April 30, 2021

We are happy to welcome three new clients into the Elevation Wealth Partners family this quarter. Thank you to everyone who continues to share with friends and family how we’ve added clarity to your financial lives and increased your net worth over the years. It’s an honor to serve you and we look forward to many years of working together.

Perspective

For our daughters’ spring break from school this year, we drove 12 hours to Moab, Utah and spent five days touring the awe inspiring Arches National Park, Canyonlands National Park, Dead Horse Point State Park, and surrounding areas. Situated in eastern Utah, Moab is the gateway to massive red rock formations and numerous adventure activities. It was my fourth time to the area, Kristin’s second, and the girls first.

The first thing we did was drive to Arches National Park and at the entrance buy a new U.S. Park Pass. At just $80, this gets us access to more than 2,000 National Parks and Federal Recreations Sites for 12 months. It is one the best deals in all of recreation.

The entrance to Arches NP is right off Highway 191 (the main road that goes through Moab) and fairly non-descript. The beauty of the park begins to reveal itself two miles up the road after you’ve ascended another 500 feet and one of the park’s major attractions comes into view: Courthouse Towers. These massive monoliths and spires, each the size of the largest and tallest skyscrapers, stretch another 500 feet from the desert floor. The sight of them literally takes your breath away . . . because at that moment you are reminded of how big this world is . . . and how small you are. That moment, that feeling, is both inspiring and humbling. For me, it is much like when you are driving east on Highway 140 and El Portal Road towards Yosemite National Park and Yosemite Valley first comes into view . . . the depth and detail of what you are staring at is almost difficult to comprehend.

It is moments like these, when we are with the ones we love, surrounded by such natural beauty whose vastness overwhelms our eyes and minds, that we are reminded about what matters most. . . time with the ones we love, health, security, and the belief that tomorrow will be better than today.

It is only natural for us to focus on what lays ahead for the next day, week, month, and year because that is what is most front of mind. At Elevation Wealth Partners, we too are focused on making sure your immediate needs are taken care of. However, as your advisors and planners, just as important to us is knowing that, together, we have a plan for the future . . . not just a year now, but five years now, ten years from now, and even for your next generation. That is the value of Perspective.

With gratitude,

Barry and the entire Elevation Wealth Partners Team

Sydney and Elliot Mendelson – Dead Horse Point State Park, Utah.

1st Quarter Market Review and Index Returns

During the first quarter, global stock markets continued to post positive performance and build on their strong finish to 2020. Major global market indices ended the period modestly higher with several indices continuing to reach new record highs. During the quarter, efforts to combat the virus and its impact continued as governments worked to support global economies – this included the recent additional U.S. fiscal stimulus payments and the initial proposal of a $1.9T infrastructure spending plan set forth by President Biden’s administration. In addition, Americans began frequenting businesses in higher numbers that were hit hard during the peak of pandemic lockdowns. Some view this as a sign that the U.S. economic recovery might be progressing more quickly than initially expected.

For the quarter, U.S. stocks (as measured by the S&P 500 Index) gained 6.17%, and non-U.S. developed market stocks (as measured by the MSCI All Country World Ex U.S. Index) gained 3.49%. Emerging market stocks (as measured by the MSCI Emerging Markets Index) gained 2.29%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased in the first quarter—the U.S. dollar increased by 3.7% compared to foreign currencies. Over the past 12 months, the U.S. dollar depreciated by 5.9%. The decrease in the dollar is a tailwind to non-U.S. investments held by U.S. investors for the last 12 months.

U.S. interest rates remained unchanged during the quarter as the Federal Reserve continues to maintain a target range of 0.0% to 0.25% for the Fed Funds rate.

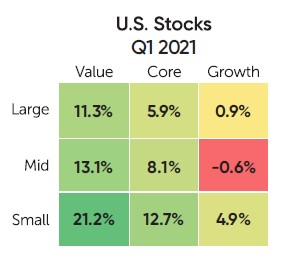

Both domestic and international stocks across all size and style categories, as well as U.S. real estate investment trust (REIT) securities, had positive performance during the quarter. International stock returns were also impacted during the quarter by the strengthening U.S. dollar. During the quarter, U.S small-cap stocks were the best performing and emerging-market stocks were the worst performing. U.S. and global bonds were each down slightly during the quarter.

In the U.S., small-cap stocks outperformed large-cap stocks in all style categories. Value stocks outperformed growth stocks in all style categories. Among the nine style boxes, small-cap value stocks performed the best and mid-cap growth stocks experienced the worst loss during the quarter. For more on our take on the 1st Quarter and our 2021 Market Review click here.

Santa Rosa office moving down the street in July

In July, our Santa Rosa office will be moving ½ mile down the street from 3510 Unocal Place to 3562 Round Circle, Suite 300 (on the 3rd Floor).

For the continued safety and security of our team, our families, and clients, we continue to recommend that we meet only by Zoom unless necessary to help with an important matter. Each of us is by our phones and almost always respond to email with 24 hours.

As always, we are grateful for the opportunity to be a resource to you and those important to you.

Sincerely,

Sources: Dimensional Fund Advisors, Morningstar Inc., and Buckingham Strategic Wealth.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.