To say the first half of 2022 has been unpredictable is an understatement. The ongoing issues associated with a multi-year pandemic, coupled with domestic and international challenges, has taken an emotional toll on many people. In addition, the economic headwinds of inflation and heightened market volatility have contributed to an amplified sense of instability. We hear this from friends, family, colleagues, and clients. While we can’t predict when or how geopolitical or macro-economic events will unfold, rest assured, our approach to investment and financial planning factor in the inevitability of these events.

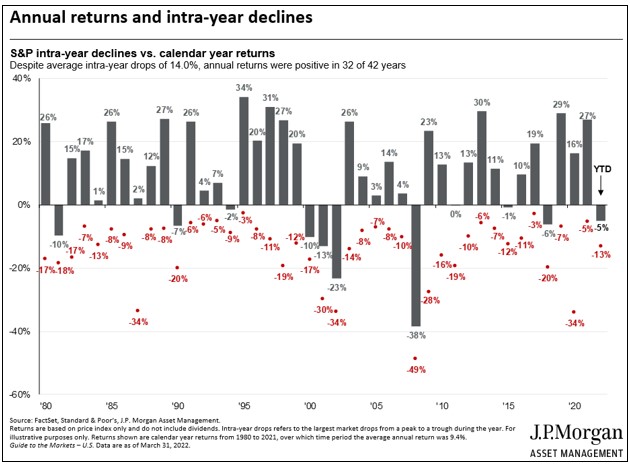

The media will have you believe that 2022 and several years preceding it have been marked with unusually wild swings in the stock market. They are wrong. A “correction” in the stock market (often defined as a decline of 10% or more) or a “bear market” (defined as a decline of 20% or more) are attendant risks of investing in stocks that should be accepted.

Consider that, since 1980, the S&P 500 Index has declined by 10% or more in 24 of the last 42 years. And yet, despite average intra-year drops of 14%, annual returns were positive in 32 of those 42 years!

Further, while the S&P 500 Index declined 12.76% through May 31 this year, consider the following;

- Looking back just one year, it has only declined 0.30% in value.

- Looking back just three years, it has still gained 57.86% on a cumulative basis.

- Looking back over just five years, it has gained an 87.39% on a cumulative basis.

- Looking back ten years, it has gained an astonishing 283.77% on a cumulative basis. To put this into perspective, this equates to an average annual return of 14.40% a year … well above its annualized return since its inception in 1926 through Dec. 31, 2021 of 10.49%.

Warren Buffet said it best, “The most important quality for an investor is temperament, not intellect.”

In fact, we can be comforted by the wisdom of successful investors who came before us. Their timeless advice is a guide all investors should follow. Below are some our favorite quotes.

“Every economic recovery since World War II has been preceded by a stock market rally. And these rallies often start when conditions are grim.” — Peter Lynch

“The four most dangerous words in investing are, it’s different this time.” — Sir John Templeton

“Someone’s sitting in the shade today because someone planted a tree a long time ago.” — Warren Buffett

“Save like a pessimist and invest like an optimist.” — Morgan Housel

“The two most powerful warriors are patience and time.” — Leo Tolstoy

“In investing, what is comfortable is rarely profitable.” — Robert Arnott

“Make investments. Frequently. Mostly in low-cost stock funds.” — Barry Mendelson, CFP

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.” — Warren Buffett

“There are a million ways to get wealth, and plenty of books on how to do so. But there’s only one way to stay wealthy: some combination of frugality and paranoia.” — Morgan Housel in his bestseller The Psychology of Money.

“When is the best time to invest? If your time horizon is at least ten years, then it’s right now!” — Kevin Goulding, CFP

“More money has been lost trying to anticipate and protect from corrections than actually in them.” — Peter Lynch

“You make most of your money in a bear market; you just don’t realize it at the time.” — Shelby Cullom Davis

“The historical data support one conclusion with unusual force: To invest with success you must be a long-term investor.” — John Bogle

“Time is your most valuable asset.” — Ryan Kosakura, CFA, CFP

May you have hindsight to know where you’ve been, the foresight to know where you are going, and the insight to know when you have gone too far. – Irish Proverb

“The stock market is designed to transfer money from the active to the patient.” — Warren Buffett

“Your personal values should determine your financial goals… and your financial goals should determine your investment strategy. Many people have this backwards.” — Barry Mendelson, CFP

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” — Dave Ramsey

One area that I hope you’re a bit less concerned about is your personal financial plan. Our tailored approach is planning accounts for the types of economic and market setbacks we’ve seen recently. As we’ve experienced, news events and economic challenges can lead to short-term “paper” losses that are often not long-lived if we “stay the course” and stick to the well-constructed plan built for you.

Discipline does not mean inaction. While we can’t control the markets or predict what might happen next, we can take advantage of planning opportunities that are within our control. We are continually evaluating your personalized financial plan against current conditions and taking proactive action when prudent and for your benefit. We’re here to answer your questions and discuss your concerns, whatever they may be. Please reach out to your advisor at any time. As your financial stewards, we’re here to guide you through the inevitable ups and downs during your financial journey.

Important dates;

- Wednesday, June 15th. 2nd Federal and State 2022 estimated tax payments due.

- Sunday, June 19th. Father’s Day. Happy Father’s Day to all the dads out there!

- Monday, June 20th. Juneteenth National Independence Day observed (markets closed and so too are Elevation Wealth Partners offices)

- Monday, July 4th. Independence Day (markets closed and so too are Elevation Wealth Partners offices)

Sources: Buckingham Strategic Partners, BlackRock, Inc. and J.P. Morgan

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.