We are happy to welcome five new clients into the Elevation Wealth Partners family this quarter. Thank you to everyone who continues to share with friends and family how we’ve helped you achieve financial independence and live your best lives. It’s an honor to serve you and we look forward to many years of working together.

Your 4th quarter report is now available for you to view in your Elevation Wealth Partners portal. If you haven’t already done so, please bookmark this page for future use.

Once you access the portal, please click on your DOCUMENTS tab to find your 4th Quarter 2021 Performance Report. The latest report will appear at the top of the page. For a demonstration on how to log into your Elevation Wealth Partners Portal and download your quarterly report (as well as save documents to your secure portal), watch this video by Kelly Gillette – Client Service Manager.

We continue to make enhancements to the information you can view and keep track of in your portal. In this step-by-step video, Kevin Goulding – Wealth Advisor demonstrates how easy it is to add outside accounts, assets, and liabilities to your portal thereby having a complete and up-to-date picture of your net-worth. And in this one-minute video, Ryan Kosakura – Wealth Advisor illustrates where you can see how your individual investments and holdings have performed over time.

Gratitude. As we begin the New Year, on behalf of the entire Elevation Wealth Partners team, I’d like to express our sincerest gratitude for the opportunity to serve you, your families, businesses, and employees. The trust you place in us to manage your hard-earned money and guide you on your financial journey inspires us every day to do our very best work for you. Thank you.

Looking back on 2021, despite lingering challenges from the Coronavirus, there were many causes for celebration. Some of you celebrated the births of children and grandchildren. A couple of you got married (Barry offered to officiate one, got ordained, and is still waiting to do his first), one of you officiated a wedding, one family moved back to the States after living abroad for many years, new jobs and promotions were celebrated, several clients’ companies went public, realizing years of hard work, and a few of you retired.

We also mourn the passing of those who left us this year. We consider ourselves blessed that such wonderful people were in our lives and their memories will forever live with us. If you lost a loved one this year, please accept our sincerest condolences.

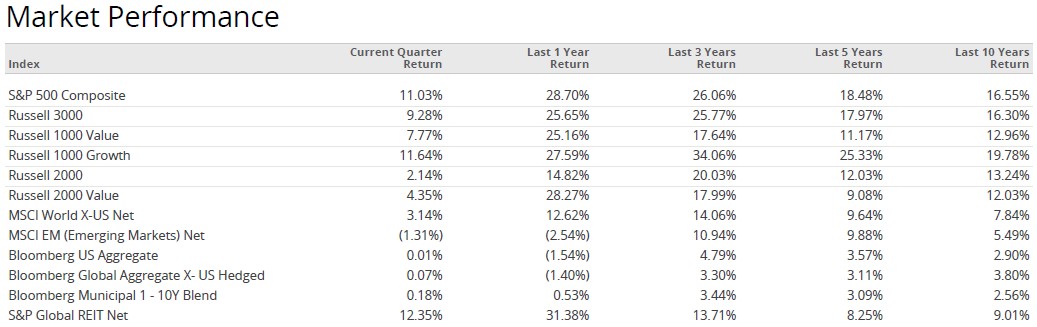

Quarterly Perspective: Financial Market Review and Index Returns

U.S. stocks finished 2021 near fresh record highs, having posted their third consecutive year of double-digit gains thanks to a strong economic rebound that helped the market weather the ongoing waves of the coronavirus pandemic. The Russell 3000 Index returned 25.65% and the S&P 500 Index returned 28.70%. Over the course of 2021, the Russell 3000 Index hit 66 new highs.

Likewise, stocks in foreign developed markets also had an excellent year with the MSCI World Ex-USA Index returning 12.62%. Meanwhile, emerging markets stock funds and indexes were dragged down by declines in Chinese stocks, overwhelming an outstanding year for India’s stock market. For the year, the MSCI Emerging Markets Index declined by 2.54%.

Looking at the 4th quarter, global stock markets progressed upward, reversing the trend from the previous quarter. Concern over the quickly spreading omicron variant spooked U.S. markets in December, but in a pattern that played out many times in 2021, stocks shook off the news and soon reached new highs. The Russell 3000 Index gained 9.28% in the final three months, its best quarter since fourth-quarter 2020.

