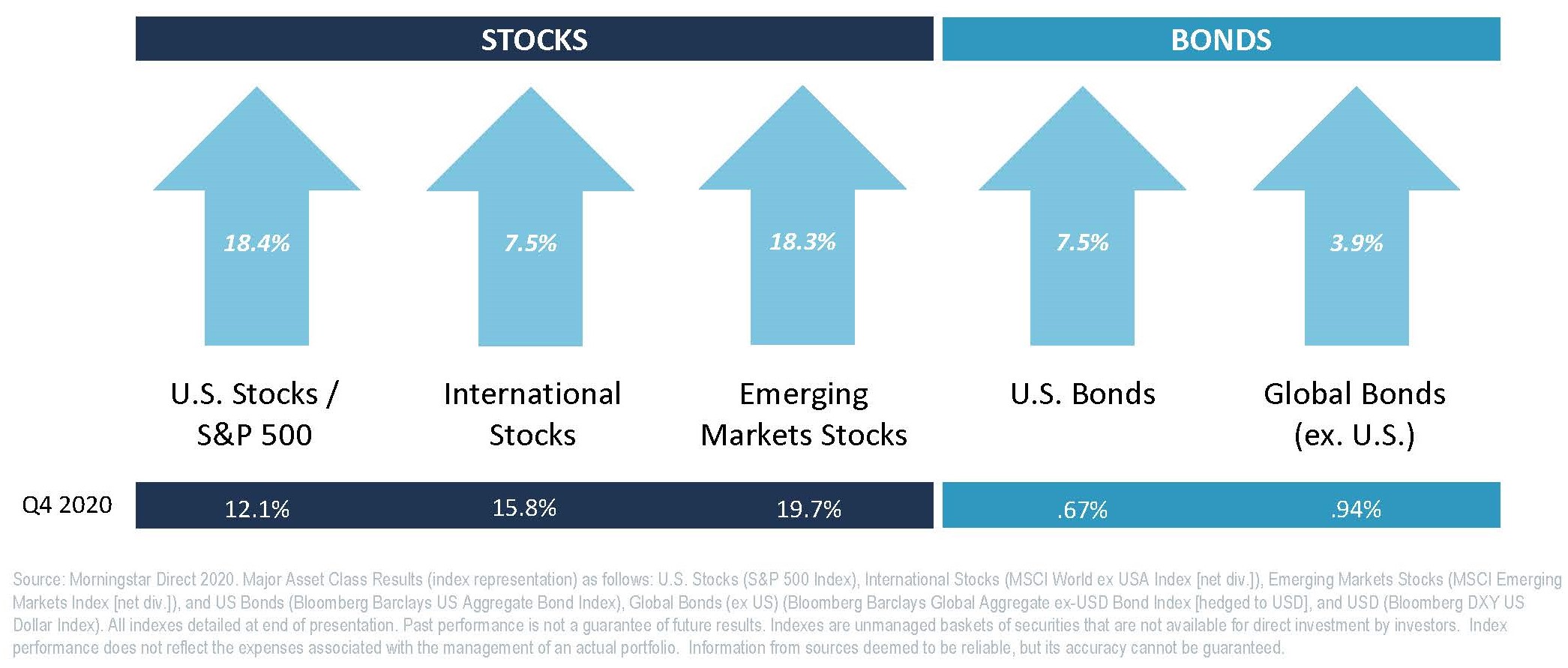

Looking back on the 4th quarter and 2020:

- The S&P 500 Index rose 12.1% in the fourth quarter, finishing 2020 with a 18.4% return.

- At year-end, the S&P 500 had rallied 70% from March lows, which had seen the index down almost 30% for the year.

- Small-value stocks topped the Morningstar Style Box in the fourth quarter, but value stocks still trail growth stocks by massive margins for longer time frames.

- Dividend stocks bounced back strongly in the fourth quarter but lagged the broader market for the year.

- International and emerging-markets stock indexes outperformed the U.S. market during the fourth quarter.

- Despite a fourth-quarter rally, energy stocks were the worst performing sector for the fourth consecutive year.

- Consumer cyclical and technology stocks soared throughout the year.

