We’re happy to welcome two new clients into the Elevation Wealth Partners family this quarter. Thank you to everyone who continues to share with friends and family how we’ve helped add clarity to your financial life and grow your net worth over the years. It’s an honor to serve you and we look forward to many years of working together.

This past quarter, we introduced clients to our new Wealth Management Portal. The new portal has many robust features that give us a clear, up-to-date picture of the client’s financial position. For example:

- One login gives you a view of all your investment accounts and assets. This information is updated daily, providing real-time details on your holdings, asset allocation, and investment performance.

- A summary of your Elevation Wealth Partners financial plan.

- For more on the cutting-edge services Elevation Wealth Partners provides.

2nd Quarter Market Review and Index Returns: A Tale of Two Markets

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

The famous opening of Charles Dickens’ A Tale of Two Cities could just as easily refer to the current state of the world as it did the French Revolution when it was written in 1859. Although many small businesses, their owners, and their employees have been hit hard by the pandemic, it has yet to be reflected in the stock market. Fortunately, for most of the readers of this newsletter, our wealth and livelihoods have barely been affected.

Similarly, as of June 30, 2020, the Standard & Poor’s 500 Composite Index was down just 3.1% year-to-date, but that figure represents the sum of many individual companies. A deeper look reveals a wide divergence of returns. On the one hand, there are those that have benefited from coronavirus-related demand like e-commerce platform Amazon.com (up 49%), streaming service Netflix (up 41%), graphics processing and chip maker NVIDIA (up 69%), online payments like PayPal (up 61%), and cloud services like Citrix Systems (up 34%). On the other hand, a number of companies have struggled. Those include United Airlines (down 61%), cruise line Royal Caribbean (down 62%), mall operator Simon Property (down 53%), department store Kohl’s (down 58%), and Boeing (down 43%). So, it has been a tale of two markets – companies that are thriving in the corona-economy and companies that are not.

Key takeaways

- Even without a full-scale shutdown of the economy—either at the federal or state/local level—economic activity is likely to be volatile and subject to consumers’ and businesses’ fears about the virus impacting activity and behavior. View this 2 minute video on how to Tune Out The Noise.

- Ongoing support from the Federal Reserve, and likely additional support from Congress, will make it difficult to predict how companies and the markets will respond.

- Remarkably, equities are not far from year-ago levels, even with the damage done to the economy by COVID-19.

- Consider a mid-year check-up and check-in with your Elevation Wealth Partners Team.

- Despite a rise in COVID-19 cases here in the United States, we see a number of reasons to be optimistic and remind investors that investment diversification, emotional discipline, and spending flexibility remain the best strategies for weathering periods of economic and financial turmoil.

