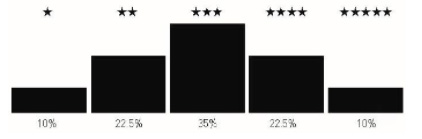

The Morningstar Rating™ for Funds, often called the “Star Rating,” was first introduced in 1985. Using a scale of one to five starts, the original rating allowed investors to quickly evaluate a fund’s past performance within six broad asset classes. For the first time, it introduced the concept of risk- and cost-adjust return to the average investor. Stars are assigned using the following scale:

Over time, investors moved from owning one or two funds to assembling diversified portfolios of funds. This meant they were more likely to need a specific type of fund, such as small-cap value, to complement their other holdings. For this reason, in 1996 Morningstar created its Category Rating,™ which rated funds within their smaller and more focused Morningstar Categories, and encouraged investors to use it along with the broader-based star rating. Today, there are more than 100 categories in which a fund is judged by its performance relative to its peers! In the taxable bond category alone, there are 17 categories! Makes picking a good investment easy, huh?

So where’s the problem? The investment community loves to tout highly rated funds – especially ones with 5 Stars because they often attract new money, inflows, and larger fees for the manager. This is especially true with fund companies (just open any issue of Money, Kiplingers, or Forbes) and with the brokerage firms such as Merrill Lynch, Morgan Stanley Smith Barney, Wells Fargo for sure, and even Charles Schwab and Fidelity. To the unsuspecting investor, Stars sell.

The problem with the Star Rating is that it is entirely based on past performance! It’s like driving while only looking in the rear-view mirror. Well you say, “If a fund has performed well in the past, shouldn’t we expect it to perform well in the future?” Unfortunately, no. In The Vanguard Group’s seminal 2010 research paper titled, “Mutual Fund Ratings and Future Performance” – in looking at 17 years of returns from 1992 – 2009, 61% of 5 Star rated fund failed to outperform their style benchmark in the three years following receiving their 5 Star rating. In other words, less than half the 5 Star funds continue to experience out-performance. Why? It could be for any number of reasons, such as;

The fund attracted a lot of assets and the manager is having difficulty continuing to execute the same strategy that generated exceptional returns in the first place. This is often referred to as “asset bloat.”

Style drift or strategy change. Perhaps, the manager changed their investment strategy or the types of securities they buy.

Manager or other personnel change. Perhaps the person that was running the fund is no longer there.

The manager’s luck has run out. In investing, it is awfully difficult to distinguish between skill and luck. There’s certainly more to it than just looking at past returns.

So, if Morningstar’s Star Rating is no better than a coin toss at helping pick the next best investment, what’s a metric we can use that actually has good predictive power? The Expense Ratio.

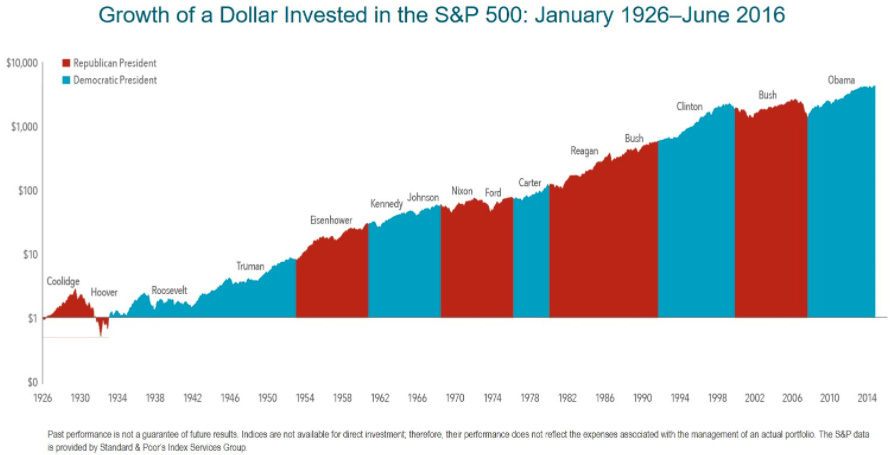

In recognizing the limitations of the Star-monster they created, Morningstar shared research done in 2010 and published a more comprehensive whitepaper in May 2016 stating that, “The expense ratio is the most proven predictor of future fund returns. There are many other things to consider, but investors should make expense ratios their first or second screen.” Specifically, funds with expense ratios in the lowest quintile (20%) were most likely to outperform all other funds in that category. The following graphic says it all;

In conclusion, if you have to start somewhere, start with the least expense and most diversified mutual funds and ETFs (exchange traded funds). At Elevation Wealth Partners, cost is a primary consideration for us as well. We also do extensive research and due-diligence on the people and process behind the investment’s performance. After all, every investment that goes in a client account also goes in our accounts as well.

As always, in these challenging and confusing times, we are here to be a resource to you and those important to you. Please do not hesitate to call, send us an email, or schedule an appointment.