- Stocks are off to strong start this year, with several major indexes in bull market territory (up 20% or more) since bottoming in October.

- Through the end of June, just seven stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta) accounted for 72% of the S&P 500 Index’s 15.9% return so far this year.

- What recession? Many economists predicted a recession in 2023. While areas of the economy of slowed, such as real estate, and others have experienced layoffs, such as in information and technology, economic activity remains quite healthy.

- Inflation continues to tick down and the June reading shows it was just 3.1% over the preceding 12 months, its 12th consecutive year-over-year and down from 4.0% in May.

Although year-over-year core inflation has declined from the peak in September 2022, inflation has proven resilient. The strong services sector and tight labor markets means inflation is likely to remain higher for longer than the Fed would like.

The strength of the services sector has contributed to the strength of the labor market. The May jobs report showed an increase in employment of 339,000. And while the unemployment rate rose to 3.7% from 3.4%, the labor market remained tight, allowing wages to increase at a faster pace (hourly earnings grew 4.3% compared to the same period last year, similar to gains in the prior three months).

Although new home sales are at their highest level since February 2022, applications by home purchasers are down by roughly a third compared to this time last year, and refinances are down even more. The combination of rising interest rates and higher home prices has resulted in housing becoming the least affordable in more than 30 years. The millions of homeowners that refinanced their mortgages during the pandemic, when rates were at historical lows, are less vulnerable to higher interest rates.

With hybrid work models now well-established, a 50% occupancy rate may be the new permanent level for offices in many metropolitan areas. In June, the New York City office occupancy rate rebounded to just above 50% – the first time it crossed that level since the pandemic began. Other cities, such as Washington, D.C. and San Francisco, have yet to break the 50% mark. Because commercial real estate construction is roughly 2.6% of GDP and fewer skyscrapers and shopping malls are being built, the sector is likely to constrain economic growth over the coming years.

Many of the economists we follow are pushing out their forecast for a recession in the U.S. to next year and are considering the potential for a soft landing more realistic.

What does low consumer confidence mean for U.S. stocks?

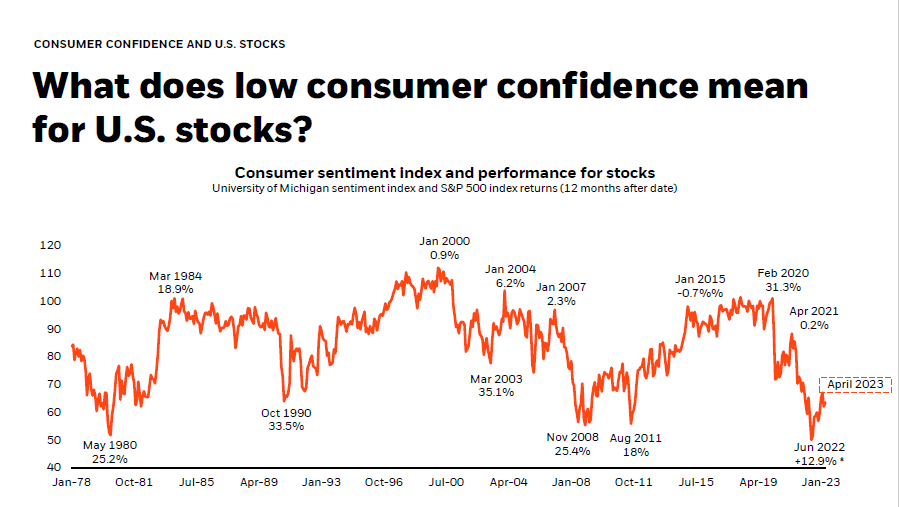

There is no shortage of things to worry about today … climate change, politics, and the economy just to name a few. One metric which economists use to gauge investors’ opinions of both current and future economic conditions is the University of Michigan Consumer Sentiment Index which is compiled from a survey of around 500 consumers.

Historically, low consumer sentiment has been a harbinger of good stock market returns ahead. This chart shows how much the S&P 500 Index returned in the 12 months after a consumer sentiment peak or trough. On average, sentiment peaks were followed by +3.5% returns over the subsequent 12-month period while sentiment troughs were followed by +24.1% returns over the next 12 months. In June 2022, the Index recorded its lowest reading ever of 50.0 and since then the S&P 500 has returned nearly 20%.

While surveying just 500 consumers is, statistically, a small and questionable sample set, it is a good reminder that the investment markets are counter-psychological, meaning that they often do best following periods when things seem the worst. In June of this year, the Consumer sentiment Index registered 63.9, still well below its long-term average of 85.1, and hopefully a harbinger that stock prices will continue to rise in the near future.

Morningstar and Gallup as of 5/31/23. Stock market represented by the S&P 500 Index. Consumer confidence represented by the University of Michigan consumer sentiment index. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index. *Represents only 11 months of performance.

Financial Markets Review

In June, the S&P 500 index notched an over 20% surge from its October 2022 low, entering a new bull market and bringing an end to the bear market that began in January 2022.

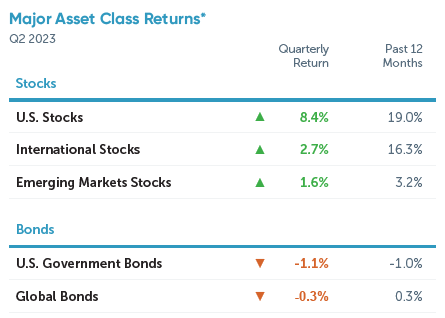

Shrugging off concerns about a looming recession, stocks performed well in the second quarter of 2023 with U.S. stocks increasing 8.4% in the second quarter. Stocks outside the U.S. increased too, albeit at a slower rate with international stocks posting a 2.7% increase and emerging markets stocks increasing by 1.6% for the quarter.

In Fixed Income markets, yields on short-term bonds rose with the yield on the two-year Treasury rising from 4.2% on April 3 to 5.0% on June 30. U.S. interest rates increased during the second quarter as the Federal Reserve raised the target range of the federal funds rate to 5.00%-5.25% with one 0.25% rate hikes in May. For more on our take on the quarter, see our Quarterly Market Review.

Source:

- Quarterly Outlook (2023 Buckingham Wealth Partners)

All investing is subject to risk, including the possible loss of the money you invest. Past performance is no guarantee of future returns. Diversification does not ensure a profit or protect against a loss in a declining market. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.