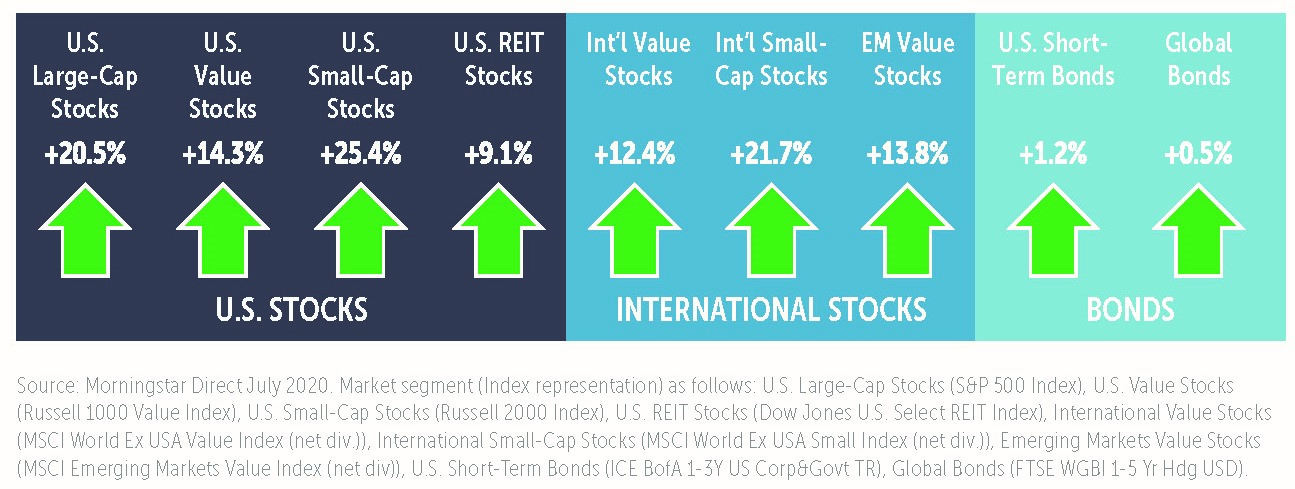

Global stock markets rebounded during the second quarter and pared losses from the previous quarter. This positive performance follows the global effort to reopen economies under continued social distancing guidelines during the quarter. While we cannot say with any certainty what caused markets to move, expansionary monetary policy, increased consumer retail spending, and modest jobs growth in the U.S. in the last two months of the quarter all seem to be contributing to market growth.

For the quarter, U.S. stocks (as measured by the S&P 500 Index) gained 20.5% and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S.) gained 15.3%. Emerging market stocks (as measured by the MSCI Emerging Markets Index) gained 18.1%.

