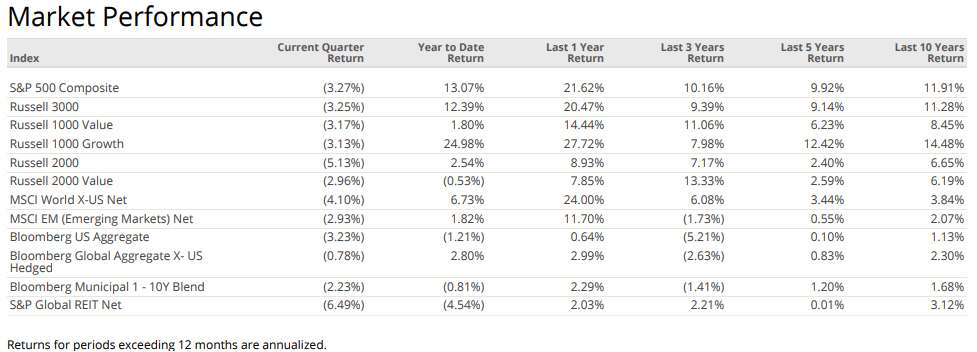

- While the three major asset classes for stocks (i.e., US, International and Emerging Markets) declined during the 3rd quarter, all three have still racked up significant gains in the past 12 months.

- Yields remain elevated in the bond market, offering investors meaningful income.

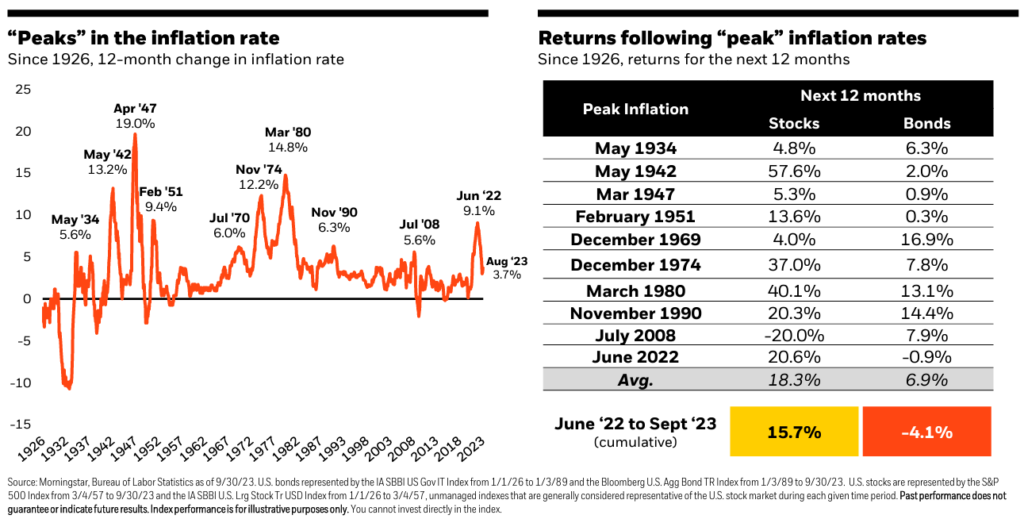

- Inflation seems to have stabilized as consumer prices grew at the same pace in September as they had in August. At just 3.7%, inflation is trending towards the Fed’s long-run 2.0% target.

- GDP grew by 2.4% year over year through Q2 (i.e., the most recent quarter available) showing few signs the economy might experience a recession.

Stock markets continue to watch the Fed and are beginning to accept that it will likely keep rates higher for longer. Although the likelihood of entering a recession in 2023 has significantly declined, growth prospects remain constrained by higher costs of labor and capital as well as a higher likelihood that consumer spending will continue to slow.

US Stocks

Q3 – The US equity market posted negative returns, outperformed non-US developed markets, but underperformed emerging markets:

- Large Cap Value stocks performed best in Q3

- Growth underperformed value in Large, Mid & Small Cap

- Small Caps underperformed Large Caps

1 Year – Our investment philosophy does not put large bets on any one stock or style. Large Cap Growth stocks have performed best over the past year:

- Large Growth funds have outperformed all other style boxes over the past year.

- Valuations suggest a breadth of expected returns going forward.

- Although growth stocks typically trade at higher multiples than value stocks, the spread between value and growth stocks is near all-time highs. While this can’t reliably be used to time the markets, this suggests value stocks have a higher expected return going forward.

