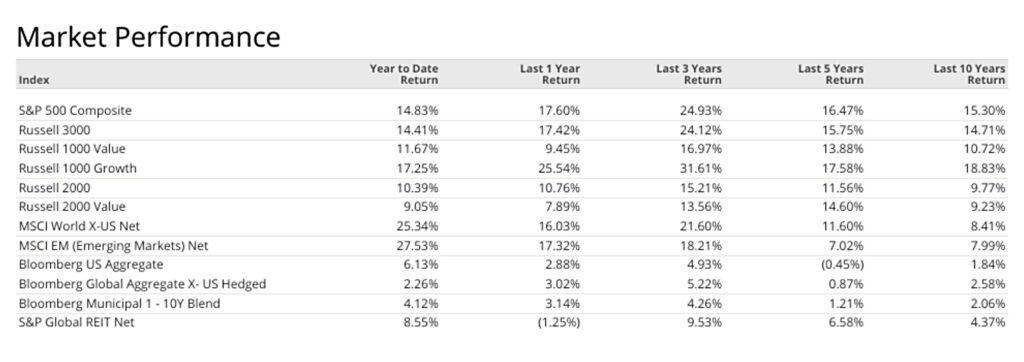

Markets wrapped up Q3 on a strong note, with September delivering gains across global stocks and bonds. U.S. assets led the charge, outperforming their developed-market peers thanks to resilient consumer spending and continued strength in technology.

The Fed reignited its rate-cut cycle on September 17, fueling a rally in U.S. equities. The S&P 500 hit another record high and logged its best September in 15 years.

Most sectors advanced, with information technology up more than 13% for the quarter.

Emerging markets outpaced developed markets, gaining nearly 11% in Q3, while non-U.S. developed stocks lagged.

The Fed and Bank of England each cut rates by 25 basis points, while the European Central Bank held steady.

Inflation ticked higher: U.S. headline inflation reached 2.9% in August, with core inflation steady at 3.1%. Europe came in at 2.2%, and the U.K. held at 3.8%.

U.S. size and style indices broadly rose in September and for the quarter. International indices also posted gains.

Treasury yields declined, supporting a positive quarter for the U.S. bond market.

Stocks across markets, styles, and market capitalizations

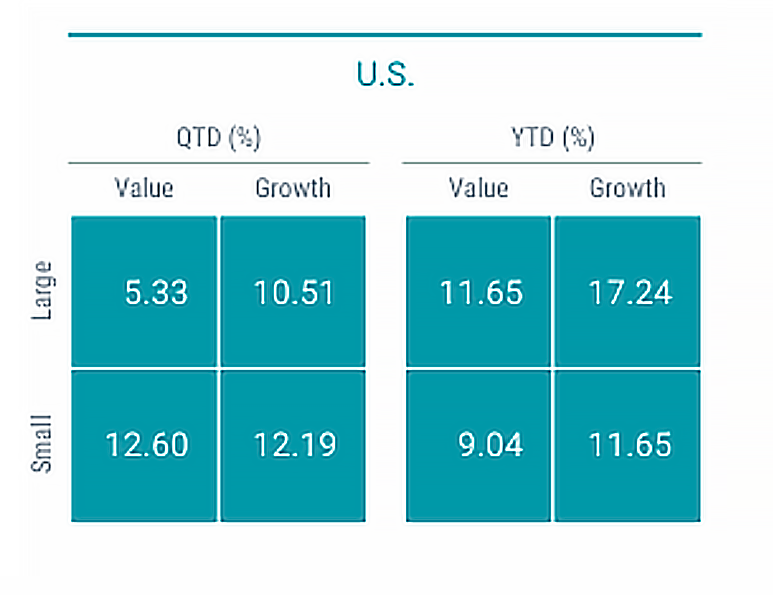

The broad U.S. stock market index rallied more than 8% in the third quarter, lifting its year-to-date return to nearly 15%. All key size and style indices advanced for both periods.

Small-cap stocks gained more than 12% for the quarter, outpacing large-caps, which returned 8%. Year to date, large-caps returned nearly 15% and outperformed small-caps, which gained more than 10%.

For the quarter, growth stocks outperformed their value peers among large-caps but lagged among small-caps. Year to date, growth stocks outperformed across the board.

