Russian’s invasion of the Ukraine and the subsequent humanitarian crisis is troubling on so many levels. Our hearts go out to those affected. We, at Elevation Wealth Partners, donated to Care.org to provide aid and essential items. Please consider doing the same.

While it is difficult to get away from the current news cycle and the latest eye-grabbing headlines, in times like these it’s important to stand back and remember a few key points:

- Market declines are part of investing

- Emotional investing can be hazardous

- Diversification matters

Market declines are part of investing

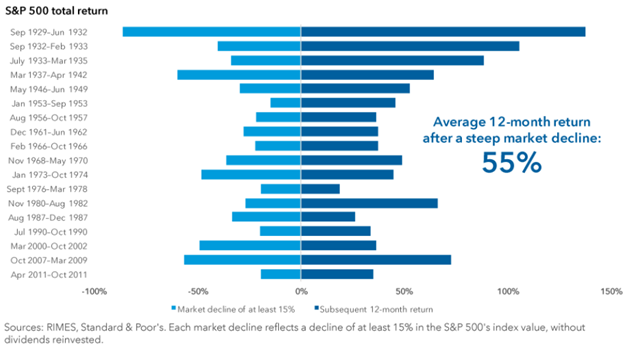

As you can see in the chart below, while markets may seem pessimistic during periods of heightened volatility, they often bounce back quickly. Despite averaging a double-digit correction per year, 31 of the last 41 calendar years have finished with positive returns.

Said another way, a decline of at least 10% occurred in 10 out of the past 20 years, with an average pullback of 15%. Despite these pullbacks, stocks rose in most years, with positive returns in all but 3 years and an average gain of approximately 7%.

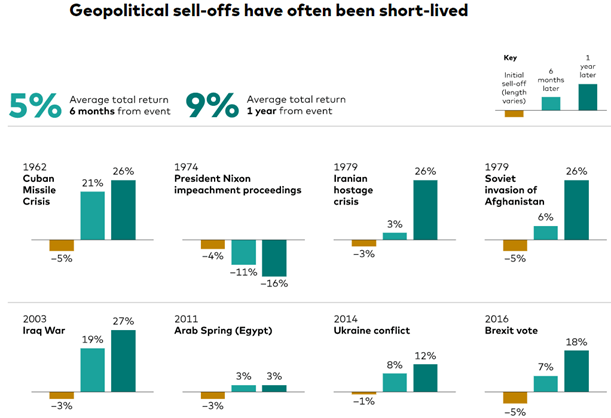

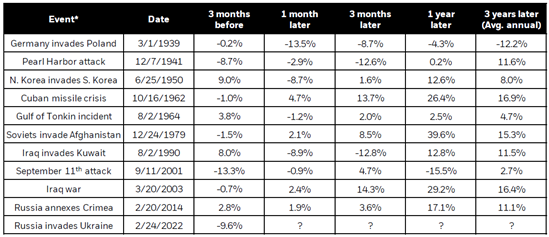

And, as the next chart shows, it hasn’t taken long for equity markets to recover from initial sell-offs in response to geopolitical events. Yet, we wouldn’t have predicted such quick recoveries at the onset of these historical sell-offs. While we’re hoping for a speedy resumption to normalcy in Ukraine, we do not predict one now.

Stay calm amid market volatility

Emotional investing can be hazardous

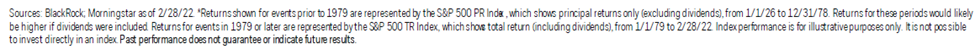

While it’s perfectly natural to feel nervous when markets decline, taking action during such periods can mean the difference between investment success and shortfall.

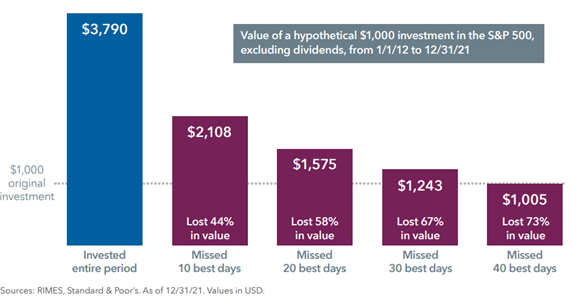

It’s important to make a plan and stick to it since the market tends to reward long-term investors. As shown below, missing just a few days of the market’s best days can jeopardize investment returns.

Diversification matters

By spreading investments across a variety of asset classes, investors can buffer the effects of volatility on their portfolios. Overall returns won’t reach the highest highs of any single investment — but they won’t hit the lowest lows either. Diversification can help lower volatility.

Stocks are important building blocks of a diversified portfolio, and bonds can provide an essential counterbalance. That’s because bonds typically have low correlation to the stock market, meaning that they have tended to zig when the stock market zagged.

Elevation Wealth Partners strategy

At Elevation Wealth Partners, we believe in the value of investing our client’s hard-earned money in solid, diversified funds with good management and a solid track record. We look at market corrections as opportunities to rebalance portfolios by selling high and buying low. We don’t try to time the market, but rather believe it is “time in the market” that counts.

In short, “Uncertainty and volatility are a part of investing. Time and again, markets have rewarded investors willing to focus on their goals and stick to their long-term plan.”

David Booth Executive Chairman and Founder, Dimensional Fund Advisors

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.