The Russian invasion of Ukraine, with its heartbreaking destruction and human suffering, has raised geopolitical uncertainties and stoked fears in global financial markets. The price of oil rose significantly and supply chain bottlenecks, coupled with a generally improving economy, kept inflation stubbornly high. Despite the aforementioned, we believe inflation will slow by early 2023 and not derail the strong economic growth we are experiencing here in the United States.

It’s important to remember that geopolitical selloffs have historically been short-lived. Just as humans adapt to crises, so do companies. The well-run businesses and publicly traded companies you are invested in will adjust to current market conditions. This is why it is important to separate one’s feelings about the economy from one’s feelings about outlook for the investment markets. Rarely do both go hand in hand.

We started the year with U.S. stocks on a downward trend and interest rates rising before the conflict in Ukraine started. The Russian invasion added to the “risk-off” sentiment permeating the markets. The economists we follow do not expect the Russia / Ukraine conflict to have a long-term impact on U.S. markets partially because U.S. corporations generally have minimal exposure to Russia and Ukraine, and Russia and Ukraine have limited global trade.

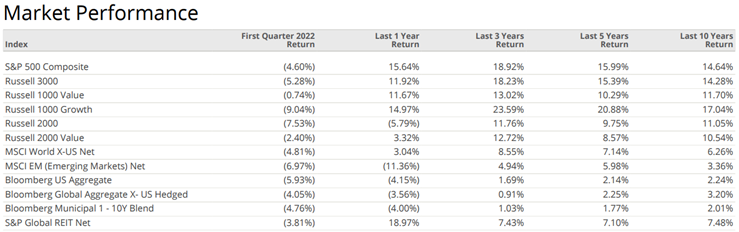

For the quarter, U.S. stocks declined slightly with the Russell 3000 Index declining 5.28% and the S&P 500 Composite declining 4.60%. Even still, over the past 12 months, the Russel 3000 still rose by 11.92% and the S&P 500 Composite increased by 15.64%.

Foreign stocks experienced similar pressure in the 1st quarter with stocks in developed countries declining by 4.81% as per the MSCI World Ex-USA Index and stocks in emerging countries as per the MSCI Emerging Markets Index declining by 6.97%.

To combat inflation and keep up with a growing economy, we expect the Federal Reserve to raise the Federal Funds Fund by at least 0.50% when they meet May 3-4. Until the Russia / Ukraine crisis is resolved, market volatility is likely to be unusually high. If you are feeling anxious, we’ve found going for a walk to be a great antidote. For more on our take on the 1st Quarter click here.

What is going on with bonds?

The last two years have been some of the most challenging for bond investors. Though the economy remains strong and the risk of an issuer defaulting on a bond (i.e. – failing to make an interest payment) is very low, the prices of bonds have fallen. Why? Some believe that inflation will persist (and possibly even accelerate) thereby requiring the Fed to raise interest rates at much faster rate than they have currently outlined. ZRC does not fall into that camp and we believe that inflation will ease by early 2023 (if not sooner) and that the pressure on bonds prices is overdone. In the meantime, we are happy for our clients to earn a steady stream of income from the interest they provide and for our fund managers to hold the bond until maturity, at which time they receive the principal payment in full.

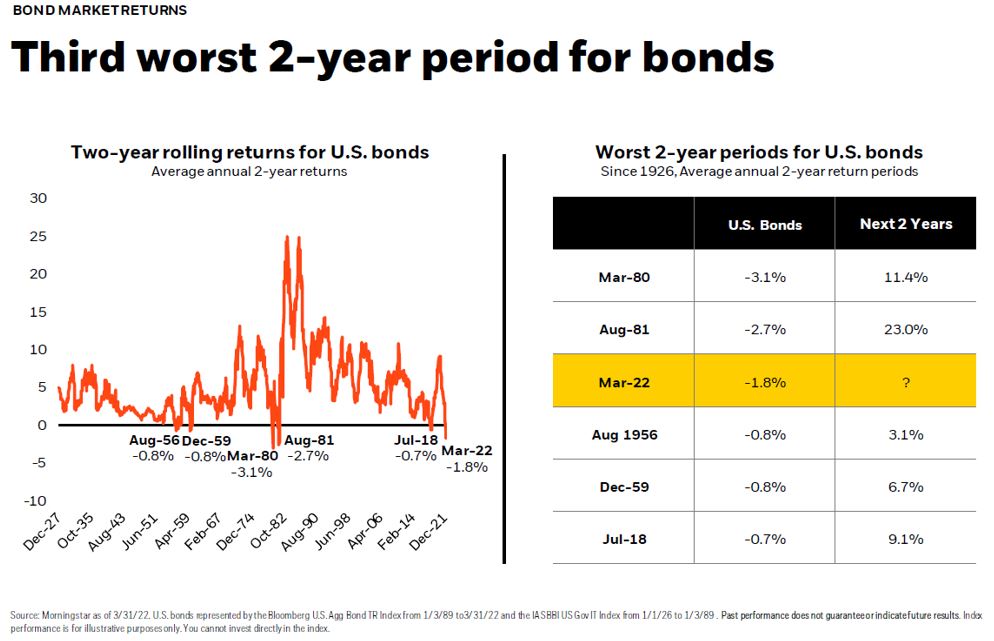

Using history as our guide, during the past 96 years there have been only six instances where the two-year returns for bonds has been negative (including the current period). In each of the subsequent two-year periods, bonds have produced positive returns ranging from +3% to +23%.

This provides another compelling reason to hold bonds even when their current performance lags. Performance-wise, bonds typically behave very differently from stocks. In the investment world we refer to them as having a “low correlation” to each other meaning that the performance of one is almost entirely unrelated to the other. Often, when stocks fall in value, bonds rise in price. And while that hasn’t been the case this year, bonds still serve an important diversification role in portfolios and keep portfolio volatility in check. Consider the chart below.

Source: Stocks: S&P 500 Index; bonds: Bloomberg US Aggregate Bond Index; Balanced: 50% stock/50% bond allocation. Past performance does not guarantee future results. The performance shown above is index performance shown for illustrative purposes only and is not representative of any Hartford Fund’s performance. Sources: Morningstar and Hartford Funds, 1/21.

In the above illustration, a balanced portfolio of ½ stocks and ½ bonds still managed to capture 93% of stock returns over this 21 year period.

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.