It was a volatile third quarter with the U.S. broad market (as represented by the Russell 3000 Index) posting 19 new highs before falling back to where it had begun three months earlier. U.S. stocks climbed higher in July and August on optimism about the U.S. economic recovery. However, shares fell back from their highs in September amid worries about the coronavirus delta variant’s impact on the economy, supply chain slowdowns leading to shortages across a number of key industries, inflation, and a regulatory crackdown in China.

U.S. Stocks: For the quarter, U.S. stocks (as measured by the Russell 3000 Index) lost 0.1%. Domestically, large-cap stocks and REITs (real estate investment trusts) posted positive performance for the quarter, returning 0.58% and 1.25% respectively. Value stocks receded a little.

Foreign Stocks: Non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. Stock Index) lost 0.66%. The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased 4.8% during the quarter, impacting the performance of foreign stocks (which are held, whenever possible, in their local currency). Emerging market stocks (as measured by the MSCI Emerging Markets Index) lost 8.09%. Chinese stocks declined 18% during the quarter, rattled by the potential collapse of Chinese property giant Evergrande and the possible related fallout. With China representing about 35% of emerging markets stocks, this explains much of the index’s decline.

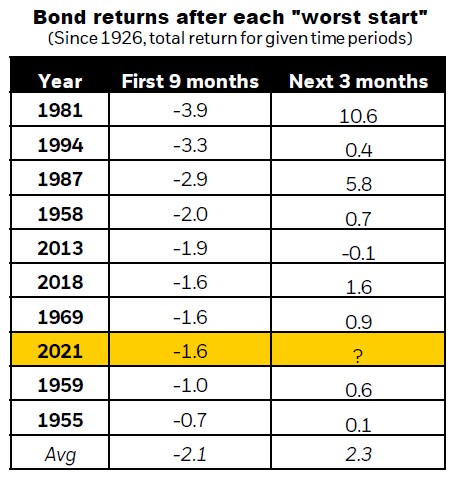

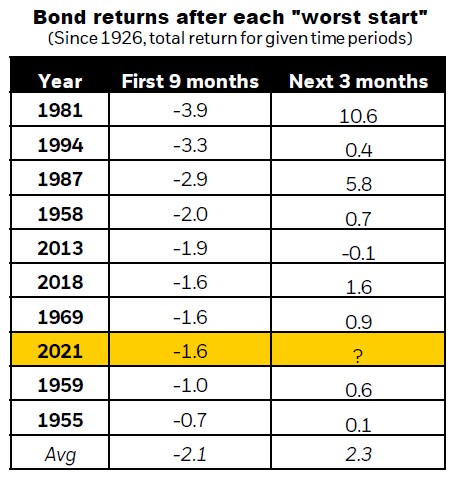

Bonds: Returns for bonds during the quarter were muted, posting small gains. Higher than expected inflation and speculation that the Federal Reserve could raise interest rates sooner than stated caused prices to decline earlier in the year and explains why total returns (interest earned + change in value) are negative for the year. In the past, such periods of performance have been short-lived, often reverting back to positive returns within a year. Specifically, in looking at the chart to the right, in the ten “worst starts” for bonds, the next three months on average saw bond returns bounce back. For these reasons and others, we recommend no changes to clients’ fixed income investments at this time.

Inflation: Here in the U.S., we have begun to emerge from the effects of the coronavirus’s delta variant. While we expect economic growth to continue to be strong, that strength is not uniform across regions, countries, and sectors. Supply chain disruptions in several emerging market economies such as Vietnam, Taiwan, and Russia that are just now dealing with the effects of the Delta variant are limiting the production of basic materials needed to meet the demand for goods here in the U.S. driven by our strengthening economy and falling unemployment. By mid-2022, we expect the global supply chain to have begun to normalize and growth here in the U.S. to slow. As a result, we expect inflation to begin to decline to more moderate levels.

While inflation may remain above the Fed’s 2% target, long-term we see it remaining in-line (if not below), our long-term forecast of 2.5% that we use in clients’ financial plans. Across the board, clients have enjoyed significant appreciation in their stock investments the last several years and net worth’s are at all-time highs. Given the resources many clients have at their disposal, we do not see higher-than-average inflation being a problem for most. Nor do we recommend a drastic change in investment strategy to attempt to hedge against the remote possibility of hyper-inflation as was experienced in the 1970’s and early 1980’s. Stocks remain the best hedge against inflation and their performance in recent years has positioned our clients to easily withstand elevated price levels . . . even if higher than normal inflation persists for another year or two.

Even with the setback at the end of the quarter, U.S. stock performance for the year remains very strong with most broad indexes and asset classes up 12% – 22% and the Russell 3000 (broad market) Index up 15%.

Bonds: Returns for bonds during the quarter were muted, posting small gains. Higher than expected inflation and speculation that the Federal Reserve could raise interest rates sooner than stated caused prices to decline earlier in the year and explains why total returns (interest earned + change in value) are negative for the year. In the past, such periods of performance have been short-lived, often reverting back to positive returns within a year. Specifically, in looking at the chart to the right, in the ten “worst starts” for bonds, the next three months on average saw bond returns bounce back. For these reasons and others, we recommend no changes to clients’ fixed income investments at this time.

