On May 4, the US Federal Reserve increased the target federal funds rate1 by 50 basis points as part of what the central bank said will be a series of rate increases to combat soaring inflation in the US. Some investors may worry that rising interest rates will decrease equity valuations and therefore lead to relatively poor equity market performance. However, history offers good news: Equity returns in the US have been positive on average following hikes in the fed funds rate.

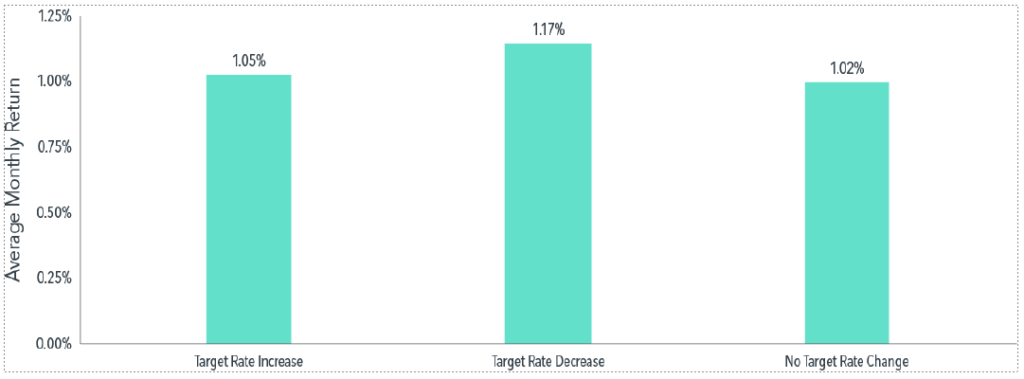

We study the relation between US equity returns, measured by the Fama/French Total US Market Research Index, and changes in the federal funds target rate from 1983 to 2021. Over this period of 468 months, rates increased in 70 months and decreased in 67 months. Exhibit 1 presents the average monthly returns of US equities in months when there is an increase, decrease, or no change in the target rate. On average, US equity market returns are reliably positive in months with increases in target rates.2 Moreover, the average stock market return in those months is similar to the average return in months with decreases or no changes in target rates.

Exhibit 1

Reliably Rewarding

US equity market returns and fed funds target rate change, January 1983–December 2021

Past performance is not a guarantee of future results.

Source: Monthly target federal funds rate data from Federal Reserve Bank of St. Louis. The monthly series reflects the federal funds target rate from January 1983 through December 2008 and the federal funds target range—upper limit (ul) from January 2009 through December 2021. Equity market returns computed using monthly return of the Fama/French Total US Market Research Index, available from Ken French Data Library. There are 70 months with a rate increase, 67 months with a rate decrease, and 331 months with no change.

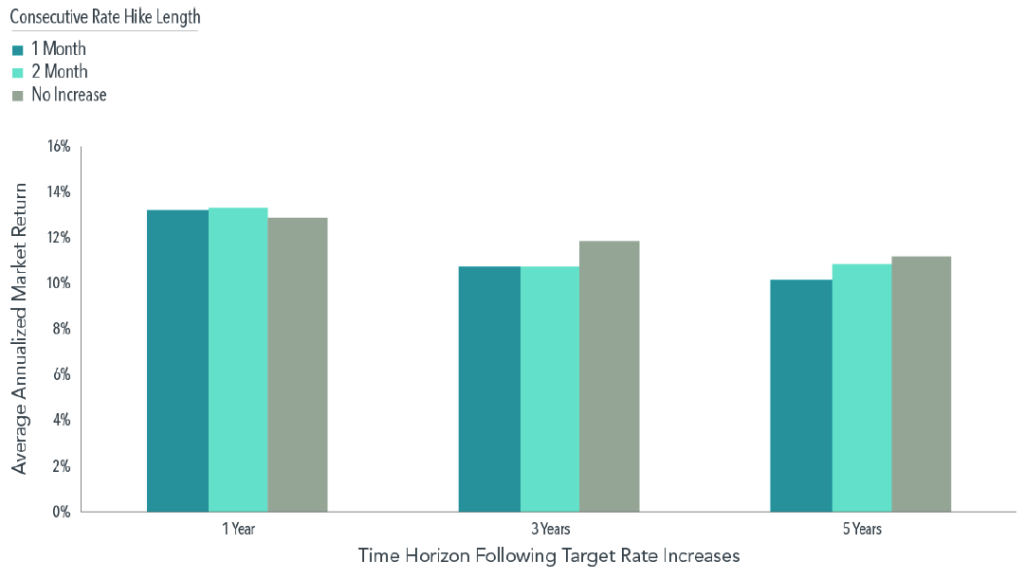

What about the months after rate hikes? This question may be of particular interest when the Fed is expected to increase the federal funds target rate multiple times. Exhibit 2 presents annualized US equity market returns over the one-, three-, and five-year periods following one or two consecutive monthly increases in the fed funds target rate, as well as following months with no increase. In reassuring news for investors concerned with the current environment of increasing rates, the US equity market has delivered strong longer-term performance on average regardless of activity at the Fed.

Exhibit 2

Keep On Keeping On

US equity market returns following consecutive fed funds rate hikes, January 1983–December 2021

Past performance is not a guarantee of future results.

Source: Monthly target federal funds rate data from Federal Reserve Bank of St. Louis. The monthly series reflects the federal funds target rate from January 1983 through December 2008 and the federal funds target range—upper limit (ul) from January 2009 through December 2021. Equity market returns computed using monthly return to the Fama/French Total US Market Research Index, available from Ken French Data Library. There are 70 one-month rate hikes, 28 two-month rate hikes, and 389 months without an increase. Average annualized returns following consecutive rate increases starting at month end; performance time horizons can overlap.

With a number of Federal Open Market Committee meetings remaining in 2022, the Fed’s signals and actions will continue to be closely watched by the market. As the Fed often signals its agenda in advance, we believe market participants are already incorporating this information into market prices. While it’s natural to wonder what the Fed’s actions mean for equity performance, our research indicates that US equity markets offer positive returns on average following rate hikes. Thus, reducing equity allocations in anticipation of, or in reaction to, fed funds rate increases is unlikely to lead to better investment outcomes. Instead, investors who maintain a broadly diversified portfolio and use information in market prices to systematically focus on higher expected returns may be better positioned for long-term investment success.

- The federal funds rate is the interest rate at which depository institutions lend balances at the US Federal Reserve to other depository institutions overnight.

- The Federal Open Market Committee (FOMC) holds eight regularly scheduled meetings per year and may not change the target rate at every meeting. The FOMC may also change the target rate multiple times within the same month; in such instances, we aggregate all changes by month.

Source: Dimensional Fund Advisors

Authors:

Kaitlin Simpson Hendrix- Senior Researcher and Vice President

Trey Roberts- Associate, Research

As always, we are grateful for the opportunity to serve you and your loved ones. If you know of others who could benefit from a conversation with us, please do not hesitate to make the connection. We would be more than happy to provide a complimentary consultation.

To schedule a 30-minute meeting with Barry Mendelson, CFP® – Wealth Advisor & Financial Planner https://calendly.com/zrc-barry-m/meet-with-barry

To schedule a 30-minute meeting with Kevin Goulding, CFP® – Wealth Advisor & Financial Planner https://calendly.com/kevin-goulding/meet-with-kevin

Sources: Dimensional Fund Advisors, Buckingham Strategic Partners, Blackrock, Inc. All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.