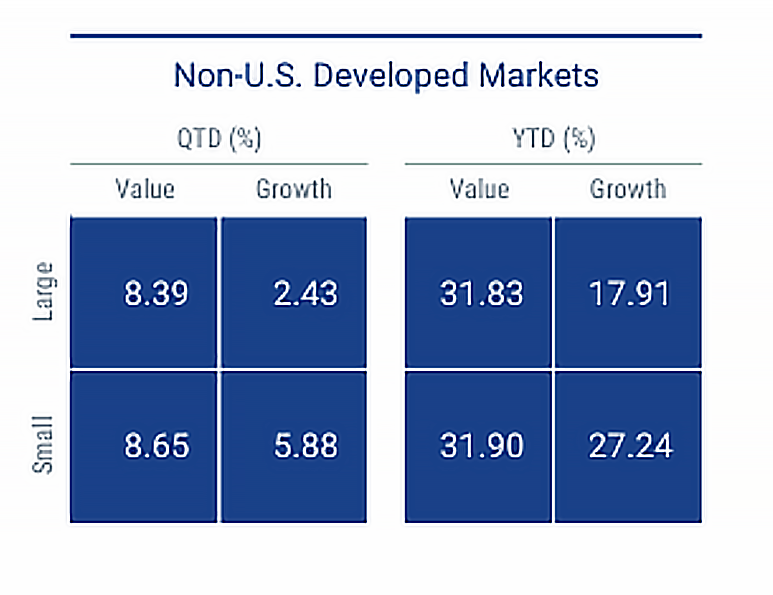

Non-U.S. developed markets stocks underperformed U.S. stocks for the quarter but outperformed year to date. All major size and style indices advanced for both periods.

Small-cap stocks outperformed large-caps for the quarter and year to date. Small-caps gained nearly 30% for the year-to-date period, while large-caps gained 25%.

Across the board, value stocks outperformed their growth-style peers in the quarter and year to date. Small-cap value stocks were top performers for both periods, advancing nearly 9% for the quarter and 32% year to date.

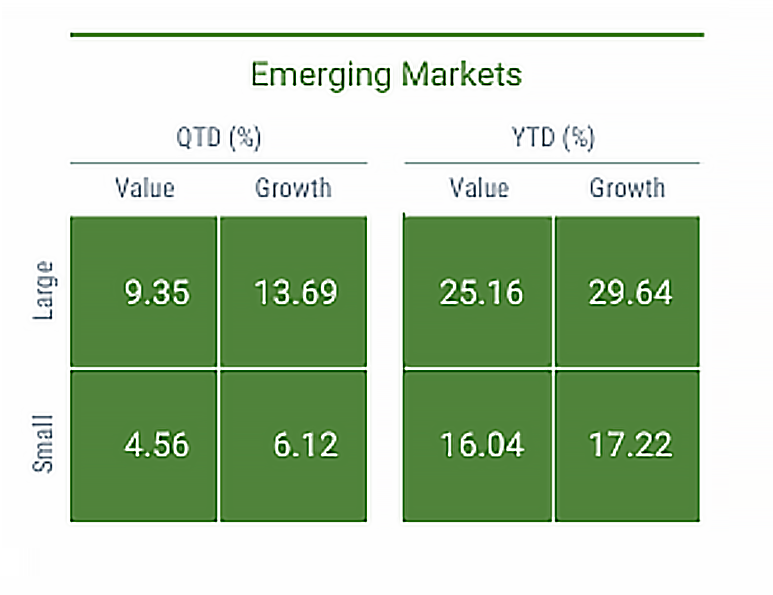

The broad emerging markets stock index outperformed developed markets stocks for the quarter and year-to-date period. The index gained nearly 11% for the quarter and almost 28% year-to-date.

Large-cap stocks rose nearly 12% in the quarter, sharply outpacing small-caps. Year to date, large-caps outperformed small-caps by more than 10 percentage points.

Growth stocks outperformed value stocks across capitalizations for the quarter and the year-to-date period. Large-cap growth stocks were top performers for both periods.

