Imagine you happened to be on holiday during the market’s latest bout of volatility—far from the headlines, the China-tariff “will they/won’t they” updates, and the daily swings that tend to dominate the news cycle. Chances are, you wouldn’t have felt the turbulence nearly as sharply.

In fact, that distance is often one of the most effective ways to experience market volatility: by not experiencing it in real time. When you zoom out from daily movements to weekly or monthly returns, the sharp edges often soften, and even meaningful drawdowns—such as those in Q3 2023 or April 2025—may appear as brief interruptions within certain long-term market trends, though outcomes vary across time periods and asset classes.

Staying informed matters, but keeping a long-range perspective can help reduce the temptation to make short-term allocation changes that research shows rarely improve outcomes.

2025 Market Update: A Strong Finish to a Strong Year

Global markets closed out 2025 on a high note. Both stocks and bonds delivered gains in the fourth quarter, wrapping up a year marked by resilience despite plenty of economic and political noise.

Stocks: A Solid Year Across the Board

- Global stocks rose in Q4, with non-U.S. markets outperforming U.S. stocks for the quarter and the full year.

- The S&P 500 posted its third straight year of double-digit gains, supported by steady corporate earnings.

- Sector performance varied in December, but most sectors gained for the quarter, led by health care.

- For the full year, every sector finished positively, with communication services up nearly 34%.

International Markets

- Developed international markets outperformed U.S. stocks for the month, quarter, and year.

- Emerging markets also outperformed U.S. stocks overall, finishing the year with a strong ~34% return, though they lagged developed markets in December and Q4.

Central Banks & Inflation

- The Federal Reserve cut rates twice in Q4.

- The Bank of England also eased, while the European Central Bank held rates steady.

- Inflation continued to cool in the U.S., U.K., and Europe, though some U.S. data was delayed by the government shutdown.

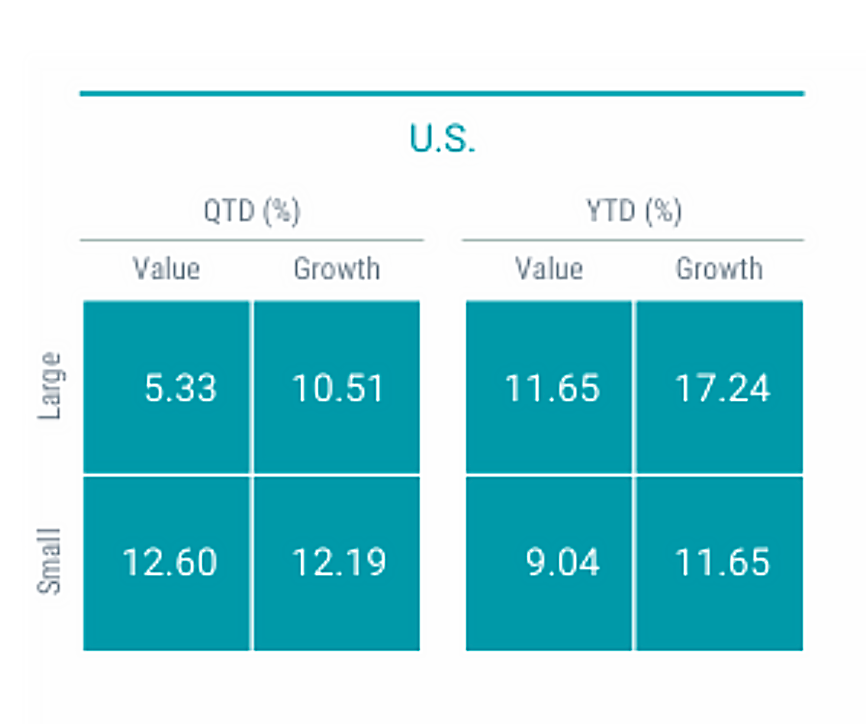

Style & Size Trends

- In the U.S., size and style performance was mixed in December.

- For the quarter, large-cap stocks led, and value outperformed growth.

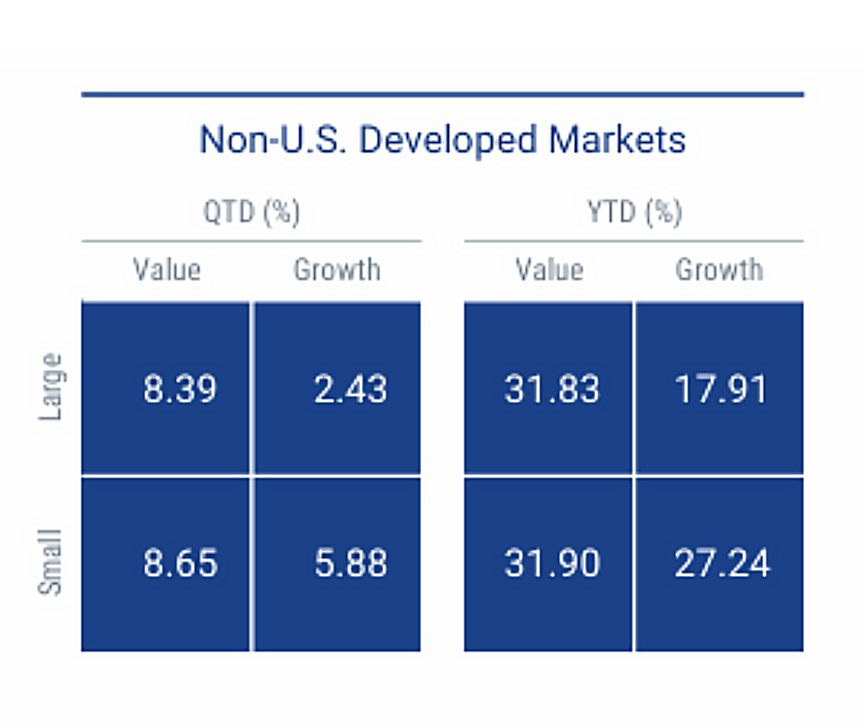

- Outside the U.S., major size and style categories advanced across both the month and quarter.

