We’re happy to welcome four new clients into the Elevation Wealth Partners family again this quarter. It’s an honor to serve you and we look forward to many years of working together.

Thank you to everyone who continues to share with friends and family how we’ve helped you achieve financial independence and live your best lives. Often, we are asked what to look for in a financial advisor. In this post How do I choose the right advisor? we list 16 essential questions to ask when interviewing an investment advisor or financial planner.

Your 3rd quarter report is now available in your Elevation Wealth Partners portal. If you haven’t already done so, please bookmark that page for future use.

Once you access the portal, please click on your DOCUMENTS tab to find your 3rd Quarter 2022 Portfolio Report. The latest report appears at the top of the page. For a demonstration on how to log into your Elevation Wealth Partners Portal and download your quarterly report (and save documents to your secure portal), watch this video by Kelly Gillette – Client Service Manager.

Don’t be afraid to look at your investments!

Have you looked around your neighborhood and noticed how scary Halloween has become? Do you feel that same sense of fear when you look at your investment accounts in a down market? If so, you can consider yourself normal. However, take a deep breath and remember it’s perfectly normal for markets to go up… and down. That’s all part of investing.

U.S. Economic Review

The US economy contracted by -0.6% in the second quarter. This was the second consecutive quarterly contraction. Historically, while two consecutive negative readings precede the official declaration of a recession, the National Bureau of Economic Research (NBER) has yet to say that we’re in a recession. The unemployment rate ticked up slightly to 3.7% in August. This coincides with a tight labor market that might be showing early signs of loosening; there were approximately 10.4 million job openings (down from 11.4 million in April) for six million unemployed workers at the end of August. Domestic inflation was 4.9% in August, as the Fed’s preferred gauge of overall inflation, the core personal consumption expenditures (PCE), remained well above the Fed’s long-term target average of 2.0%. Headline inflation, as measured by the consumer price index (CPI), closed out August at 8.3%. The CPI and PCE readings tend to differ primarily because CPI includes volatile categories like food and energy in its methodology while core PCE does not.

Many economists consider a half-point rise in the unemployment rate, averaged over several months, as the most historically reliable sign of an economic downturn. If the NBER eventually does declare a recession, which they typically don’t do until well after one has begun (sometimes for up to a year), what does a century of economic cycles teach us about investing? Our interactive exhibit examines how stocks have behaved during US economic downturns.

Financial Markets Review

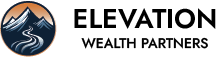

During the third quarter, global stock and bond markets continued their downward trends from the previous quarter. The S&P 500 index extended its decline from the first half of the year by closing the quarter with its worst month since March 2020. Bond markets also continued to decline, fueled by the expectation of continued rate hikes and elevated inflation readings. Growing concerns that central banks around the globe will be willing to push economies into recession to stop inflation resulted in negative performance for the quarter across all major asset classes.

For the quarter, U.S. stocks (as measured by the Russell 3000 index) lost 4.5%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. IMI Index) lost 9.2%. Emerging market stocks (as measured by the MSCI Emerging Markets IMI Index) lost 11.6%.

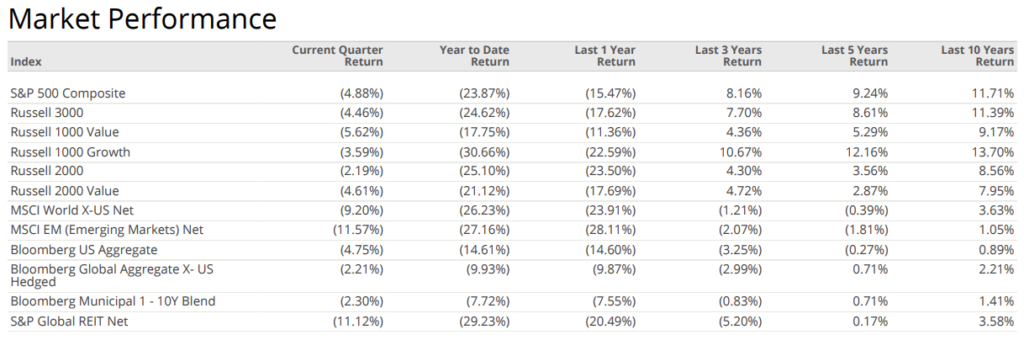

Cycles of U.S. Equity Outperformance

Over the past 50 years, there have been different regimes of U.S. vs. international stock outperformance. Given cyclical tailwinds for international equities as we emerge from the pandemic, we could be entering a period of international outperformance ahead. A regime change is called when there is sustained outperformance of one region over the other for a cumulative 12 months. The key take-away: Don’t give up on international stocks now. For more on this topic, see Why Should You Diversify?

The U.S. dollar index, a measure of the value of the U.S. dollar relative to a basket of foreign currencies, increased during the quarter by 7.1%. Over the past 12 months, the U.S. dollar increased by 19.0%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors.