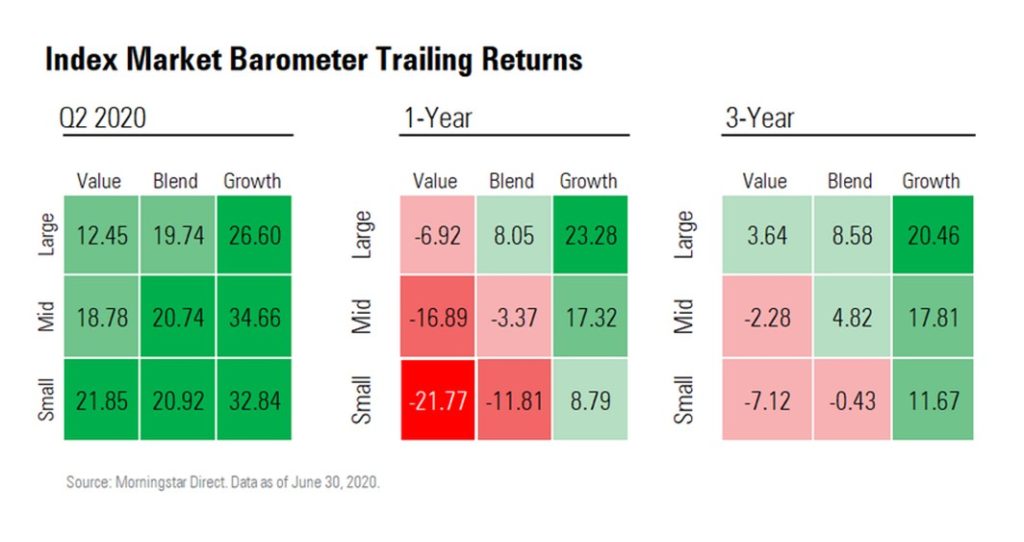

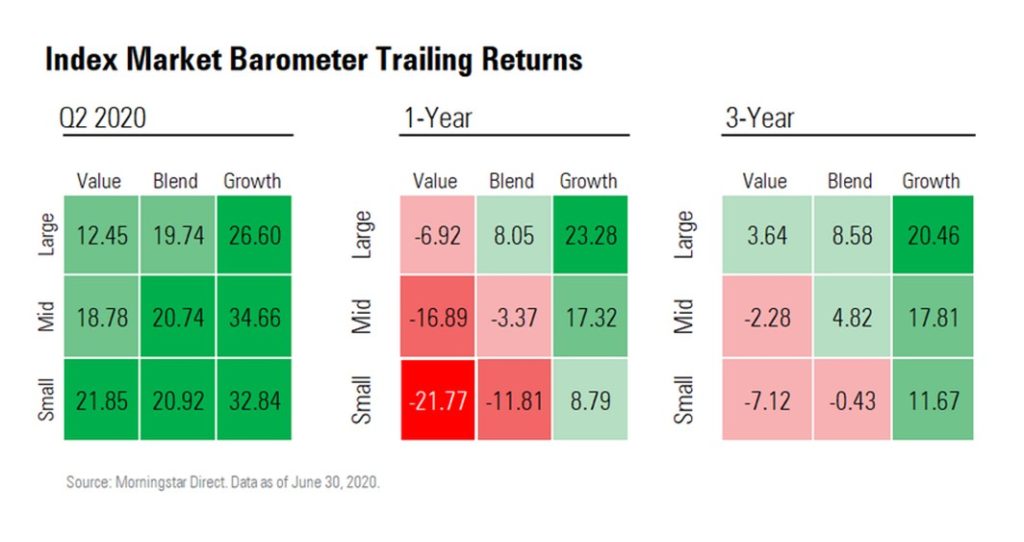

For a change, the second quarter wasn’t all bad news for value stocks. As shown in the chart below, the group has lagged significantly behind growth stocks in recent years and this was once again the case for the most recent three-month period. Across all three market-capitalization segments, growth was in the lead. However, small-value stocks did manage to top small-blend stocks, and mid-value stocks were just a shade behind mid-blend. As we explained in previous newsletters, in time this trend will reverse itself and value stocks will once again lead the market. For perspective on the current spread between value and growth stocks read Dimensional’s article: Spread the Word: What’s New with Valuation Ratios.

Digging a little deeper, it’s only a small number of stocks driving the bulk of the market so far this year. Specifically, the FAAMA stocks (Facebook, Apple, Amazon, Microsoft, and Alphabet) have enormous weight in stock indexes. In the S&P 500, these five stocks represent a little more than 20% of the weight of the index and in the first half of the year had an average return of almost 24%. In the tech-heavy NASDAQ Composite Index, these five names comprise more than 35% of the index (despite the index having twice the holdings of the S&P 500). That reason, along with the financial and energy sectors representing less than 10% of the index, explains why the index is up 12% on the year. Even still, 3/4 of all U.S. publicly traded stocks are negative for the year so we continue to orient portfolios toward less expensive stocks with value attributes. For more on Elevation Wealth Partners approach to investing and how we construct client portfolios read 10 Keys To A Successful Investment Experience.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, decreased by 1.7% in the second quarter compared to foreign currencies. Over the past 12 months, however, the U.S. dollar appreciated by 1.3%. The decrease in the dollar is a tailwind to non-U.S. investments held by U.S. investors in the second quarter.

U.S. interest rates remained unchanged during the quarter as the Federal Reserve continues to maintain a target range of 0.0% to 0.25% for the Fed Funds rate. Since changes in interest rates and bond prices are inversely related, continued low interest rates helped increase the quarterly return for many bond asset classes.

The U.S. economy began to contract this year for this first time since 2014. The final reading for first quarter 2020 GDP showed a decline in economic growth of 5.0% and stands in stark contrast to the economic progress of the past 10 years. The unemployment rate finished the quarter at 11.1% after briefly spiking to nearly 15%. Domestic inflation remains near all-time lows as the Fed’s preferred gauge of overall inflation and the core Personal Consumption Expenditures (PCE) index, stayed below the Fed’s target of 2.0% with a reading of 1.0% in May 2020. Earlier this year, we reduced the Base Inflation Rate in client’s financial plans by 0.5% (from 3.0% to 2.5%). In doing so, this increased the Probability of Success of achieving all the financial and life goals articulated in the plan by 4% (a significant amount). We continue to monitor inflation very closely and immerse ourselves in spending patterns during retirement so as to give our clients the most valuable and useful insights and information available.