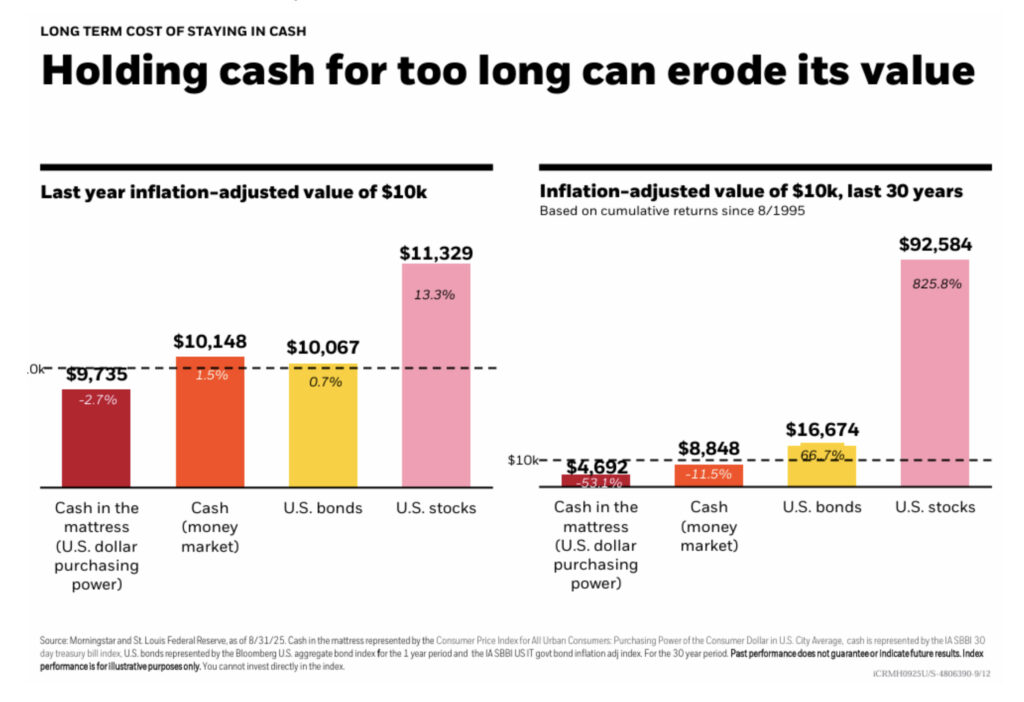

Is Holding Cash Keeping Up with Inflation?

Historically, bond returns have improved when the Fed resumes rate cuts after a pause—though long-term Treasury yields don’t always follow suit. With only a slim yield spread between short- and long-term Treasuries, many investors remain parked in cash—but that may change if rate cuts accelerate.

September is historically the weakest month for U.S. stocks on average, yet gains still occur more than half the time—reminding us that seasonality is a guide, not a rule.

Market concentration continues to climb, with the top 10 S&P 500 stocks now representing 39% of the index, its highest level in decades. Despite this, overall volatility has remained modest. The “Magnificent Seven”—Amazon, Tesla, Alphabet, Meta, Apple, Nvidia, and Microsoft—continue to drive performance, though returns within the group vary widely.

International equities are leading 2025 returns, buoyed by a weaker U.S. dollar, while alternative strategies such as Global Macro and Equity Market Neutral are thriving in today’s elevated rate environment.

For long-term investors, the data underscores the cost of staying in cash: over 30 years, $10,000 invested in stocks grew to more than $92,584, while cash held under the mattress barely reached $4,692 after inflation.

For more on the markets, see our Market Slides.

Important Deadlines and Dates

Oct 15: Medicare Open Enrollment begins. Annual period when those 65 and older can review and change their health and prescription drug coverage for the following year

Oct 15: Extended Individual Tax returns due

Oct 28: Federal Reserve Open Market Committee Meeting

Oct 31: Deadline to file quarterly payroll reports (Form 941) and pay Q3 payroll taxes

Nov 27: Thanksgiving- The markets are closed and so are Elevation Wealth Partners offices

Dec 1–15: Ideal window to finalize year-end tax planning—Roth conversions, DAF contributions, bonus timing, and capital gains harvesting

Dec 25: Christmas – The markets are closed and so are Elevation Wealth Partners offices

Dec 31: Deadline for Roth conversions, charitable contributions, and 401(k)/403(b) employee deferrals

• Last day to take RMDs (Required Minimum Distributions) if applicable

• Deadline to establish Solo 401(k) plans for 2025 contributions (funding can happen later)

• Final day to make business purchases for Section 179 or bonus depreciation

Jan 1: New Year’s Day – The Markets are closed and so are Elevation Wealth Partners

Sources: Avantis Investors, by American Century Investments – Monthly ETF Field Guide, Morningstar, Inc. Blackrock-Student of the Market September 2025.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.