Inflation: Here in the U.S., we have begun to emerge from the effects of the coronavirus’s delta variant. While we expect economic growth to continue to be strong, that strength is not uniform across regions, countries, and sectors. Supply chain disruptions in several emerging market economies such as Vietnam, Taiwan, and Russia that are just now dealing with the effects of the Delta variant are limiting the production of basic materials needed to meet the demand for goods here in the U.S. driven by our strengthening economy and falling unemployment. By mid-2022, we expect the global supply chain to have begun to normalize and growth here in the U.S. to slow. As a result, we expect inflation to begin to decline to more moderate levels.

While inflation may remain above the Fed’s 2% target, long-term we see it remaining in-line (if not below), our long-term forecast of 2.5% that we use in clients’ financial plans. Across the board, clients have enjoyed significant appreciation in their stock investments the last several years and net worth’s are at all-time highs. Given the resources many clients have at their disposal, we do not see higher-than-average inflation being a problem for most. Nor do we recommend a drastic change in investment strategy to attempt to hedge against the remote possibility of hyper-inflation as was experienced in the 1970’s and early 1980’s. Stocks remain the best hedge against inflation and their performance in recent years has positioned our clients to easily withstand elevated price levels . . . even if higher than normal inflation persists for another year or two.

Even with the setback at the end of the quarter, U.S. stock performance for the year remains very strong with most broad indexes and asset classes up 12% – 22% and the Russell 3000 (broad market) Index up 15%.

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Bonds: Returns for bonds during the quarter were muted, posting small gains. Higher than expected inflation and speculation that the Federal Reserve could raise interest rates sooner than stated caused prices to decline earlier in the year and explains why total returns (interest earned + change in value) are negative for the year. In the past, such periods of performance have been short-lived, often reverting back to positive returns within a year. Specifically, in looking at the chart to the right, in the ten “worst starts” for bonds, the next three months on average saw bond returns bounce back. For these reasons and others, we recommend no changes to clients’ fixed income investments at this time.

Inflation: Here in the U.S., we have begun to emerge from the effects of the coronavirus’s delta variant. While we expect economic growth to continue to be strong, that strength is not uniform across regions, countries, and sectors. Supply chain disruptions in several emerging market economies such as Vietnam, Taiwan, and Russia that are just now dealing with the effects of the Delta variant are limiting the production of basic materials needed to meet the demand for goods here in the U.S. driven by our strengthening economy and falling unemployment. By mid-2022, we expect the global supply chain to have begun to normalize and growth here in the U.S. to slow. As a result, we expect inflation to begin to decline to more moderate levels.

While inflation may remain above the Fed’s 2% target, long-term we see it remaining in-line (if not below), our long-term forecast of 2.5% that we use in clients’ financial plans. Across the board, clients have enjoyed significant appreciation in their stock investments the last several years and net worth’s are at all-time highs. Given the resources many clients have at their disposal, we do not see higher-than-average inflation being a problem for most. Nor do we recommend a drastic change in investment strategy to attempt to hedge against the remote possibility of hyper-inflation as was experienced in the 1970’s and early 1980’s. Stocks remain the best hedge against inflation and their performance in recent years has positioned our clients to easily withstand elevated price levels . . . even if higher than normal inflation persists for another year or two.

Even with the setback at the end of the quarter, U.S. stock performance for the year remains very strong with most broad indexes and asset classes up 12% – 22% and the Russell 3000 (broad market) Index up 15%.

Bonds: Returns for bonds during the quarter were muted, posting small gains. Higher than expected inflation and speculation that the Federal Reserve could raise interest rates sooner than stated caused prices to decline earlier in the year and explains why total returns (interest earned + change in value) are negative for the year. In the past, such periods of performance have been short-lived, often reverting back to positive returns within a year. Specifically, in looking at the chart to the right, in the ten “worst starts” for bonds, the next three months on average saw bond returns bounce back. For these reasons and others, we recommend no changes to clients’ fixed income investments at this time.

Inflation: Here in the U.S., we have begun to emerge from the effects of the coronavirus’s delta variant. While we expect economic growth to continue to be strong, that strength is not uniform across regions, countries, and sectors. Supply chain disruptions in several emerging market economies such as Vietnam, Taiwan, and Russia that are just now dealing with the effects of the Delta variant are limiting the production of basic materials needed to meet the demand for goods here in the U.S. driven by our strengthening economy and falling unemployment. By mid-2022, we expect the global supply chain to have begun to normalize and growth here in the U.S. to slow. As a result, we expect inflation to begin to decline to more moderate levels.

While inflation may remain above the Fed’s 2% target, long-term we see it remaining in-line (if not below), our long-term forecast of 2.5% that we use in clients’ financial plans. Across the board, clients have enjoyed significant appreciation in their stock investments the last several years and net worth’s are at all-time highs. Given the resources many clients have at their disposal, we do not see higher-than-average inflation being a problem for most. Nor do we recommend a drastic change in investment strategy to attempt to hedge against the remote possibility of hyper-inflation as was experienced in the 1970’s and early 1980’s. Stocks remain the best hedge against inflation and their performance in recent years has positioned our clients to easily withstand elevated price levels . . . even if higher than normal inflation persists for another year or two.

Even with the setback at the end of the quarter, U.S. stock performance for the year remains very strong with most broad indexes and asset classes up 12% – 22% and the Russell 3000 (broad market) Index up 15%.

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.