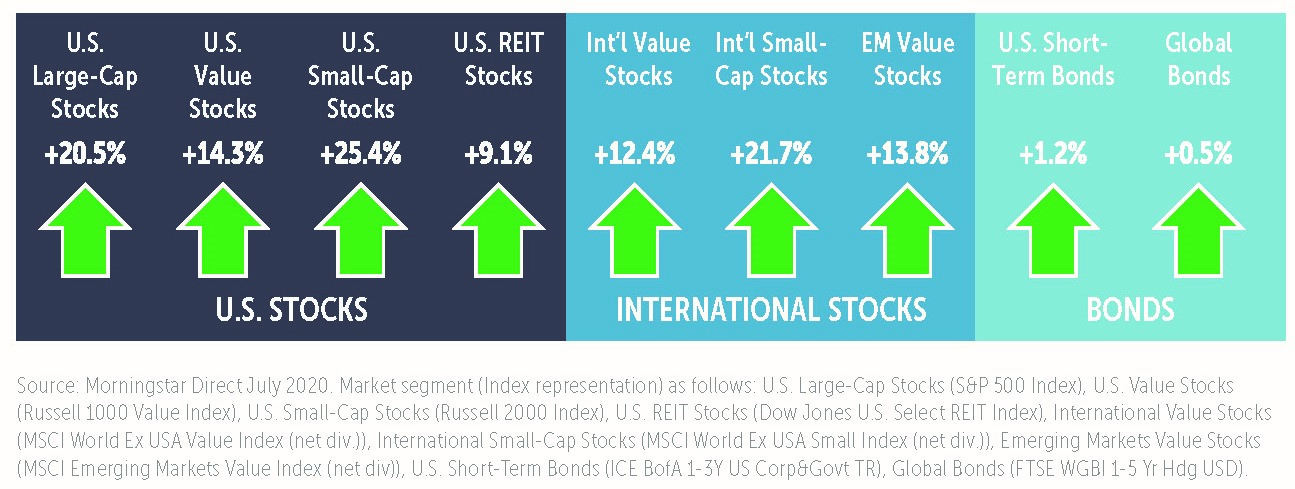

Finally, the chart below shows performance across a wide range of asset classes in recent years and in the first half of 2020. Given the extraordinary disruption to the U.S. and global economies so far this year, the resiliency of financial markets is remarkable. However, investors should not take this for granted. The next few months should answer many questions with regard to the race to produce a vaccine for COVID-19 as well as the pace and shape of the U.S. and global recoveries caused by the pandemic induced recession. Given all the uncertainty, it is wise to be somewhat defensive and very diversified in one of the most difficult and unusual years in modern history.1

Form CRS (Client Relationship Summary). The Form CRS (Client Relationship Summary) is a uniform disclosure document prescribed by the SEC; it’s intended to enhance investor protection by providing succinct and relevant information to retail investors, thus enabling comparability between broker-dealers and investment advisers.

Its main purpose is to provide retail investors with “simple, easy-to-understand information about the nature of their relationships with their financial professional.” Elevation Wealth Partners Form CRS is here and at the bottom of every page of our website.

As always, we are grateful for the opportunity to serve you and to now provide a new, engaging online experience. If on your dashboard, the “Current Probability of Success” of your financial plan happens to say “N/A,” then it has been a while since we have reviewed it together. Please let us know when a convenient time is for us to do so.

Sincerely,

Sources: 1 Dr. David Kelly at J.P. Morgan Asset Management, Morningstar, Inc., The Vanguard Group, Inc., Dimensional Fund Advisors, Charles Schwab & Co., Capital Group and Buckingham Strategic Wealth.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

July 2020: 2nd Quarter Commentary and Outlook

We’re happy to welcome two new clients into the Elevation Wealth Partners family this quarter. Thank you to everyone who continues to share with friends and family how we’ve helped add clarity to your financial life and grow your net worth over the years. It’s an honor to serve you and we look forward to many years of working together.

This past quarter, we introduced clients to our new Wealth Management Portal. The new portal has many robust features that give us a clear, up-to-date picture of the client’s financial position. For example:

2nd Quarter Market Review and Index Returns: A Tale of Two Markets

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way—in short, the period was so far like the present period, that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

The famous opening of Charles Dickens’ A Tale of Two Cities could just as easily refer to the current state of the world as it did the French Revolution when it was written in 1859. Although many small businesses, their owners, and their employees have been hit hard by the pandemic, it has yet to be reflected in the stock market. Fortunately, for most of the readers of this newsletter, our wealth and livelihoods have barely been affected.

Similarly, as of June 30, 2020, the Standard & Poor’s 500 Composite Index was down just 3.1% year-to-date, but that figure represents the sum of many individual companies. A deeper look reveals a wide divergence of returns. On the one hand, there are those that have benefited from coronavirus-related demand like e-commerce platform Amazon.com (up 49%), streaming service Netflix (up 41%), graphics processing and chip maker NVIDIA (up 69%), online payments like PayPal (up 61%), and cloud services like Citrix Systems (up 34%). On the other hand, a number of companies have struggled. Those include United Airlines (down 61%), cruise line Royal Caribbean (down 62%), mall operator Simon Property (down 53%), department store Kohl’s (down 58%), and Boeing (down 43%). So, it has been a tale of two markets – companies that are thriving in the corona-economy and companies that are not.

Key takeaways

Global stock markets rebounded during the second quarter and pared losses from the previous quarter. This positive performance follows the global effort to reopen economies under continued social distancing guidelines during the quarter. While we cannot say with any certainty what caused markets to move, expansionary monetary policy, increased consumer retail spending, and modest jobs growth in the U.S. in the last two months of the quarter all seem to be contributing to market growth.

