We are pleased to welcome two new clients to the firm this quarter. It’s an honor to serve you and we look forward to many years of working together. Thank you to those who continue to share what we do with friends and family.

2nd Quarter Commentary

U.S. stocks ended the quarter just a bit higher than where they began, but they didn’t take a smooth path getting there. The broad-based Dow Jones U.S. Total Stock Market Index finished the second quarter up 2.6% and is up just 2.1% over the trailing one-year period. Although the Brexit vote led to two days of steep losses toward the end of the quarter, the market recovered nearly all of its losses with three days of strong gains.

Early in the second quarter, it seemed as though the Fed had the necessary tools in its belt to consider raising interest rates at its June meeting: inflation remained a bit below the Fed’s target 2%, consumer and housing data remained strong, and the unemployment rate sank to 4.7%. Alas, as investors globally sought safety while trying to make sense of Brexit, they piled into U.S. Treasuries – raising their prices and pushing yields to just 1.7% (even lower than they were the quarter before). In terms of stock sector performance, energy was the top performer in the quarter, rising more than 11% as oil prices rose over the quarter. On the flip side, technology had a rough quarter, sliding 2%.*

Learning From History

It’s possible Brexit could have lasting effects on stocks. Or it could be that Brexit will affect stock prices much like Greece’s financial crisis, Putin’s aggressions, S&P’s downgrade of U.S. debt, and Washington’s budget brinkmanship. Those items splattered against the U.S. marketplace like a water balloon hitting an elephant. At the time, each seemed to be globally important, causing several weeks’ worth of stock-market losses accompanied by anxious commentary.

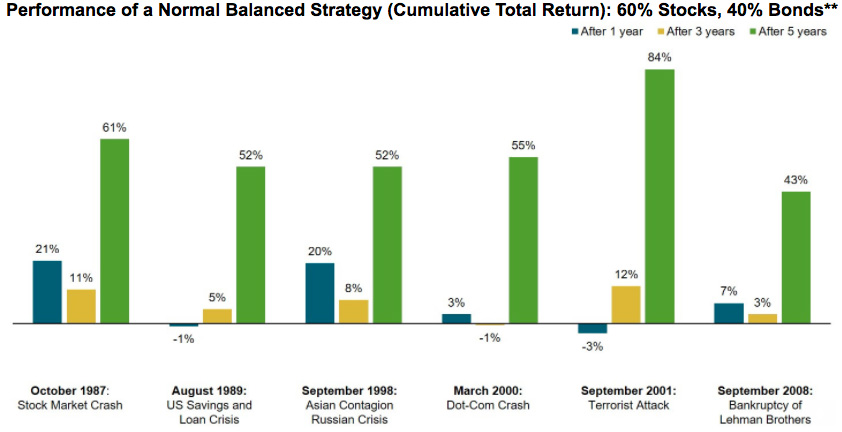

The chart below illustrates how the markets (and a balanced investment strategy) behaved in response to recent market crises. Although a global investment strategy would have suffered losses immediately following most of these events, the financial markets recovered over time, as indicated by the positive five-year cumulative returns. Negative events such as these may tempt investors to flee the financial markets. But diversification and a long-term perspective can help investors apply discipline to ride out the storm.

History’s Limits

As the book (and movie) The Big Short told us, the smart money knew the housing market was dangerously overheated and profited handsomely from it (some like Goldman Sachs, profited on both sides by issuing such junk to begin with and then correctly wagering that it would eventually decline in value). Unfortunately, almost no investors repeat such outsized success. Evident to this is that John Paulson (one of the biggest stars inThe Big Short) was recently forced to plow money back into his ailing hedge funds.

The managers that will profit from the next bear market are not the people who avoided previous bear markets. They are instead newcomers. They will get this call right, but only this call. They will not anticipate the next bear market, nor likely any other bear market. Of course, the exact timing of the bear’s arrival is never known and much suffering can occur while awaiting that event. When it comes to profiting from bear markets, one can be right and yet wrong. Timing is critical. As the English economist John Maynard Keynes famously said, “Markets can remain irrational longer than you can remain solvent.” Every financial crisis is different. Because of that, it is difficult to apply lessons from the past to learn about the future. Nor we can look to those who made the right call last time. There’s nothing to do, logically, but to trudge along as always, on the logic that the markets go up more than they do down and focus on that which we can control (namely our financial behavior).***

If it has been some time since we reviewed your financial goals or something has changed in your financial life; you sold your business (or are considering selling your business), you are nearing retirement, recently changed jobs (or want to change jobs!), or lost a loved one – please call the office to schedule a meeting. As always, we are here to be a resource to you and those important to you.

Sincerely,

Barry N. Mendelson, CFP | Richard P, Clarke, CPA, PFS | Ryan K. Kosakura, CFA | John L. Davis, CFP