The Income is back in Fixed Income!

Bonds dropped in Q3 with US Bonds down -3.23% and Global Bonds outside the US down -0.78%.

With prices falling, bond yields increased during the 3rd quarter with the 10-year Treasury yield rising by nearly 80 basis points to 4.6% this quarter, marking its highest level in 16 years. With inflation trending down, bonds are once again providing returns above inflation – which they haven’t done since 2019.

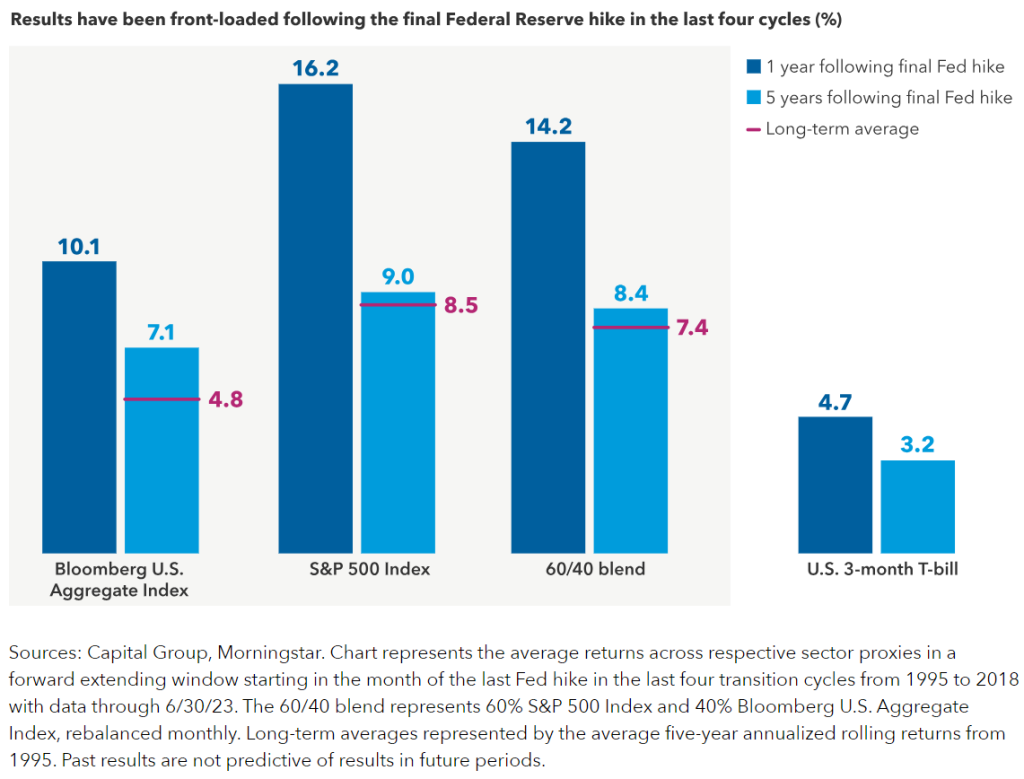

After the Fed’s final hike in the last four cycles, both stock and bond returns were strong in the year that followed. Importantly, for long-term investors, these sectors continued to do well over a five-year period.

After Fed hikes ended, long-term results outpaced cash, with the first year contributing most

What if Inflation has Peaked?

Inflation continues to prove to be resilient, prompting the Fed to issue guidance “higher for longer”. On September 20, the Fed announced it expects to keep interest rates over 5% through 2024, meaning rates for mortgages, personal loans, and credit cards will stay near their current high levels.

Looking at the chart below, historically stocks and bonds have both done well following periods when inflation has peaked. That has certainly been the case for stocks in the 15 months following when inflation peaked in June 2022 at 9.1%. However, that hasn’t been the case for bonds yet as they are out of lockstep with history. Assuming we continue to see better inflation numbers, that could be the catalyst for bonds to do really well. For more on our take on the quarter, see our Quarterly Market Review.

Sources: Inflation: U.S. Bureau of Labor Statistics, Quarterly Outlook (2023 Buckingham Wealth Partners), Morningstar Direct. Data as of Sept. 30, 2023, JP Morgan Midyear 2023 outlook: 10 considerations for the U.S. economy, BlackRock Investments, LLC, and Capital Group.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.