For the quarter, U.S. stocks (as measured by the S&P 500 Index) gained 20.5% and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S.) gained 15.3%. Emerging market stocks (as measured by the MSCI Emerging Markets Index) gained 18.1%.

For a change, the second quarter wasn’t all bad news for value stocks. As shown in the chart below, the group has lagged significantly behind growth stocks in recent years and this was once again the case for the most recent three-month period. Across all three market-capitalization segments, growth was in the lead. However, small-value stocks did manage to top small-blend stocks, and mid-value stocks were just a shade behind mid-blend. As we explained in previous newsletters, in time this trend will reverse itself and value stocks will once again lead the market. For perspective on the current spread between value and growth stocks read Dimensional’s article: Spread the Word: What’s New with Valuation Ratios.

Digging a little deeper, it’s only a small number of stocks driving the bulk of the market so far this year. Specifically, the FAAMA stocks (Facebook, Apple, Amazon, Microsoft, and Alphabet) have enormous weight in stock indexes. In the S&P 500, these five stocks represent a little more than 20% of the weight of the index and in the first half of the year had an average return of almost 24%. In the tech-heavy NASDAQ Composite Index, these five names comprise more than 35% of the index (despite the index having twice the holdings of the S&P 500). That reason, along with the financial and energy sectors representing less than 10% of the index, explains why the index is up 12% on the year. Even still, 3/4 of all U.S. publicly traded stocks are negative for the year so we continue to orient portfolios toward less expensive stocks with value attributes. For more on Elevation Wealth Partners approach to investing and how we construct client portfolios read 10 Keys To A Successful Investment Experience.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, decreased by 1.7% in the second quarter compared to foreign currencies. Over the past 12 months, however, the U.S. dollar appreciated by 1.3%. The decrease in the dollar is a tailwind to non-U.S. investments held by U.S. investors in the second quarter.

U.S. interest rates remained unchanged during the quarter as the Federal Reserve continues to maintain a target range of 0.0% to 0.25% for the Fed Funds rate. Since changes in interest rates and bond prices are inversely related, continued low interest rates helped increase the quarterly return for many bond asset classes.

The U.S. economy began to contract this year for this first time since 2014. The final reading for first quarter 2020 GDP showed a decline in economic growth of 5.0% and stands in stark contrast to the economic progress of the past 10 years. The unemployment rate finished the quarter at 11.1% after briefly spiking to nearly 15%. Domestic inflation remains near all-time lows as the Fed’s preferred gauge of overall inflation and the core Personal Consumption Expenditures (PCE) index, stayed below the Fed’s target of 2.0% with a reading of 1.0% in May 2020. Earlier this year, we reduced the Base Inflation Rate in client’s financial plans by 0.5% (from 3.0% to 2.5%). In doing so, this increased the Probability of Success of achieving all the financial and life goals articulated in the plan by 4% (a significant amount). We continue to monitor inflation very closely and immerse ourselves in spending patterns during retirement so as to give our clients the most valuable and useful insights and information available.

Finally, the chart below shows performance across a wide range of asset classes in recent years and in the first half of 2020. Given the extraordinary disruption to the U.S. and global economies so far this year, the resiliency of financial markets is remarkable. However, investors should not take this for granted. The next few months should answer many questions with regard to the race to produce a vaccine for COVID-19 as well as the pace and shape of the U.S. and global recoveries caused by the pandemic induced recession. Given all the uncertainty, it is wise to be somewhat defensive and very diversified in one of the most difficult and unusual years in modern history.1

Form CRS (Client Relationship Summary). The Form CRS (Client Relationship Summary) is a uniform disclosure document prescribed by the SEC; it’s intended to enhance investor protection by providing succinct and relevant information to retail investors, thus enabling comparability between broker-dealers and investment advisers.

Its main purpose is to provide retail investors with “simple, easy-to-understand information about the nature of their relationships with their financial professional.” Elevation Wealth Partners Form CRS is here and at the bottom of every page of our website.

As always, we are grateful for the opportunity to serve you and to now provide a new, engaging online experience. If on your dashboard, the “Current Probability of Success” of your financial plan happens to say “N/A,” then it has been a while since we have reviewed it together. Please let us know when a convenient time is for us to do so.

Sincerely,

Sources: 1 Dr. David Kelly at J.P. Morgan Asset Management, Morningstar, Inc., The Vanguard Group, Inc., Dimensional Fund Advisors, Charles Schwab & Co., Capital Group and Buckingham Strategic Wealth.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.