We hope this email finds you and your loved ones safe and healthy. We are still in the process of reaching-out to each and every one of you. While we have no concerns whatsoever about your Elevation Wealth Partners managed accounts, recent events are stressful for all of us and we are here to be a calm and reassuring voice during these challenging times. We want to hear from you and we want to connect with you. If we haven’t heard from you in the last couple of weeks, please call, request to Zoom video-conference, or send us an email of how you and your loved ones are doing.

We just launched a YouTube channel to increase communications and share updates via video. To hear an update from Barry Mendelson, CFP recorded on Sunday, March 22 click here. Barry is just one of your team of Wealth Advisors you have here at Elevation Wealth Partners.

In the absence of being able to meet in-person, we invite you to meet with us virtually via Zoom! Zoom is one of the leading video conferencing apps and Elevation Wealth Partners has been using it for several years. The URL to join a meeting is https://www.zoom.us/join (for the best performance, we recommend you download the “client” first). Zoom also works great on an iPad, iPhone, tablet, or Android device (just download the app from the app store).

Your Elevation Wealth Partners managed accounts are custom-tailored to personal financial plans. Financial planning is about more than assets, investments and net worth. It’s about you, what you would like to do with your money and why. It’s about identifying your concerns, expectations and goals – it’s about how you feel and what you want.