Bonds

- U.S. Treasury yields declined over the quarter, helping the broad U.S. bond market deliver positive returns.

- December was more mixed, with yields fluctuating and the bond index dipping slightly.

Stocks across markets, styles, and market capitalizations

- The broad U.S. stock market index rallied more than 8% in the third quarter, lifting its year-to-date return to nearly 15%. All key size and style indices advanced for both periods.

- Small-cap stocks gained more than 12% for the quarter, outpacing large-caps, which returned 8%. Year to date, large-caps returned nearly 15% and outperformed small-caps, which gained more than 10%.

- For the quarter, growth stocks outperformed their value peers among large-caps but lagged among small-caps. Year to date, growth stocks outperformed across the board.

- Non-U.S. developed markets stocks underperformed U.S. stocks for the quarter but outperformed year to date. All major size and style indices advanced for both periods.

- Small-cap stocks outperformed large-caps for the quarter and year to date. Small-caps gained nearly 30% for the year-to-date period, while large-caps gained 25%.

- Across the board, value stocks outperformed their growth-style peers in the quarter and year to date. Small-cap value stocks were top performers for both periods, advancing nearly 9% for the quarter and 32% year to date.

- The broad emerging markets stock index outperformed developed markets stocks for the quarter and year-to-date period. The index gained nearly 11% for the quarter and almost 28% year-to-date.

- Large-cap stocks rose nearly 12% in the quarter, sharply outpacing small-caps. Year to date, large-caps outperformed small-caps by more than 10 percentage points.

- Growth stocks outperformed value stocks across capitalizations for the quarter and the year-to-date period. Large-cap growth stocks were top performers for both periods.

| Index | Last 1 Year Return | Last 3 Years Return | Last 5 Years Return | Last 10 Years Return | Inception to Date Return |

|---|---|---|---|---|---|

| S&P 500 Composite | 17.88% | 23.00% | 14.43% | 14.82% | 22.87% |

| Russell 3000 | 17.16% | 22.25% | 13.16% | 14.29% | 22.18% |

| Russell 1000 Value | 15.92% | 13.90% | 11.33% | 10.53% | 17.26% |

| Russell 1000 Growth | 18.57% | 31.15% | 15.33% | 18.13% | 26.89% |

| Russell 2000 | 12.81% | 13.73% | 6.10% | 9.62% | 16.02% |

| Russell 2000 Value | 12.59% | 11.73% | 8.88% | 9.27% | 14.02% |

| MSCI World X-US Net | 31.85% | 17.64% | 9.47% | 8.55% | 19.67% |

| MSCI EM (Emerging Markets) Net | 33.57% | 16.39% | 4.20% | 8.42% | 22.17% |

| Bloomberg US Aggregate | 7.30% | 4.66% | (0.36%) | 2.01% | 5.51% |

| Bloomberg Global Aggregate X- US Hedged | 2.80% | 5.34% | 0.79% | 2.58% | 4.75% |

| Bloomberg Municipal 1 – 10Y Blend | 5.14% | 3.53% | 1.21% | 2.08% | 3.46% |

| S&P Global REIT Net | 7.67% | 6.84% | 3.92% | 3.79% | 8.43% |

Returns for periods exceeding 12 months are annualized.

Fixed Income Review

The U.S. bond market delivered another solid quarter, marking its fourth straight period of gains. The Federal Reserve cut interest rates twice—once in September and again in December, which helped push short-term Treasury yields lower over the quarter.

The Bloomberg U.S. Aggregate Bond Index rose more than 1% in Q4 and finished the year with a 7%+ return, though it dipped slightly in December. Longer-term yields were mixed: the 10-year Treasury ended the quarter near 4.17%, while the 2-year yield fell to 3.48%.

Across sectors, mortgage-backed securities (MBS) were the standout performer for the quarter and were the only sector to rise in December. High-yield bonds outperformed investment-grade corporates as credit spreads widened modestly.

Inflation continued to cool, with headlines and core CPI easing to 2.7% and 2.6% in November. Some government data releases were delayed due to the shutdown, including the Fed’s preferred inflation gauge (core PCE).

Municipal bonds also had a strong quarter, returning more than 1.5% and outperforming Treasuries for both the quarter and December. With inflation expectations easing, TIPS underperformed traditional Treasuries.

For more on the markets, see our Market Sides

Sources: Avantis Investors, by American Century Investments – Monthly ETF Field Guide, Morningstar, Inc. Blackrock-Student of the Market December 2025, Dimensional Funds.

Disclosure: All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.