U.S. stocks advanced for the fifth straight month and rose to several record highs in September, leading to another quarterly gain. Non-U.S. stocks also posted upbeat monthly and quarterly returns. Meanwhile, U.S. bonds rallied in September and for the quarter.

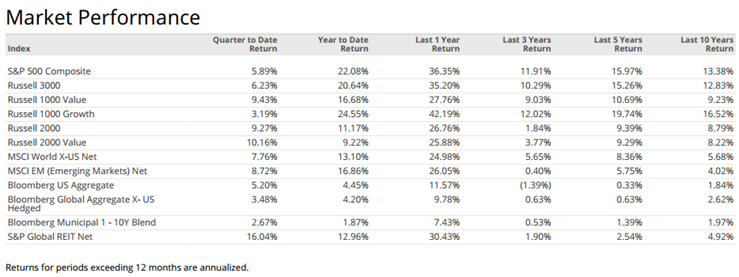

- U.S. stocks gained more than 2% in September as inflation slowed, growth persisted, and the Fed launched its first easing campaign in four years. The S&P 500 Index’s monthly gain led to a 5.9% third-quarter return and year-to-date gain of 22.1%.

- Most S&P 500 Index sectors advanced in September and for the third quarter. Utilities were the top sector performer for both periods, while energy was the weakest.

- Non-U.S. developed markets stocks also advanced for the month, and they outperformed U.S. stocks for the quarter. With China’s stock market surging 24% in September, emerging markets stocks advanced and outperformed their developed markets peers for the month and quarter.

- The Fed announced an aggressive 50-bps rate cut in September due to cooling inflation. The European Central Bank cut rates another 25 bps, while the Bank of England left its target rate unchanged after easing in August.

- The annual rate of U.S. headline inflation slowed to 2.5% in August from 2.9% in July, while core inflation was unchanged at 3.2%. Inflation eased in Europe and held steady in the U.K.

- In the U.S., large-cap stocks outperformed small-caps in September but lagged for the quarter. Growth stocks outpaced value stocks for the month but underperformed for the quarter.

- U.S. Treasury yields declined for the month and quarter, and the broad bond market advanced for both periods.

Stocks across markets, styles, and market capitalizations

Amid expectations for the Fed to start cutting interest rates in September, U.S. Treasury yields steadily declined in the quarter, particularly among short-maturity securities. The broad U.S. bond index advanced for the month and quarter.

The Bloomberg U.S. Aggregate Bond Index returned 5.2% for the second quarter, and its year-to-date gain climbed to 4.5%.

- Treasury yields declined. The 10-year note ended the quarter at 3.70%, 61 bps lower than June 30. The two-year Treasury yield dropped 112 bps to 3.65%, and the yield curve’s slope turned positive for the first time in more than two years.

- Credit spreads were volatile but ended the quarter tighter. Investment-grade corporates rallied and outperformed Treasuries, Mortgage-Backed Securities and the broad bond index. MBS also outperformed Treasuries and the bond index. High-yield corporates also advanced for the quarter.

- Amid signs of resilient economic growth, slowing inflation and labor market weakness, the Fed cut its target lending rate in September for the first time since March 2020. The 50-bps move pushed the federal funds rate to a range of 4.75% to 5%. Fed officials also suggested more easing is in store.

- Headline Consumer Price Index (CPI) slowed for the fifth straight month to an annualized pace of 2.5% in August. Annual core CPI was 3.2% in August, unchanged from July. Annual core PCE, the Fed’s preferred inflation gauge, inched up in August, to 2.7% from 2.6% in July.

- Municipal bonds delivered gains for the month and the quarter but lagged Treasuries.

For more financial information see our 3rd Quarter 2024 Market Review Slides

Sources:

Avantis Investors, by American Century Investments – Monthly ETF Field Guide

J.P. Morgan Asset Management, Guide to the Markets

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.