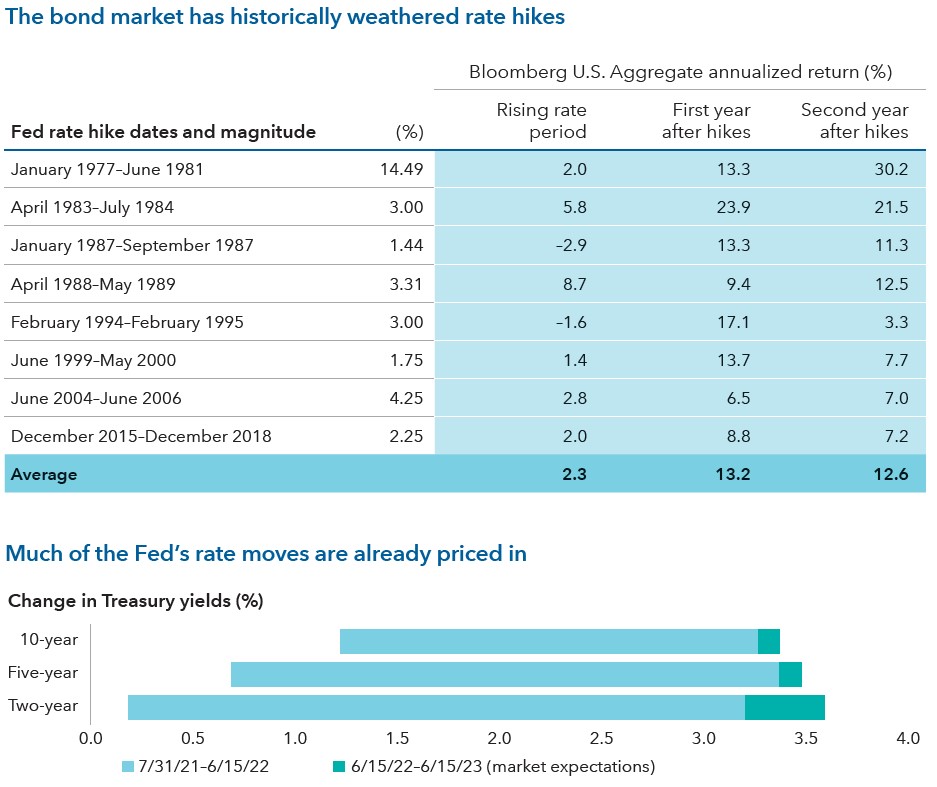

U.S. interest rates increased during the quarter as the Federal Reserve raised the target range of the federal funds rate from 1.50%-1.75% to 3.00%-3.25% by way of two rate hikes of 0.75% in July and September. However, markets have currently priced in the expectation of two additional rate hikes during the remainder of 2022 with an implied target range of 4.00%-4.25% by year’s end.

Domestically, all size and style equity categories were down during the quarter. International developed stock markets also posted negative performance, and, for U.S. investors, returns were negatively impacted during the quarter by the strengthening U.S. dollar. U.S. small-cap stocks were the best performing asset class, and U.S. REITs were the worst performing asset class during the quarter. The economic uncertainty caused by continuing war in Ukraine, high inflation and the Fed’s ongoing rate-hike campaign caused U.S. and global bonds to decline for the quarter and move in the same direction as stocks.

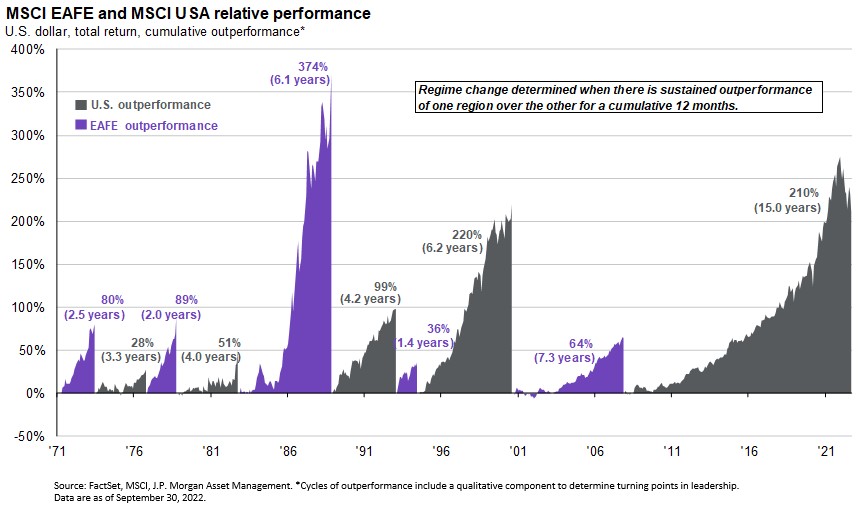

Fixed Income: After big bond declines, history suggests better days ahead

2022 has been the worst period for bonds in roughly 40 years with the Bloomberg Aggregate Bond Index down more than 14%. The highest inflation in decades thrust the Federal Reserve into rate-hiking mode and current bond prices now reflect that pain. The good news is that bonds now have much higher yields and the potential for higher income that could make up for those losses in just a few years. Furthermore, looking at the chart below, bonds have done quite well immediately after the Fed has stopped raising rates … which could be later this year or early next. The key take-away: Now is probably not the time to change your bond allocation.