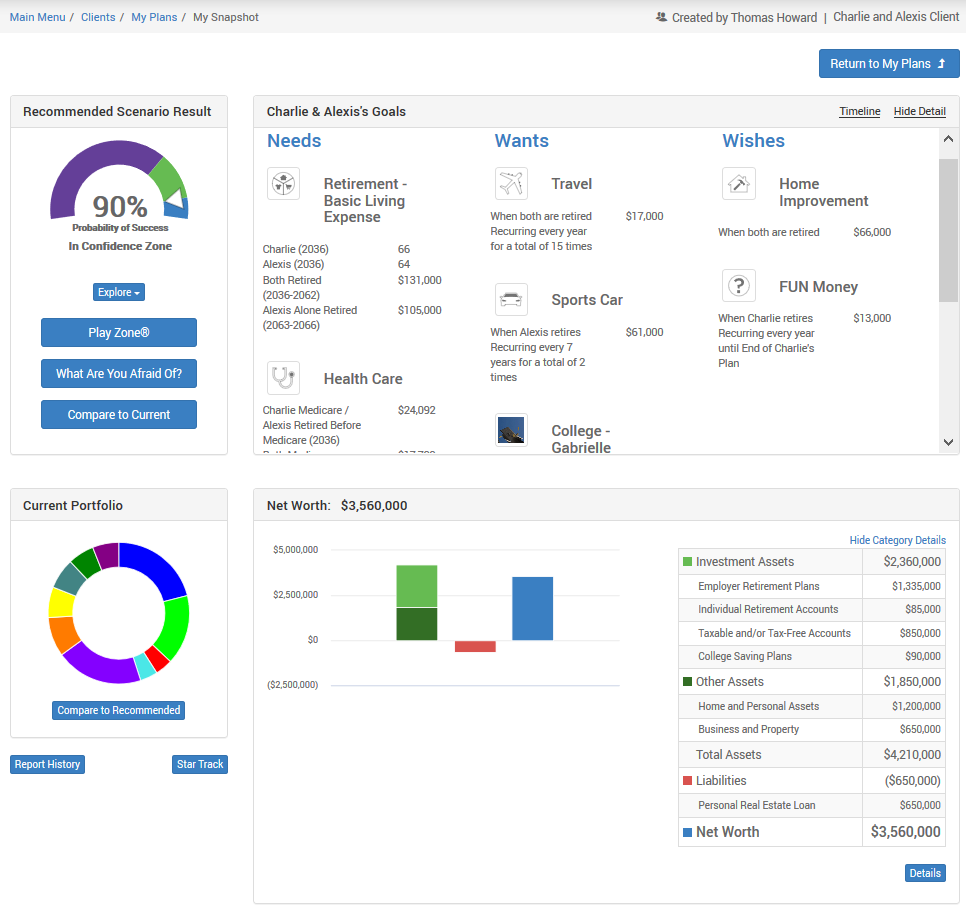

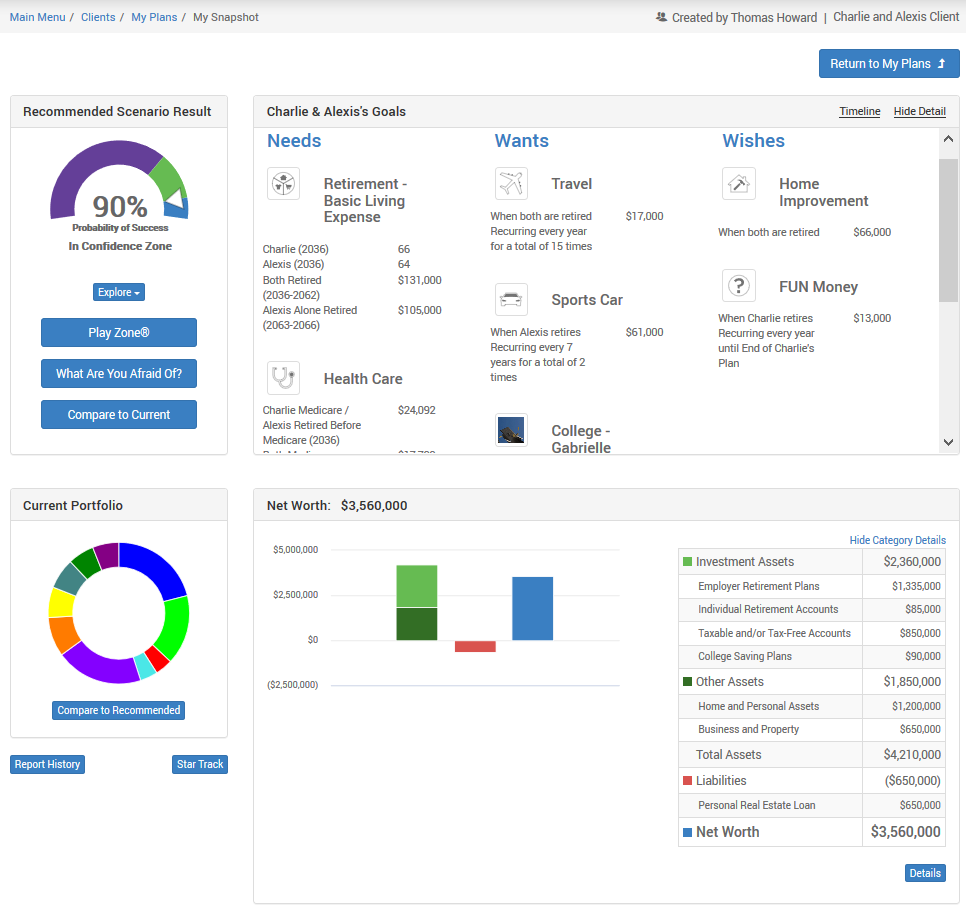

Elevation Wealth Partners comprehensive financial planning process helps address common fears and concerns such as health care costs, outliving your money and the best time to file for Social Security benefits. The confidence meter helps you gauge how likely you are to reach your goals and whether you are on track instead of focusing on news headlines. There is always something that can be done to improve your financial position and sense of security that does not involve making changes to your investment portfolio. This is one of the purposes of a financial plan: to understand what is under your control and focus on that. Below is an example of a client’s financial plan.

If you previously had access to the financial plan we developed together, click here.

If you have never accessed your comprehensive financial plan online and now would like to, please contact Kevin Goulding, CFP® – Wealth Advisor at 707-524-6131 or kevin@elevationwp.com

If you would like to update your comprehensive financial plan, you can complete and return any or all of the comprehensive questionnaire found here OR email Kevin Goulding the changes you would like to make.

To access and review your Investment Policy Statement on CitrixFiles click here. The investment policy statement (IPS) is the cornerstone of the investment management process. The IPS establishes a clear understanding between you (the Client) and Elevation Wealth Partners as to the goals and objectives in the management of your investment portfolio. It is a best practice used by many Registered Investment Advisors, Fiduciaries, ultra-high net-worth investors as well as institutional investors such as pensions, endowments, and foundations. The IPS:

- Establishes reasonable expectations, objectives, guidelines and criteria used to measure an appropriate investment plan.

- Encourages clear, candid, and effective communications between the Client(s) and Advisor in regards to investment management decisions and services provided.

- Establishes the investment structure with regards to permissible asset classes, asset allocation targets, and points in which to measure risk and return outcomes.

- Provides a frame of reference that will help keep us focused on long-term objectives. This focus is especially valuable during periods of market volatility when there may be a temptation to react to short-term factors.

- Describes Elevation Wealth Partners investment philosophy and manager selection process.

Last week, the IRS released a tax-relief notice that it would, with certain conditions, allow taxpayers to defer payment of income taxes due April 15, 2020, for up to three months as part of an economic relief initiative surrounding the COVID-19 pandemic. Here is a brief Q&A about this measure and what it might mean for your tax plans. If you have questions about your tax situation and do not use a tax professional, please contact us to discuss your situation. We know some of the best tax professionals in Northern California and can put you in contact with them.

