How Much Impact Does the President Have on Stocks_The anticipation building up to elections often brings with it questions about how financial markets will respond. But the outcome of an election is only one of many inputs to the market. Our interactive exhibit examines market and economic data for nearly 100 years of US presidential terms and shows a consistent upward march for US equities regardless of the administration in place. This is an important lesson on the benefits of a long-term investment approach. Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio. In US dollars. Growth of wealth shows the growth of a hypothetical investment of $100 in the securities in the Fama/French US Total Market Research Index. The chart begins with the start of the first full presidential term (March 4, 1929) for which Fama/French Total US Market Research Index data is available and ends on June 30, 2020. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Fama/French Total US Market Research Index: This value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

How Much Impact Does the President Have on Stocks?

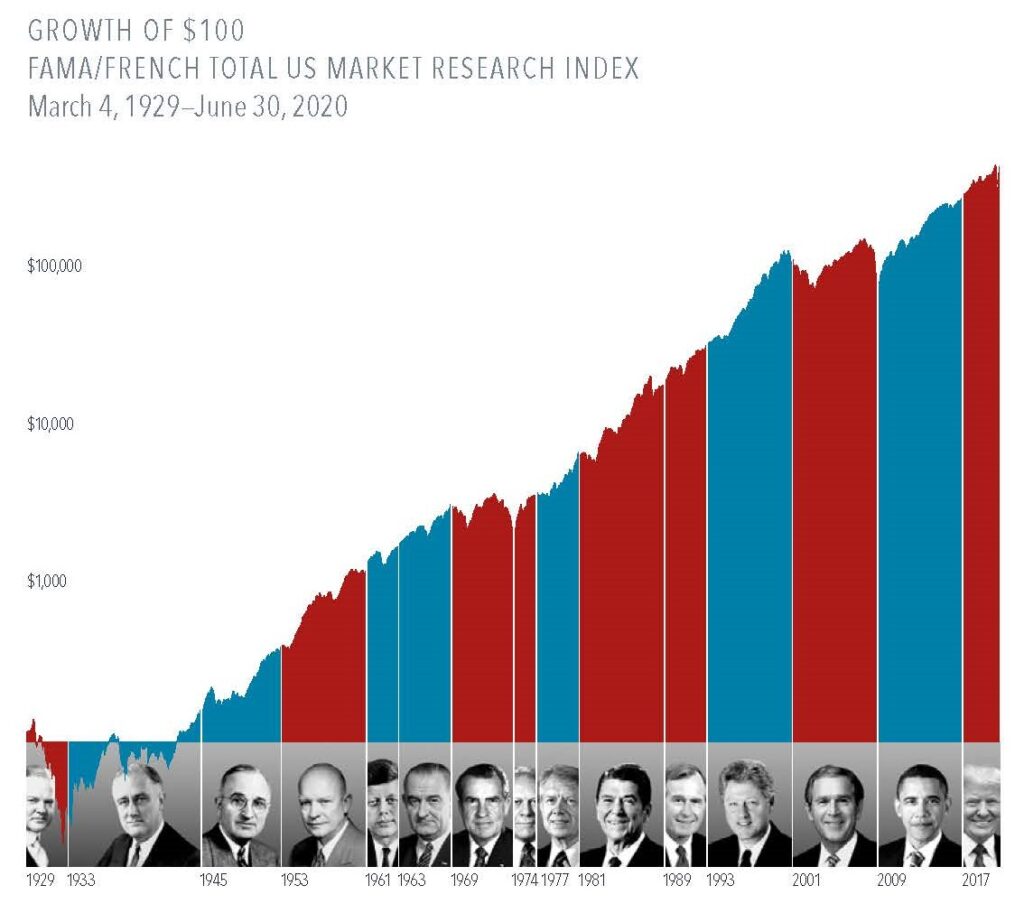

How Much Impact Does the President Have on Stocks_The anticipation building up to elections often brings with it questions about how financial markets will respond. But the outcome of an election is only one of many inputs to the market. Our interactive exhibit examines market and economic data for nearly 100 years of US presidential terms and shows a consistent upward march for US equities regardless of the administration in place. This is an important lesson on the benefits of a long-term investment approach.

Past performance is not a guarantee of future results. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In US dollars. Growth of wealth shows the growth of a hypothetical investment of $100 in the securities in the Fama/French US Total Market Research Index. The chart begins with the start of the first full presidential term (March 4, 1929) for which Fama/French Total US Market Research Index data is available and ends on June 30, 2020. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment.

Fama/French Total US Market Research Index: This value-weighed US market index is constructed every month, using all issues listed on the NYSE, AMEX, or Nasdaq with available outstanding shares and valid prices for that month and the month before. Exclusions: American depositary receipts. Sources: CRSP for value-weighted US market return. Rebalancing: Monthly. Dividends: Reinvested in the paying company until the portfolio is rebalanced.

Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.