Comprehensive Wealth Management

Together, we look at the major aspects of your financial life including your specific values and goals, time horizon, income and liquidity needs, and ability and willingness to take risk. Then jointly, we create your personal definition of financial success and work with you to translate this into prioritized goals.

Because life is never static, we closely monitor your plan and make sure that it always reflects your situation. In addition, as financial markets go up and down, we help manage the level of risk in your portfolio through periodic rebalancing.

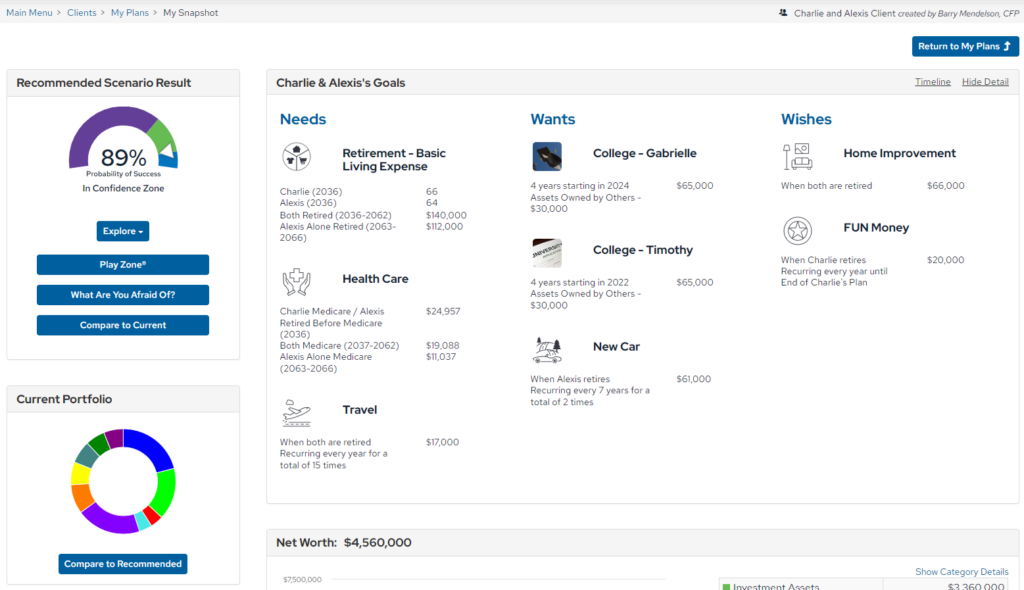

Comprehensive Process

Our comprehensive financial planning process helps address concerns such as health care costs, outliving your money, and the best time to file for Social Security benefits. The confidence meter helps you gauge how likely you are to reach your goals.

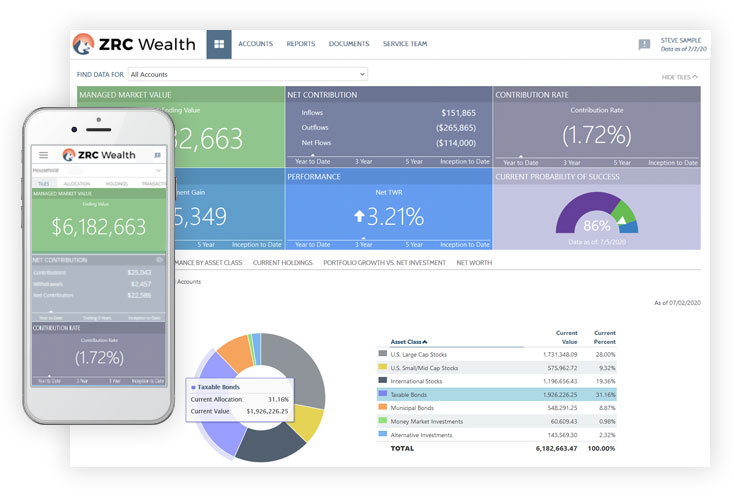

Wealth Management Client Portal

The Elevation Wealth Partners provides you with a real-time view of your investments, including quarterly reports and other portfolio information.

Fee Schedule

There is no charge for our first two meetings. This gives us time to learn about each other and decide if we might be a fit.

The fee for our services is 1.00% per annum on the first $1,000,000 a client has with us and tiers down from there. The fee is based on the value of your investment portfolio that we manage and covers full wealth management services, including financial planning and investment management. Fees are billed quarterly, in advance, based upon the portfolio value at the end of the preceding quarter.

For investors nearing retirement, we would expect that they have at least $1,000,000 in investable assets. For younger investors, we can expertly serve those that have less than $500,000. Unlike many wealth management firms, we do not charge a separate financial planning fee.