We’ve seen this scary movie before!

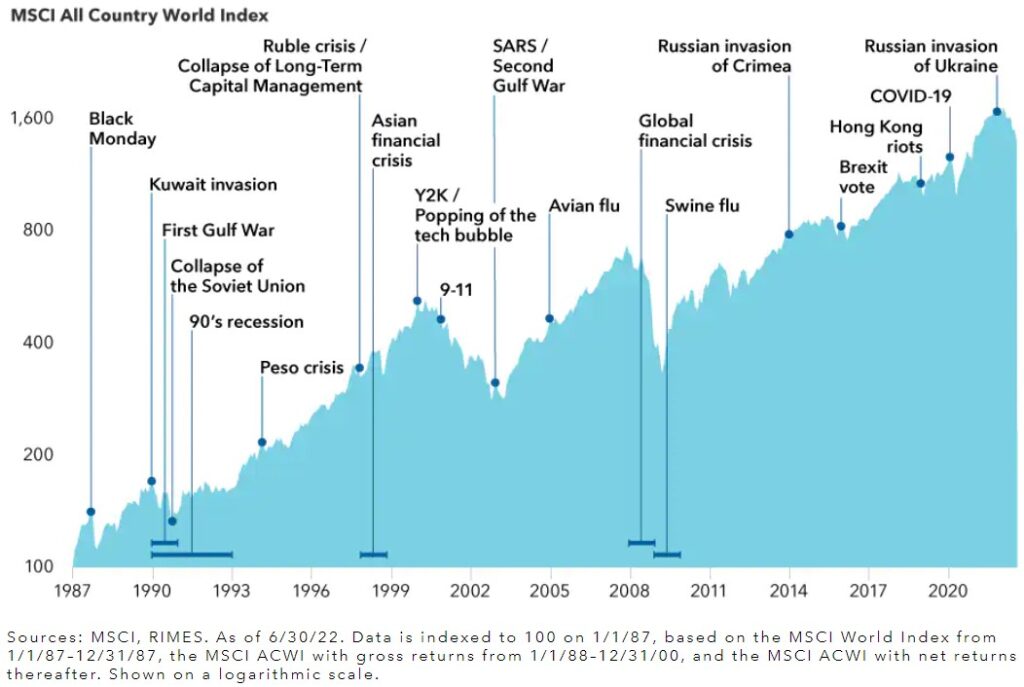

It’s perfectly normal to get concerned when you hear news about Ukraine, inflation, extreme weather events, etc. and you see that your retirement nest egg is smaller than the last time you reviewed it. Keep in mind that every bear market has eventually ended, and the market started back up again. Financial markets have demonstrated remarkable ability to anticipate a better tomorrow even when today’s news feels so bad. While no one can predict the future and no two market declines are the same, rest assured, we’ve been here before, and have seen markets recover.

Elevation Wealth Partners: Focus on what you can control and stay invested

Much that impacts us is beyond our control. So, in times like this, it’s important to think about what you can control and improve your outcome. So, while you shouldn’t make any emotional decisions that you might regret later, you should stay calm and look to the future.

Here’s some things that you can do that are within your control:

- Increase your contributions – If you’re already contributing to your 401(k), IRA, or trust account, consider increasing the amount. Adding more money now means you can benefit from the recovery when it occurs.

- Pause large expenditures – If you’re worried about liquidating investments while the markets are down.

- Convert an IRA to a Roth – With prices down, this may be a good time to convert a traditional IRA to a tax-free Roth IRA. This could allow the market recovery to be captured in a tax-free account.

- Make an end-of-year checklist – Take Required Minimum Distributions and make 401(k) contributions before December 31, review your spending patterns, convert IRA money to a Roth account, shop Medicare coverage, or make Qualified Charitable Distributions.

Be sure to call your Elevation Wealth Partners to discuss changes to your financial plan or call anyone on the Elevation Wealth Partners team for general questions. You can read more about our take on global capital markets performance in our Q3 Market Review.

Important deadlines and dates for the upcoming quarter

October 15………………. Medicare Open Enrollment begins

November 24…………. Thanksgiving – The financial markets are closed and so are Elevation Wealth Partners offices

December 7…………….. Medicare Open Enrollment ends

December 26………….. Christmas observed – The financial markets are closed and so are Elevation Wealth Partners offices

December 31………….. Last day to contribute to charity (for a Tax Deduction) & make 401(k) contributions

As always, we are grateful for the opportunity to serve you and your loved ones.

Sincerely,

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc., Capital Group Fixed Income: Macro, markets, actionable ideas and portfolio construction, JP Morgan Guide to the Markets.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.