The favorable economic backdrop for stocks in 2021 made for a lackluster year for bond investors. Surging inflation sent bond prices lower, leading key bond market indexes to post their first losses since 2013.

U.S. interest rates remained unchanged during the quarter as the Fed continues to maintain a target range of 0.0% to 0.25% for the federal funds rate. However, markets have currently priced in the expectation of three rate hikes during 2022.

Looking Ahead: The Fed, Future Interest Rate Hikes, and Inflation

The economy continues to gain steam, the unemployment rate continues to fall, and inflation is rising. The Fed has already announced that it is going to slowly reduce the amount of money it spends on bonds – a process called tapering – and it plans to stop buying bonds altogether sometime in the first half of 2022.

After the bond-buying stops, the Fed’s focus shifts to the level of interest rates. This will likely be one of the hot topics of 2022. Fed members are currently debating when and how quickly interest rates should increase in an effort to moderate the economy and slow the rate of inflation. At their January meeting, the Fed hinted that the first rate hike could be as soon as this March.

The Capital Group defines two types of inflation: sticky and flexible. Sticky inflation tends to have longer staying power. Sticky categories include rent, insurance and medical expenses. Flexible inflation — affecting items such as food, energy and cars — has risen much faster in recent months but many believe it won’t last. While there is no silver bullet to guard against the threat of sustained higher prices, stocks and flexible spending habits are an investor’s two greatest tools.

We’re now clearly at the start of a change in policy at the Federal Reserve. This change in policy likely means the end of historically low interest rates. Given how accommodative the Fed has been, it doesn’t seem inclined to turn the temperature of the economy from hot to cold in one quick motion. Like past rate-hike cycles, we’ll be in the warm zone for a while.

Rising rates have pluses and minuses. On the plus side, higher interest rate levels mean we may see increases in our cash savings accounts, money market funds and other savings accounts. On the negative side, rising interest rates typically send bond prices lower and create more price uncertainty for stocks.

The last ten years have been some of the best for stock investors. Who would have imagined? Looking ahead to the next decade, despite solid fundamentals, high stock prices and rising interest rates are likely to be a headwind for stock investors with some forecasting mid-to-low single digit average annual returns.

Stock valuations in relation to their 15-year averages

Source: Capital Group, Bloomberg Index Services Ltd., IBES, J.P. Morgan, MSCI, Refinitiv Datastream, RIMES, Standard & Poor’s. As of 11/30/21.

For this reason, we continue to balance growth investments with value investments, leaning towards companies, sectors, and regions with more reasonable valuations. Additionally, there is lots of evidence that value stocks do better than growth stocks in periods of higher inflation. Whatever lays ahead for the markets and investors, we are prepared to help you make well-informed and confident decisions. For more on our take on the 4th Quarter click here.

Form 1099 Composite and/or Year End Summary documents

If you have a taxable Brokerage or Trust account at Charles Schwab & Co. that we manage, then this week you would have received an email from Charles Schwab that your Form 1099 Composite and/or Year End Summary documents are now available online. Since this is a tax document, Schwab will also mail a copy to your address of record.

As Charles Schwab often issues a corrected or revised 1099 Composite and/or Year End Summary document, we recommend clients wait until the end of February before sending this document to their tax preparer or using it to prepare their tax returns.

For many of our clients, we send this document directly to their tax preparer. If we did this for you in the past or you have instructed us to do it for you this year, we will send them the first week of March. If we didn’t do this for you in the past and you would like us to do it this year (or your tax preparer has changed), please let us know.

As always, we are grateful for the opportunity to serve you and your loved ones.

Sincerely,

Elevation Wealth Partners, LLC

Walnut Creek & Santa Rosa

925-962-5600 or 707-524-6131

https://elevationwp.com/

Sources: Dimensional Fund Advisors, Morningstar Inc., Buckingham Strategic Partners, Blackrock, Inc., and Capital Group.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.