- The stock market was once again led by a strong performance from large U.S. stocks while small U.S. stocks and international stocks saw single-digit gains. The valuations continue to widen between these asset classes.

- The 10-Year U.S. Treasury bond yield closed the year on an upswing to 4.6%. Two Fed-fund rate cuts are expected in 2025 and economists forecast long-term rates will fall by half a percent later this year. However, proposed tariff hikes, if done haphazardly, could push inflation and interest rates higher. An uptick in inflation is one of the greatest threats to the economy. Since there is a lag between new policies being enacted and a measurable change in inflation, the effects of such policy changes might not be known for a year or two, or even longer.

- The United States continues to grow at a remarkably consistent rate. Since 2022’s third quarter, our GDP has posted at least a 2% annual growth rate in eight of the last nine quarters… higher than what most economists forecasted and proof of the resiliency of the U.S. economy.

- Looking ahead, macroeconomic factors in the U.S. remain solid with unemployment and inflation at reasonably low levels. Consumer spending, household net worth, productivity, and corporate profits are all growing at a modest clip. The typical economic expansion lasts four to five years and that’s how long it’s been since the COVID related recession in 2020. However, we see the likelihood of a recession this year to be quite low.

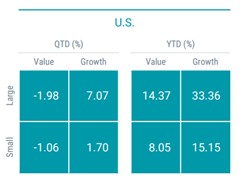

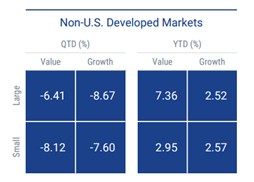

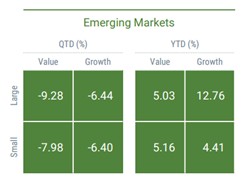

Stocks across markets, styles, and market capitalizations

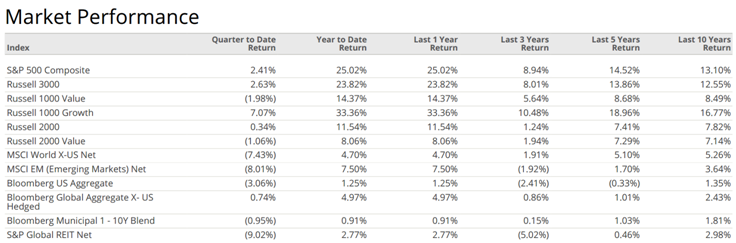

- Led by the technology sector, large US stocks charged higher in 2024, gaining 25.0% on the back of 2023’s 26.3% gain.

- Small US stocks performed well, rising 12% in 2024 led by growth stocks while value stocks continue to lag.

- Growth has become very expensive: large growth stocks are 58% more expensive than large value stocks and small US growth stocks are now 103% more expensive than value stocks.

- Developed international stocks, led by the value group, gained just 5% in 2024 after a nice 18% return in 2023. Strong gains from Singapore and Israel outperformed those in Europe, a region whose economies continued to struggle with high inflation and energy prices.

- Could 2025 be the year developed international markets outperform the US? Investors may gravitate to lower valuations, lower inflation, and an expected pickup in GDP growth.

- Like the developed markets, those countries exposed to technology performed well: China, Taiwan, Malaysia, and India, primarily.

- This asset class has been a performance laggard in recent years due to its 25% exposure to underperforming China. Taiwan and India represent 20% each.

- While China is always a wildcard, India has much potential serving a massive population with upwardly mobile people. Taiwan’s semiconductor industry is serving the world’s technology growth.

Donald Trump’s victory signals significant policy changes ahead, with key initiatives like tax cuts, higher tariffs, and stricter immigration policies likely to be implemented quickly. His win, along with Republican control of the Senate, gives him the power to push his agenda, including deregulating business and reshaping government agencies.

Trump inherits a strong U.S. economy, and his policies could boost growth, inflation, and interest rates. Tax cuts, public spending, and deregulation may offset some risks from tariffs and global tensions. Tariffs, especially on Chinese goods, are a priority, and the stock market has responded positively to the election outcome, with strong rallies in equities.

In terms of industries, banks and defense sectors are likely to benefit from deregulation and increased military spending. Energy production could see a boost, while healthcare might face challenges from deregulation. Small-cap companies could thrive due to a stronger economy and reshoring efforts.

Trump’s administration will take a more aggressive stance on trade, including tariffs and restrictions on China, and may push for lower corporate taxes. Geopolitically, U.S.-Europe relations could face tension, particularly over national security, defense, and trade, with potential shifts in U.S. support for NATO and Ukraine. While these policies are clearly designed to benefit U.S. interests and companies, how they will actually play out in a globally inter-connected economy is difficult to predict. Therefore, we believe that a diversified portfolio that includes both U.S. and foreign investments is still the most prudent for short and long-term investors alike.

International Equities Lag Again – Will the Tide Turn in 2025?

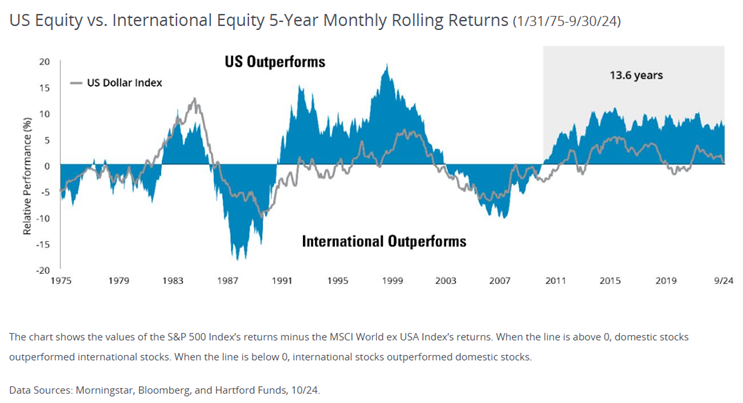

If, every month, you compared the five-year returns of large U.S. stocks and international stocks, you’d see as we do in the chart below that it’s been nearly 14 years that the U.S. has outperformed international! Today, large U.S. stocks are priced at nearly 22 times earnings versus 16 times historically. This compares with 14 for international stocks, about average for this asset class.

Why has this gap widened so substantially?

The U.S. has more technology exposure, earnings have grown faster, and the U.S. dollar has gotten stronger. The technology sector’s strong earnings growth has been the leading driver of large US stocks’ performance. However, the tech sector’s earnings growth is expected to slow markedly this year and next. Conversely, international markets are expected to regain revenue and earnings growth this year; these economies have lagged coming out of the COVID years. Some of this growth should come from reshoring manufacturing, building out clean energy infrastructure, and increased military spending. Additionally, lower expected European inflation could strengthen the Euro, lower expected interest rates would make it cheaper to borrow, and fighting in the Middle East and Eastern Europe could subside. These factors, coupled with dramatically lower stock prices in Europe, could drive international stock outperformance in 2025. The key, as always, is to remain diversified in your investment mix.

For more on the markets during the 4th quarter and 2024 click here.

Sources: Yarndeni, Buckingham, Hartford Funds “US and International Markets Have Moved in Cycles”, Morningstar Direct, Principal Asset Management “The Resurgence of International Equities”, European Commission, “2025 Euro Area Report”, MSCI Indices, Avantis Investors: Monthly ETF Field Guide, Capital Group “Trump’s victory signals major policy shifts ahead”.

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.