The Best of the North Bay’s readers poll is now open through February 28th. Please vote for Elevation Wealth Partners under Best Business Services / Wealth Management Company here (even if you don’t live in the North Bay).

If at the beginning of the year, we told you the United Kingdom would vote to exit the European Union (aka “Brexit”), several countries (including Japan) would have negative rates in an experiment to jump-start their economies, and Donald Trump would be elected President of the United States, you would have probably expected stocks across the globe to finish the year lower. Instead, 2016 was a very good year for stock investors with almost all major equity asset classes finishing higher and the S&P 500 Index returning 11.96%. The performance of Elevation Wealth Partners client portfolios was especially good (for reasons detailed below) and decidedly positive across all time periods.

This was despite an inauspicious start to 2016. Through February 11, 2016, the S&P 500 Index fell more than 11% on fears of a global economic slowdown – the worst start ever for any year! Yet, we remained disciplined and focused on the long-term prospects for stocks and you remained focused on your long-term financial goals. Despite the headlines on the next page, 2016 marked the 8th year in a row the S&P 500 Index finished the year without a loss (when you include dividends).

The biggest story of the quarter was the election of Donald Trump as President. Although the futures market briefly sunk on the news, the market quickly turned around and rallied through the end of the year. In the 4th Quarter, the S&P 500 Index of U.S. large company stocks returned 3.82%. Across the entire globe, U.S. small company value stocks (stocks that may be temporarily undervalued by investors and that were one of biggest laggards in 2015) performed best, returning 10.00%. For the year, the U.S. small company value funds held in client accounts (DFA U.S. Small Cap Value, Vericimetry U.S. Small Cap Value, and Vanguard Small-Cap Value) also performed best; returning between 23.33% and 28.26% for the year!

Likewise, two other assets classes that performed poorly a year ago, shined in 2016. U.S. large company value stocks as represented by the DFA US Core Equity 1, DFA US Core Equity 2, and Schwab Fundamental US Large Company Index Fund returned from 14.80% to 16.58%. And a year ago, in our 4th Quarter 2015 Commentary, we addressed concerns about Emerging Market stocks (and China in particular). In 2016, that asset class came roaring back, returning 12.35% or more!

2016 turned out to a challenging year for fixed income investors. All was well through October with all major fixed income asset classes positive for the year. Then, in November investors bet the new administration would spend heavily on infrastructure, cut taxes, and reduce regulations. Bond prices significantly declined as investors priced in higher expectations for inflation and growth. In November, the Bloomberg Barclays U.S. Aggregate Bond Index fell 2.37%, its worst month in 13 ½ years. Adding to November’s pressure came news that the city of Dallas, Texas (one of the nation’s largest) could be forced into bankruptcy due to underfunded pensions owed to retired police and fireman. For that reason, tax-free municipal bonds did even worse, with the Bloomberg Barclays Municipal Bond Index declining 3.73% that month. After November’s pull-back, the Bloomberg Barclays U.S. Aggregate Bond Index still managed to return 2.65% for the year and the Bloomberg Barclays Municipal California Bond Index lost 0.14%.

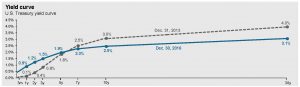

With the flattening of the yield curve (see below) Elevation Wealth Partners fixed income strategy the last several years has been to overweight investments in short-term investment grade corporate bonds and underweight long-term bonds (those with maturities of 15 years or longer). We believe that the slightly higher yields of long-term bonds, in general, do not adequately compensate investors for the interest rate and duration risk they take in owning these securities. This strategy served our clients well in 2016 and we expect it to continue to serve clients well with the prospect of the Fed steadily raising rates in the coming years.

What has worked well in the past will continue to work well in the future.

There were several reasons for the outstanding performance of client accounts in 2016. Namely; the great deal of thought we put into getting a client’s asset allocation right (the mix of stocks to bond and other investments); Intelligent diversification and exposure to a variety of global asset classes (such as emerging market stocks and REITs); Superior performance by most of our managers including; Dimensional Fund Advisors, PrimeCap Odyssey Growth Fund, First Eagle Overseas Fund, and Schwab/Research Affiliates Fundamental Indexes; And the foresight and discipline to stick with a particular investment, manager, or strategy. This last point is incredibly important as the three laggards in client accounts in 2015 (U.S small company stocks, value stocks, and emerging market stocks) were the best performers in 2016!

One investment trend that continues to benefit investors is the increased use of index funds and ETFs (Exchange Traded Funds). This is an investment strategy (and in the case of ETFs) an investment vehicle that has stripped-out a lot of the costs of traditional investing. And in investing, most of the money the investor saves, goes back into their own pocket. Elevation Wealth Partners has long been at the forefront of this trend. An index fund or ETF by itself is not a solution, but a tool or building block to achieve your desired investment objectives.

Another trend that has attracted an enormous amount of attention the last several years is Smart Beta. Simply put, Smart Beta is (in general) an alternative way to construct a stock or bond fund using easily applied rules or factors. For example, instead of trying to determine through research if Microsoft presents a better investment opportunity than say, Salesforce.com, factor-based strategies will search across thousands of stocks and buy those that have qualities or fundamentals that the manager believes will lead to superior performance; such as low price to book value or high profitability. Such strategies seek to offer all the potential benefits of traditional active management (namely Alpha, or investment returns in excess of an index or benchmark), but with much lower cost, turnover, and with greater tax-efficiency. Smart Beta is nothing new and factor investing has been around for decades, pioneered by none other than Dimensional Fund Advisors. At Elevation Wealth Partners, we have long been a fan of Dimensional and other such carefully selected strategies (such as those offered by Research Affiliates – whose investment methodology is the basis for Schwab’s Fundamental Index Funds). In future newsletters we’ll talk more about Smart Beta.

Finally, we believe that having an open, consultative relationship with us – your trusted financial advisor and financial planner – can have a significant impact on your financial well-being. Call us, email us, engage us, and challenge us. As one of our valued clients, you should know exactly where you stand in relation to your financial goals. In these often confusing and challenging times, we are here to be a resource to you and those important to you.

Sincerely,

![]()

Sources: Morningstar, Inc., Dimensional Fund Advisors, and J.P. Morgan Asset Management

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.