How your assets are protected at Schwab. Your investment accounts at Charles Schwab & Co. are protected by the SIPC (Securities Investors Protection Corporation) up to $500,000 per client for all accounts held in the same capacity, including a maximum of $250,000 in claims for cash. Additionally, the FDIC (Federal Deposit Insurance Corporation) covers up to $250,000 per owner for all single accounts at each bank and up to $500,000 for joint accounts. All deposit accounts held at Schwab Bank, including cash in brokerage accounts using the Bank Sweep feature, Schwab Bank High Yield Investor Checking® account and the Schwab Bank High Yield Investor Savings® account, are FDIC-insured. To learn more about how Schwab protects your assets click here.

Lastly, for a list of Working From Home and Family Survival Suggestions click here.

Sincerely,

Simply checking in

We hope this email finds you and your loved ones safe and healthy. We are still in the process of reaching-out to each and every one of you. While we have no concerns whatsoever about your Elevation Wealth Partners managed accounts, recent events are stressful for all of us and we are here to be a calm and reassuring voice during these challenging times. We want to hear from you and we want to connect with you. If we haven’t heard from you in the last couple of weeks, please call, request to Zoom video-conference, or send us an email of how you and your loved ones are doing.

We just launched a YouTube channel to increase communications and share updates via video. To hear an update from Barry Mendelson, CFP recorded on Sunday, March 22 click here. Barry is just one of your team of Wealth Advisors you have here at Elevation Wealth Partners.

In the absence of being able to meet in-person, we invite you to meet with us virtually via Zoom! Zoom is one of the leading video conferencing apps and Elevation Wealth Partners has been using it for several years. The URL to join a meeting is https://www.zoom.us/join (for the best performance, we recommend you download the “client” first). Zoom also works great on an iPad, iPhone, tablet, or Android device (just download the app from the app store).

Your Elevation Wealth Partners managed accounts are custom-tailored to personal financial plans. Financial planning is about more than assets, investments and net worth. It’s about you, what you would like to do with your money and why. It’s about identifying your concerns, expectations and goals – it’s about how you feel and what you want.

Elevation Wealth Partners comprehensive financial planning process helps address common fears and concerns such as health care costs, outliving your money and the best time to file for Social Security benefits. The confidence meter helps you gauge how likely you are to reach your goals and whether you are on track instead of focusing on news headlines. There is always something that can be done to improve your financial position and sense of security that does not involve making changes to your investment portfolio. This is one of the purposes of a financial plan: to understand what is under your control and focus on that. Below is an example of a client’s financial plan.

If you previously had access to the financial plan we developed together, click here.

If you have never accessed your comprehensive financial plan online and now would like to, please contact Kevin Goulding, CFP® – Wealth Advisor at 707-524-6131 or kevin@elevationwp.com

If you would like to update your comprehensive financial plan, you can complete and return any or all of the comprehensive questionnaire found here OR email Kevin Goulding the changes you would like to make.

To access and review your Investment Policy Statement on CitrixFiles click here. The investment policy statement (IPS) is the cornerstone of the investment management process. The IPS establishes a clear understanding between you (the Client) and Elevation Wealth Partners as to the goals and objectives in the management of your investment portfolio. It is a best practice used by many Registered Investment Advisors, Fiduciaries, ultra-high net-worth investors as well as institutional investors such as pensions, endowments, and foundations. The IPS:

Last week, the IRS released a tax-relief notice that it would, with certain conditions, allow taxpayers to defer payment of income taxes due April 15, 2020, for up to three months as part of an economic relief initiative surrounding the COVID-19 pandemic. Here is a brief Q&A about this measure and what it might mean for your tax plans. If you have questions about your tax situation and do not use a tax professional, please contact us to discuss your situation. We know some of the best tax professionals in Northern California and can put you in contact with them.

How your assets are protected at Schwab. Your investment accounts at Charles Schwab & Co. are protected by the SIPC (Securities Investors Protection Corporation) up to $500,000 per client for all accounts held in the same capacity, including a maximum of $250,000 in claims for cash. Additionally, the FDIC (Federal Deposit Insurance Corporation) covers up to $250,000 per owner for all single accounts at each bank and up to $500,000 for joint accounts. All deposit accounts held at Schwab Bank, including cash in brokerage accounts using the Bank Sweep feature, Schwab Bank High Yield Investor Checking® account and the Schwab Bank High Yield Investor Savings® account, are FDIC-insured. To learn more about how Schwab protects your assets click here.

Lastly, for a list of Working From Home and Family Survival Suggestions click here.

Sincerely,