- Yields on the U.S. Treasury 10-year fell by nearly 1% for the year to 0.93%.

- The Bloomberg Barclays Aggregate Bond Index rose 0.67% in the fourth quarter and returned 7.5% for the year.

For investors, the year was characterized by sharp swings for stocks. In March, we saw the S&P 500 Index decline as much as 33.79% from the previous high as the pandemic worsened. This was followed by a rally in April and stocks continuing to increase and reaching their previous highs by August. Ultimately, despite a sequence of epic events and continued concerns over the pandemic, global stock market returns in 2020 were above their historical norm. The U.S. markets finished the year in record territory with an 18.40% annual return for the S&P 500 Index, Non-US developed markets, as measured by the MSCI World ex USA Index, returned 7.59% and Emerging markets, as measured by the MSCI Emerging Markets Index, returned 18.31% for the year.

The 2020 economy and markets also underscored the importance of staying broadly diversified across companies and industries. The downturn in stocks impacted some segments of the market more than others in ways that were consistent with the impact of the COVID-19 pandemic on certain types of businesses or industries. For example, airline, hospitality, and retail industries tended to suffer disproportionately with people around the world staying at home, whereas companies in communications, online shopping, and technology emerged as relative winners during the crisis. However, making a prediction at the beginning of 2020 on exactly how this might play out would have proved challenging.

Looking forward . . . optimism and hope.

Though we see many challenges in the coming year, we also see many reasons to be optimistic.

- Though unemployment remains high, we believe the U.S. could begin to see the benefits of mass vaccinations and herd immunity by Summer, thereby easing social distancing restrictions and opening the path for rising employment. Permanent job losses are likely to be low.

- While parts of the market have lofty valuations and some investors continue to be enamored with money losing unicorns such as DoorDash and Airbnb as well as special purpose acquisition companies (SPACs) and cryptocurrencies, a number of areas of the market (both in the U.S. and abroad) present compelling investments and trade at reasonable prices with solid fundamentals.

- COVID-19 has accelerated many positive trends that we believe will have lasting affects including; increased work-from-home and a focus on work-life balance, improved online learning that is reaching a greater audience, increased awareness and attention to one’s physical and mental health.

Diversification, discipline, and a long-term view remain the key tenants of Elevation Wealth Partners investment philosophy and what we execute for our clients.

What to do when a loved one passes (and how to prepare for it).

When a loved one passes, they leave behind more than just memories. Their funeral must be planned, their bank and investment accounts transferred and closed, their pets rehomed, and their final bills paid.

The job of handling those personal and legal details may add to the stress and grief you are already feeling. Cheryl Nobusada (Ryan Kosakura’s wife) shares with us what to do, and even how to prepare, for the end of someone’s time here on earth in this comprehensive checklist.

Just know that others are here to help, including us, your trusted wealth advisors. You’ll also want to seek the help of attorneys and CPAs, as well as friends and family whom you can delegate tasks or lean on for emotional support.

Elevation Wealth Partners is hiring! We are actively seeking another Wealth Advisor & Financial Planner to join our team.

As Elevation Wealth Partners continues to grow, we want to ensure that the needs of our clients are well-met. We are seeking to add another Wealth Advisor and/or Financial Planner to our team based in our Santa Rosa office (they will telecommute until at least Summer 2021). Our ideal candidate thrives on being a trusted advisor, is passionate about helping others, has an entrepreneurial spirit and believes strongly in providing exceptional client service. Someone with excellent verbal and written communication skills and a positive, can‐do attitude is also a must. If you know of such a person that is currently a Wealth Advisor, Financial Advisor, Financial Planner, or CPA (Certified Public Account) with the PFS (Personal Financial Specialist) designation, please consider making an introduction. To view the job description, please click here. To forward Barry’s LinkedIn profile to someone who might be interested in learning more about Elevation Wealth Partners click here.

As always, we are grateful for the opportunity to serve you. If the “Current Probability of Success” of your financial plan happens to read “N/A,” then it has been too long since we have reviewed it together. Please let us know a convenient time for us to meet.

Sincerely,

Sources: Dimensional Fund Advisors, Morningstar Inc., and Buckingham Strategic Wealth.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.